Are you a seasoned Loan Reviewer seeking a new career path? Discover our professionally built Loan Reviewer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

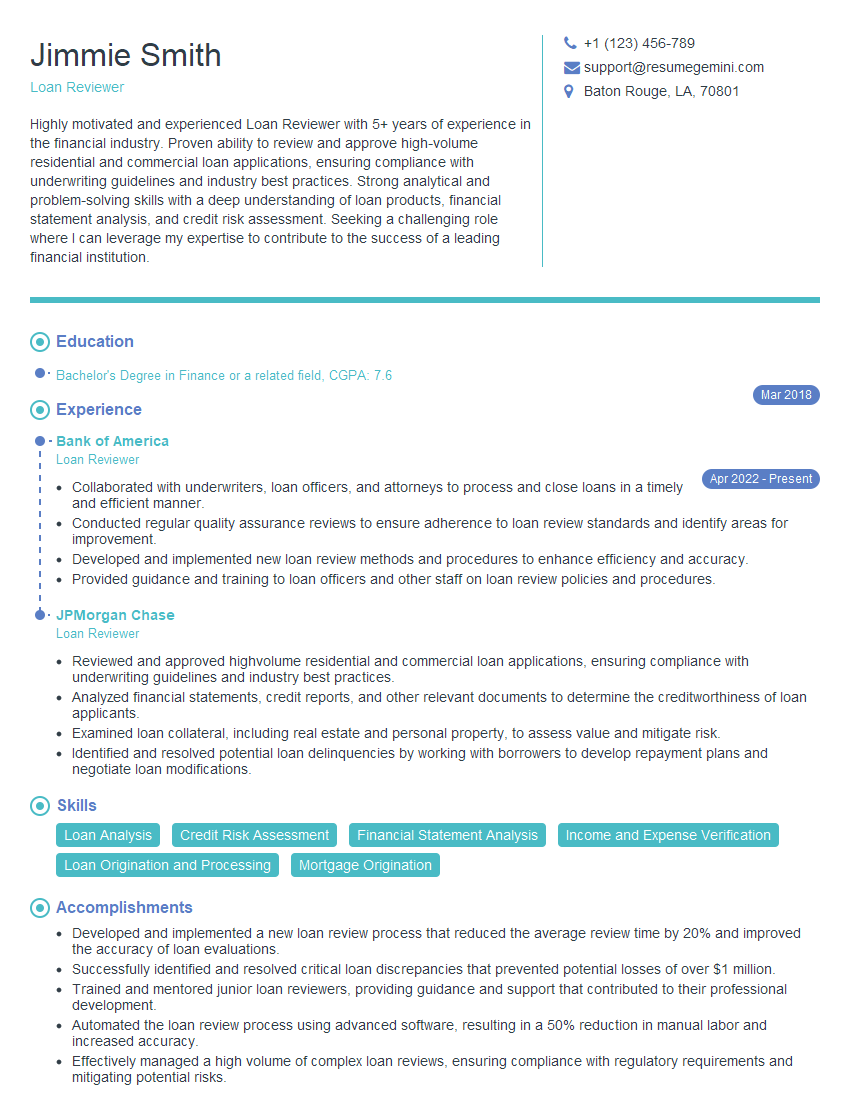

Jimmie Smith

Loan Reviewer

Summary

Highly motivated and experienced Loan Reviewer with 5+ years of experience in the financial industry. Proven ability to review and approve high-volume residential and commercial loan applications, ensuring compliance with underwriting guidelines and industry best practices. Strong analytical and problem-solving skills with a deep understanding of loan products, financial statement analysis, and credit risk assessment. Seeking a challenging role where I can leverage my expertise to contribute to the success of a leading financial institution.

Education

Bachelor’s Degree in Finance or a related field

March 2018

Skills

- Loan Analysis

- Credit Risk Assessment

- Financial Statement Analysis

- Income and Expense Verification

- Loan Origination and Processing

- Mortgage Origination

Work Experience

Loan Reviewer

- Collaborated with underwriters, loan officers, and attorneys to process and close loans in a timely and efficient manner.

- Conducted regular quality assurance reviews to ensure adherence to loan review standards and identify areas for improvement.

