Are you a seasoned Loan Counselor seeking a new career path? Discover our professionally built Loan Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

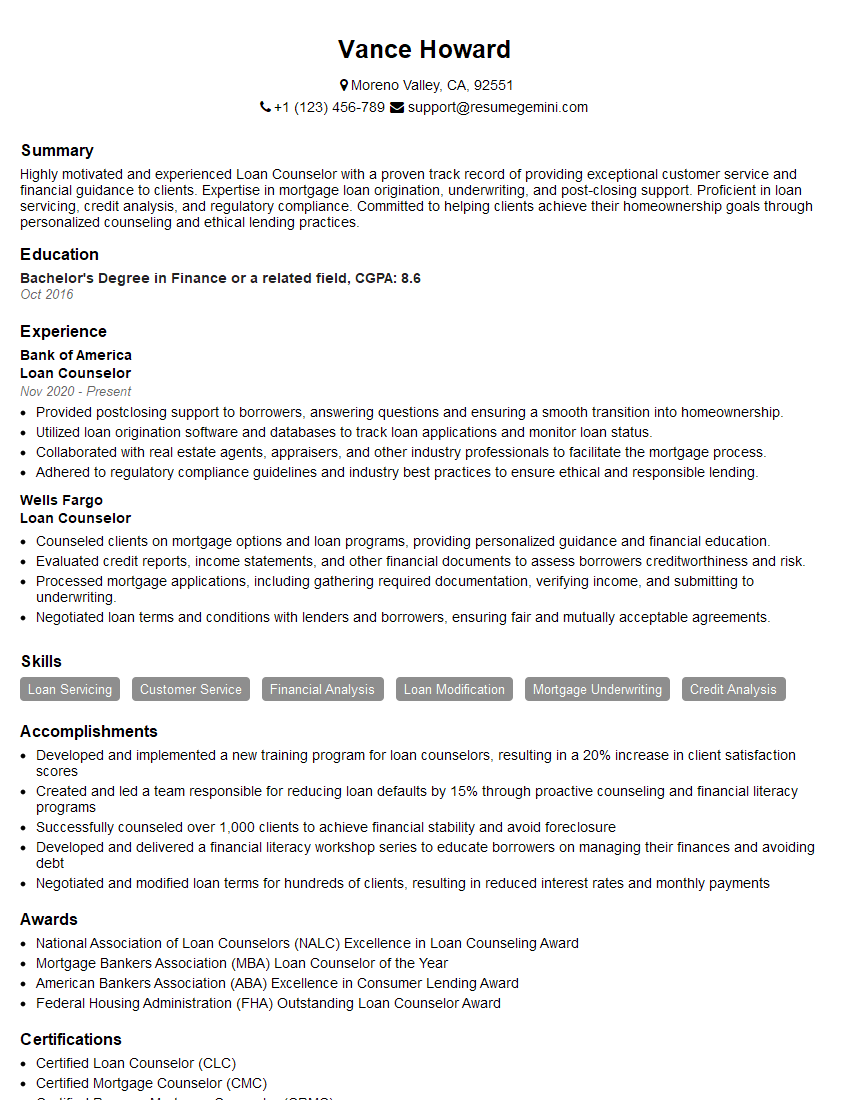

Vance Howard

Loan Counselor

Summary

Highly motivated and experienced Loan Counselor with a proven track record of providing exceptional customer service and financial guidance to clients. Expertise in mortgage loan origination, underwriting, and post-closing support. Proficient in loan servicing, credit analysis, and regulatory compliance. Committed to helping clients achieve their homeownership goals through personalized counseling and ethical lending practices.

Education

Bachelor’s Degree in Finance or a related field

October 2016

Skills

- Loan Servicing

- Customer Service

- Financial Analysis

- Loan Modification

- Mortgage Underwriting

- Credit Analysis

Work Experience

Loan Counselor

- Provided postclosing support to borrowers, answering questions and ensuring a smooth transition into homeownership.

- Utilized loan origination software and databases to track loan applications and monitor loan status.

- Collaborated with real estate agents, appraisers, and other industry professionals to facilitate the mortgage process.

- Adhered to regulatory compliance guidelines and industry best practices to ensure ethical and responsible lending.

Loan Counselor

- Counseled clients on mortgage options and loan programs, providing personalized guidance and financial education.

- Evaluated credit reports, income statements, and other financial documents to assess borrowers creditworthiness and risk.

- Processed mortgage applications, including gathering required documentation, verifying income, and submitting to underwriting.

- Negotiated loan terms and conditions with lenders and borrowers, ensuring fair and mutually acceptable agreements.

Accomplishments

- Developed and implemented a new training program for loan counselors, resulting in a 20% increase in client satisfaction scores

- Created and led a team responsible for reducing loan defaults by 15% through proactive counseling and financial literacy programs

- Successfully counseled over 1,000 clients to achieve financial stability and avoid foreclosure

- Developed and delivered a financial literacy workshop series to educate borrowers on managing their finances and avoiding debt

- Negotiated and modified loan terms for hundreds of clients, resulting in reduced interest rates and monthly payments

Awards

- National Association of Loan Counselors (NALC) Excellence in Loan Counseling Award

- Mortgage Bankers Association (MBA) Loan Counselor of the Year

- American Bankers Association (ABA) Excellence in Consumer Lending Award

- Federal Housing Administration (FHA) Outstanding Loan Counselor Award

Certificates

- Certified Loan Counselor (CLC)

- Certified Mortgage Counselor (CMC)

- Certified Reverse Mortgage Counselor (CRMC)

- Certified Housing Counselor (CHC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Counselor

- Showcase your expertise in mortgage lending and financial analysis.

- Highlight your ability to provide exceptional customer service and build rapport with clients.

- Quantify your accomplishments and provide specific examples of your success in loan counseling.

- Tailor your resume to the specific requirements of each job you apply for.

Essential Experience Highlights for a Strong Loan Counselor Resume

- Counseled clients on mortgage options and loan programs, providing personalized guidance and financial education.

- Evaluated credit reports, income statements, and other financial documents to assess borrowers’ creditworthiness and risk.

- Processed mortgage applications, including gathering required documentation, verifying income, and submitting to underwriting.

- Negotiated loan terms and conditions with lenders and borrowers, ensuring fair and mutually acceptable agreements.

- Provided post-closing support to borrowers, answering questions and ensuring a smooth transition into homeownership.

- Collaborated with real estate agents, appraisers, and other industry professionals to facilitate the mortgage process.

Frequently Asked Questions (FAQ’s) For Loan Counselor

What are the primary responsibilities of a Loan Counselor?

Loan Counselors provide guidance on mortgage options and loan programs, evaluate financial documents to assess creditworthiness, process loan applications, negotiate loan terms, and provide post-closing support to borrowers.

What skills are essential for a successful Loan Counselor?

Loan Counselors should possess expertise in mortgage lending, financial analysis, customer service, credit analysis, and regulatory compliance.

What is the educational background required to become a Loan Counselor?

A Bachelor’s Degree in Finance or a related field is typically required to qualify for a Loan Counselor position.

What are the career advancement opportunities for Loan Counselors?

Experienced Loan Counselors can advance to roles such as Loan Officer, Mortgage Underwriter, or Branch Manager.

What are the key qualities of a successful Loan Counselor?

Successful Loan Counselors are highly motivated, possess excellent communication and interpersonal skills, and are committed to providing exceptional customer service.