Are you a seasoned Agricultural Loan Officer seeking a new career path? Discover our professionally built Agricultural Loan Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

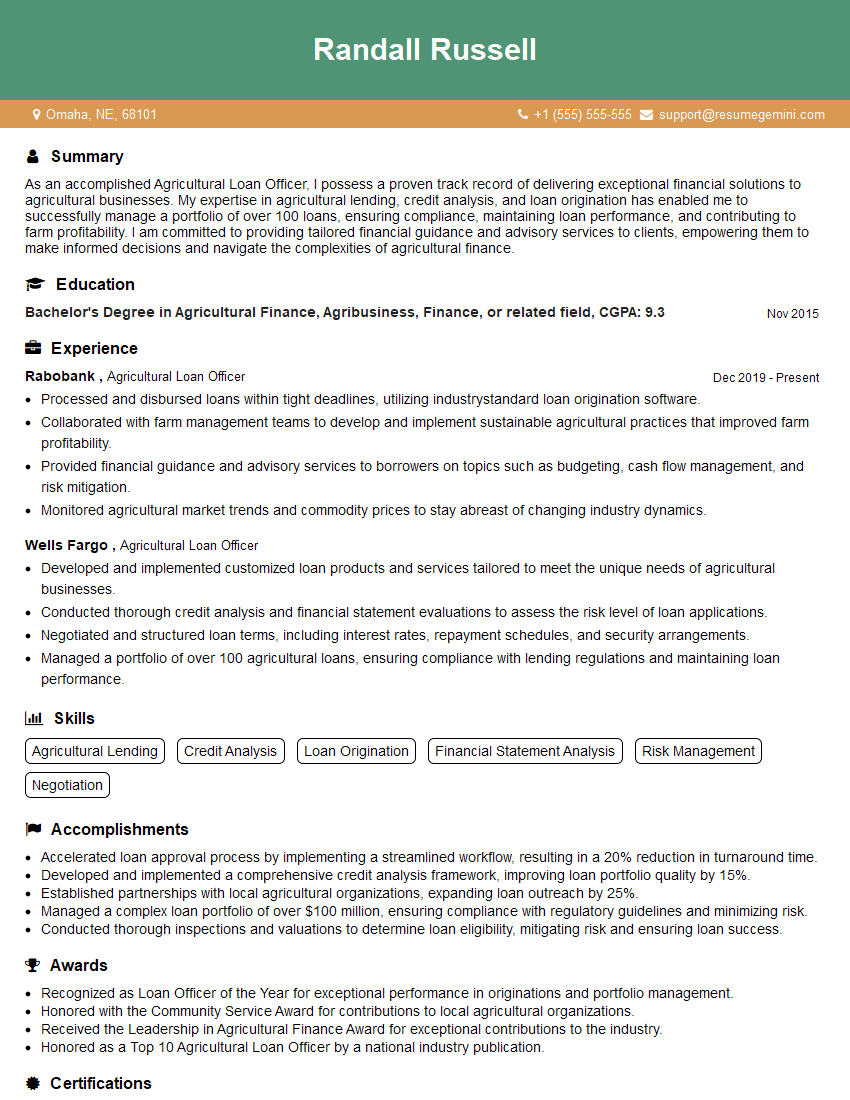

Randall Russell

Agricultural Loan Officer

Summary

As an accomplished Agricultural Loan Officer, I possess a proven track record of delivering exceptional financial solutions to agricultural businesses. My expertise in agricultural lending, credit analysis, and loan origination has enabled me to successfully manage a portfolio of over 100 loans, ensuring compliance, maintaining loan performance, and contributing to farm profitability. I am committed to providing tailored financial guidance and advisory services to clients, empowering them to make informed decisions and navigate the complexities of agricultural finance.

Education

Bachelor’s Degree in Agricultural Finance, Agribusiness, Finance, or related field

November 2015

Skills

- Agricultural Lending

- Credit Analysis

- Loan Origination

- Financial Statement Analysis

- Risk Management

- Negotiation

Work Experience

Agricultural Loan Officer

- Processed and disbursed loans within tight deadlines, utilizing industrystandard loan origination software.