- Developed and implemented new loan review methods and procedures to enhance efficiency and accuracy.

- Provided guidance and training to loan officers and other staff on loan review policies and procedures.

Loan Reviewer

- Reviewed and approved highvolume residential and commercial loan applications, ensuring compliance with underwriting guidelines and industry best practices.

- Analyzed financial statements, credit reports, and other relevant documents to determine the creditworthiness of loan applicants.

- Examined loan collateral, including real estate and personal property, to assess value and mitigate risk.

- Identified and resolved potential loan delinquencies by working with borrowers to develop repayment plans and negotiate loan modifications.

Accomplishments

- Developed and implemented a new loan review process that reduced the average review time by 20% and improved the accuracy of loan evaluations.

- Successfully identified and resolved critical loan discrepancies that prevented potential losses of over $1 million.

- Trained and mentored junior loan reviewers, providing guidance and support that contributed to their professional development.

- Automated the loan review process using advanced software, resulting in a 50% reduction in manual labor and increased accuracy.

- Effectively managed a high volume of complex loan reviews, ensuring compliance with regulatory requirements and mitigating potential risks.

Awards

- Received the Loan Reviewer of the Year Award for consistently exceeding performance targets and demonstrating exceptional attention to detail.

- Honored with the Quality Excellence Award for maintaining a consistently high level of accuracy and professionalism in loan reviews.

- Recognized with the Team Excellence Award for effectively collaborating with colleagues to enhance the efficiency and effectiveness of the loan review department.

- Received the Customer Service Award for providing exceptional assistance to internal and external clients in resolving loanrelated inquiries.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Residential Mortgage Underwriter (CRMU)

- Certified Mortgage Servicing Specialist (CMSS)

- Certified Default Manager (CDM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Reviewer

- Highlight your relevant skills and experience in your resume, including your knowledge of loan products, financial statement analysis, and credit risk assessment.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it, ensuring that there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Loan Reviewer Resume

- Reviewed and approved high-volume residential and commercial loan applications, ensuring compliance with underwriting guidelines and industry best practices.

- Analyzed financial statements, credit reports, and other relevant documents to determine the creditworthiness of loan applicants.

- Examined loan collateral, including real estate and personal property, to assess value and mitigate risk.

- Identified and resolved potential loan delinquencies by working with borrowers to develop repayment plans and negotiate loan modifications.

- Collaborated with underwriters, loan officers, and attorneys to process and close loans in a timely and efficient manner.

- Conducted regular quality assurance reviews to ensure adherence to loan review standards and identify areas for improvement.

- Developed and implemented new loan review methods and procedures to enhance efficiency and accuracy.

Frequently Asked Questions (FAQ’s) For Loan Reviewer

What is the role of a Loan Reviewer?

A Loan Reviewer is responsible for reviewing and approving loan applications, ensuring that they meet the lender’s underwriting guidelines and industry best practices. They analyze financial statements, credit reports, and other relevant documents to determine the creditworthiness of loan applicants and assess the risk associated with each loan.

What are the qualifications for becoming a Loan Reviewer?

Most Loan Reviewers have a bachelor’s degree in finance or a related field, such as accounting or economics. They also typically have several years of experience in the financial industry, with a focus on loan underwriting or credit analysis.

What are the key skills required for a Loan Reviewer?

Loan Reviewers need to have strong analytical and problem-solving skills, as well as a deep understanding of loan products, financial statement analysis, and credit risk assessment. They also need to be able to work independently and as part of a team, and to communicate effectively both verbally and in writing.

What is the career outlook for Loan Reviewers?

The job outlook for Loan Reviewers is expected to be good over the next few years, as the demand for qualified professionals continues to grow. This is due in part to the increasing complexity of loan products and the need for lenders to ensure that they are making sound lending decisions.

What is the average salary for a Loan Reviewer?

The average salary for a Loan Reviewer in the United States is around $65,000 per year. However, salaries can vary depending on experience, location, and the size of the company.

What are the benefits of working as a Loan Reviewer?

Loan Reviewers enjoy a number of benefits, including a competitive salary, good benefits, and the opportunity to work in a challenging and rewarding field. They also have the opportunity to make a real difference in the lives of others by helping them to achieve their financial goals.