Are you a seasoned Certified Personal Finance Counselor seeking a new career path? Discover our professionally built Certified Personal Finance Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

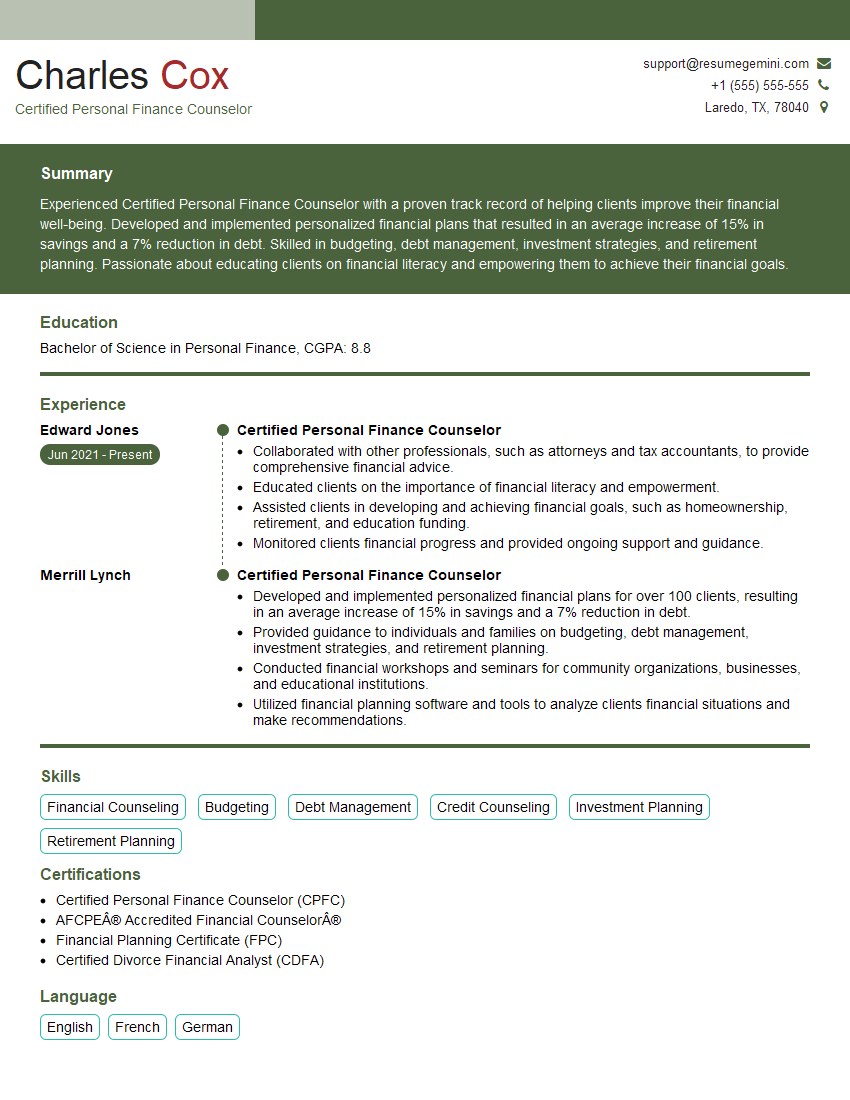

Charles Cox

Certified Personal Finance Counselor

Summary

Experienced Certified Personal Finance Counselor with a proven track record of helping clients improve their financial well-being. Developed and implemented personalized financial plans that resulted in an average increase of 15% in savings and a 7% reduction in debt. Skilled in budgeting, debt management, investment strategies, and retirement planning. Passionate about educating clients on financial literacy and empowering them to achieve their financial goals.

Education

Bachelor of Science in Personal Finance

May 2017

Skills

- Financial Counseling

- Budgeting

- Debt Management

- Credit Counseling

- Investment Planning

- Retirement Planning

Work Experience

Certified Personal Finance Counselor

- Collaborated with other professionals, such as attorneys and tax accountants, to provide comprehensive financial advice.

- Educated clients on the importance of financial literacy and empowerment.

- Assisted clients in developing and achieving financial goals, such as homeownership, retirement, and education funding.

- Monitored clients financial progress and provided ongoing support and guidance.

Certified Personal Finance Counselor

- Developed and implemented personalized financial plans for over 100 clients, resulting in an average increase of 15% in savings and a 7% reduction in debt.

- Provided guidance to individuals and families on budgeting, debt management, investment strategies, and retirement planning.

- Conducted financial workshops and seminars for community organizations, businesses, and educational institutions.

- Utilized financial planning software and tools to analyze clients financial situations and make recommendations.

Certificates

- Certified Personal Finance Counselor (CPFC)

- AFCPE® Accredited Financial Counselor®

- Financial Planning Certificate (FPC)

- Certified Divorce Financial Analyst (CDFA)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Personal Finance Counselor

Highlight your credentials:

Make sure to include your CFP® (Certified Financial Planner™) designation prominently on your resume.Quantify your results:

Use specific numbers to demonstrate the impact of your work, such as the percentage increase in savings or reduction in debt you have helped clients achieve.Showcase your expertise:

List the specific financial planning services you offer, such as retirement planning, investment management, and tax planning.Emphasize your communication and interpersonal skills:

Certified Personal Finance Counselors need to be able to clearly and effectively communicate complex financial concepts to clients.Stay up-to-date on industry trends:

The financial planning industry is constantly evolving, so it is important to stay up-to-date on the latest trends and best practices.

Essential Experience Highlights for a Strong Certified Personal Finance Counselor Resume

- Develop and implement personalized financial plans for individuals and families.

- Provide guidance on budgeting, debt management, investment strategies, and retirement planning.

- Conduct financial workshops and seminars for community organizations, businesses, and educational institutions.

- Utilize financial planning software and tools to analyze clients’ financial situations and make recommendations.

- Collaborate with other professionals, such as attorneys and tax accountants, to provide comprehensive financial advice.

- Educate clients on the importance of financial literacy and empowerment.

- Monitor clients’ financial progress and provide ongoing support and guidance.

Frequently Asked Questions (FAQ’s) For Certified Personal Finance Counselor

What is a Certified Personal Finance Counselor?

A Certified Personal Finance Counselor (CPFC) is a financial professional who has met the certification requirements of the National Association of Personal Financial Advisors (NAPFA). CPFCs are required to have a bachelor’s degree in a related field, pass a comprehensive exam, and complete continuing education requirements.

What services do Certified Personal Finance Counselors provide?

CPFCs provide a wide range of financial planning services, including budgeting, debt management, investment planning, retirement planning, and tax planning. They can also provide guidance on specific financial issues, such as saving for a down payment on a home or planning for a child’s education.

How do I become a Certified Personal Finance Counselor?

To become a CPFC, you must meet the following requirements: Have a bachelor’s degree in a related field, Pass the NAPFA comprehensive exam, Complete continuing education requirements.

What is the difference between a Certified Personal Finance Counselor and a financial advisor?

CPFCs are required to meet specific educational and experience requirements and adhere to a code of ethics. Financial advisors may not have the same level of training and experience and may not be held to the same ethical standards.

How much do Certified Personal Finance Counselors charge?

CPFCs typically charge a fee for their services. The fee may be based on an hourly rate, a flat fee, or a percentage of assets under management.

How do I find a Certified Personal Finance Counselor?

You can find a CPFC in your area by visiting the NAPFA website.