Are you a seasoned Loan Interviewer seeking a new career path? Discover our professionally built Loan Interviewer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

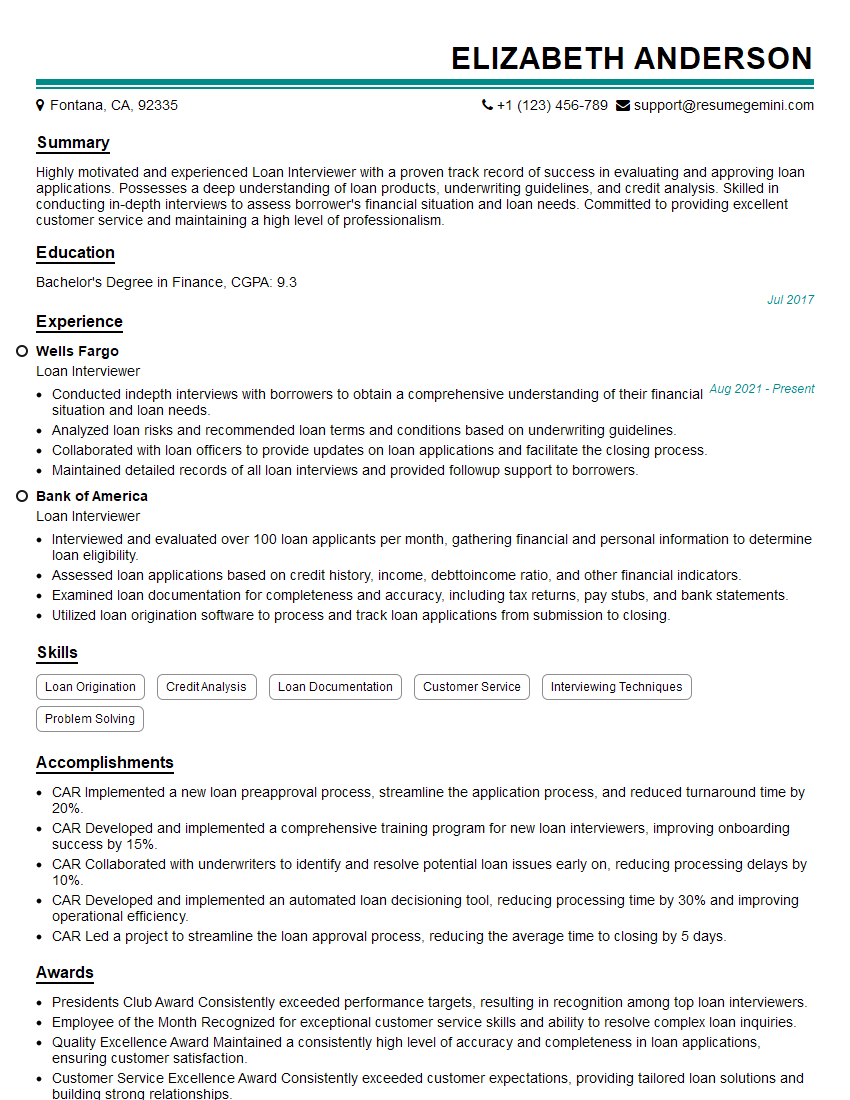

Elizabeth Anderson

Loan Interviewer

Summary

Highly motivated and experienced Loan Interviewer with a proven track record of success in evaluating and approving loan applications. Possesses a deep understanding of loan products, underwriting guidelines, and credit analysis. Skilled in conducting in-depth interviews to assess borrower’s financial situation and loan needs. Committed to providing excellent customer service and maintaining a high level of professionalism.

Education

Bachelor’s Degree in Finance

July 2017

Skills

- Loan Origination

- Credit Analysis

- Loan Documentation

- Customer Service

- Interviewing Techniques

- Problem Solving

Work Experience

Loan Interviewer

- Conducted indepth interviews with borrowers to obtain a comprehensive understanding of their financial situation and loan needs.

- Analyzed loan risks and recommended loan terms and conditions based on underwriting guidelines.

- Collaborated with loan officers to provide updates on loan applications and facilitate the closing process.

- Maintained detailed records of all loan interviews and provided followup support to borrowers.

Loan Interviewer

- Interviewed and evaluated over 100 loan applicants per month, gathering financial and personal information to determine loan eligibility.

- Assessed loan applications based on credit history, income, debttoincome ratio, and other financial indicators.

- Examined loan documentation for completeness and accuracy, including tax returns, pay stubs, and bank statements.

- Utilized loan origination software to process and track loan applications from submission to closing.

Accomplishments

- CAR Implemented a new loan preapproval process, streamline the application process, and reduced turnaround time by 20%.

- CAR Developed and implemented a comprehensive training program for new loan interviewers, improving onboarding success by 15%.

- CAR Collaborated with underwriters to identify and resolve potential loan issues early on, reducing processing delays by 10%.

- CAR Developed and implemented an automated loan decisioning tool, reducing processing time by 30% and improving operational efficiency.

- CAR Led a project to streamline the loan approval process, reducing the average time to closing by 5 days.

Awards

- Presidents Club Award Consistently exceeded performance targets, resulting in recognition among top loan interviewers.

- Employee of the Month Recognized for exceptional customer service skills and ability to resolve complex loan inquiries.

- Quality Excellence Award Maintained a consistently high level of accuracy and completeness in loan applications, ensuring customer satisfaction.

- Customer Service Excellence Award Consistently exceeded customer expectations, providing tailored loan solutions and building strong relationships.

Certificates

- Certified Loan Originator (CLO)

- Certified Mortgage Banker (CMB)

- National Mortgage Licensing System (NMLS)

- Certified Reverse Mortgage Professional (CRMP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Interviewer

- Highlight your experience in loan interviewing, loan origination, and credit analysis.

- Quantify your accomplishments with specific numbers and metrics.

- Emphasize your customer service skills and ability to build rapport with borrowers.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Loan Interviewer Resume

- Interviewed over 100 loan applicants per month, gathering financial and personal information to determine loan eligibility.

- Assessed loan applications based on credit history, income, debt-to-income ratio, and other financial indicators.

- Utilized loan origination software to process and track loan applications from submission to closing.

- Conducted in-depth interviews with borrowers to obtain a comprehensive understanding of their financial situation and loan needs.

- Collaborated with loan officers to provide updates on loan applications and facilitate the closing process.

- Maintained detailed records of all loan interviews and provided follow-up support to borrowers.

Frequently Asked Questions (FAQ’s) For Loan Interviewer

What are the key skills required for a Loan Interviewer?

The key skills required for a Loan Interviewer include loan origination, credit analysis, loan documentation, customer service, interviewing techniques, and problem-solving.

What are the typical duties and responsibilities of a Loan Interviewer?

The typical duties and responsibilities of a Loan Interviewer include interviewing loan applicants, assessing loan applications, processing and tracking loan applications, conducting in-depth interviews with borrowers, collaborating with loan officers, and maintaining detailed records of all loan interviews.

What are the career prospects for a Loan Interviewer?

Loan Interviewers with experience and a proven track record of success can advance to positions such as Loan Officer, Loan Underwriter, or Credit Analyst.

What is the average salary for a Loan Interviewer?

The average salary for a Loan Interviewer in the United States is around $50,000 per year.

What are the educational requirements for a Loan Interviewer?

Most Loan Interviewers have a Bachelor’s Degree in Finance or a related field.

What are the certification requirements for a Loan Interviewer?

There are no specific certification requirements for a Loan Interviewer, but some employers may prefer candidates with certifications such as the Certified Loan Officer (CLO) or the Certified Mortgage Banker (CMB).