- Collaborated with farm management teams to develop and implement sustainable agricultural practices that improved farm profitability.

- Provided financial guidance and advisory services to borrowers on topics such as budgeting, cash flow management, and risk mitigation.

- Monitored agricultural market trends and commodity prices to stay abreast of changing industry dynamics.

Agricultural Loan Officer

- Developed and implemented customized loan products and services tailored to meet the unique needs of agricultural businesses.

- Conducted thorough credit analysis and financial statement evaluations to assess the risk level of loan applications.

- Negotiated and structured loan terms, including interest rates, repayment schedules, and security arrangements.

- Managed a portfolio of over 100 agricultural loans, ensuring compliance with lending regulations and maintaining loan performance.

Accomplishments

- Accelerated loan approval process by implementing a streamlined workflow, resulting in a 20% reduction in turnaround time.

- Developed and implemented a comprehensive credit analysis framework, improving loan portfolio quality by 15%.

- Established partnerships with local agricultural organizations, expanding loan outreach by 25%.

- Managed a complex loan portfolio of over $100 million, ensuring compliance with regulatory guidelines and minimizing risk.

- Conducted thorough inspections and valuations to determine loan eligibility, mitigating risk and ensuring loan success.

Awards

- Recognized as Loan Officer of the Year for exceptional performance in originations and portfolio management.

- Honored with the Community Service Award for contributions to local agricultural organizations.

- Received the Leadership in Agricultural Finance Award for exceptional contributions to the industry.

- Honored as a Top 10 Agricultural Loan Officer by a national industry publication.

Certificates

- American Bankers Association Agricultural Lending Specialist

- Certified Loan Originator (CLO)

- Certified Credit Analyst (CCA)

- Certified Crop Adviser (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Agricultural Loan Officer

- Highlight your expertise in agricultural lending and your understanding of the unique financial challenges faced by agricultural businesses.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Showcase your ability to build strong relationships with clients and your commitment to providing exceptional customer service.

- Emphasize your knowledge of industry trends and your ability to provide valuable financial advice to clients.

Essential Experience Highlights for a Strong Agricultural Loan Officer Resume

- Developed and implemented customized loan products and services to meet the unique needs of agricultural businesses.

- Conducted thorough credit analysis and financial statement evaluations to assess the risk level of loan applications.

- Negotiated and structured loan terms, including interest rates, repayment schedules, and security arrangements.

- Managed a portfolio of over 100 agricultural loans, ensuring compliance with lending regulations and maintaining loan performance.

- Collaborated with farm management teams to develop and implement sustainable agricultural practices that improved farm profitability.

- Processed and disbursed loans within tight deadlines, utilizing industry-standard loan origination software.

Frequently Asked Questions (FAQ’s) For Agricultural Loan Officer

What are the key skills required to be a successful Agricultural Loan Officer?

Key skills include agricultural lending, credit analysis, loan origination, financial statement analysis, risk management, negotiation, and a deep understanding of agricultural finance.

What are the career opportunities for Agricultural Loan Officers?

Agricultural Loan Officers can advance to roles such as Senior Loan Officer, Portfolio Manager, or Vice President of Agricultural Lending.

What is the job outlook for Agricultural Loan Officers?

The job outlook for Agricultural Loan Officers is expected to grow faster than average due to the increasing demand for agricultural financing and the need for professionals with expertise in this field.

What are the challenges faced by Agricultural Loan Officers?

Challenges include assessing the risk associated with agricultural lending, staying abreast of industry trends and regulations, and managing a diverse portfolio of loans.

What are the rewards of being an Agricultural Loan Officer?

Rewards include making a positive impact on the agricultural industry, helping businesses succeed, and developing strong relationships with clients.

What is the average salary for Agricultural Loan Officers?

The average salary for Agricultural Loan Officers varies depending on experience, location, and company size, but it typically ranges from $60,000 to $120,000 per year.