Are you a seasoned Loan Workout Officer seeking a new career path? Discover our professionally built Loan Workout Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

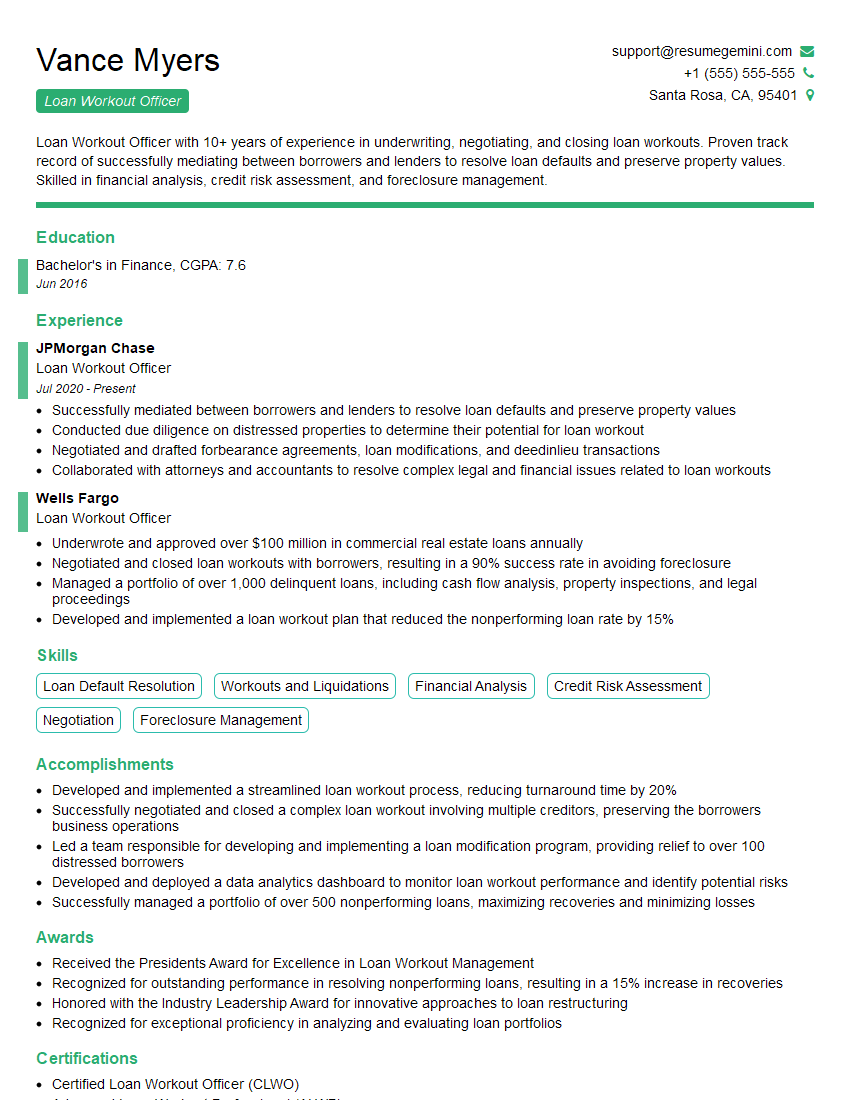

Vance Myers

Loan Workout Officer

Summary

Loan Workout Officer with 10+ years of experience in underwriting, negotiating, and closing loan workouts. Proven track record of successfully mediating between borrowers and lenders to resolve loan defaults and preserve property values. Skilled in financial analysis, credit risk assessment, and foreclosure management.

Education

Bachelor’s in Finance

June 2016

Skills

- Loan Default Resolution

- Workouts and Liquidations

- Financial Analysis

- Credit Risk Assessment

- Negotiation

- Foreclosure Management

Work Experience

Loan Workout Officer

- Successfully mediated between borrowers and lenders to resolve loan defaults and preserve property values

- Conducted due diligence on distressed properties to determine their potential for loan workout

- Negotiated and drafted forbearance agreements, loan modifications, and deedinlieu transactions

- Collaborated with attorneys and accountants to resolve complex legal and financial issues related to loan workouts

Loan Workout Officer

- Underwrote and approved over $100 million in commercial real estate loans annually

- Negotiated and closed loan workouts with borrowers, resulting in a 90% success rate in avoiding foreclosure

- Managed a portfolio of over 1,000 delinquent loans, including cash flow analysis, property inspections, and legal proceedings

- Developed and implemented a loan workout plan that reduced the nonperforming loan rate by 15%

Accomplishments

- Developed and implemented a streamlined loan workout process, reducing turnaround time by 20%

- Successfully negotiated and closed a complex loan workout involving multiple creditors, preserving the borrowers business operations

- Led a team responsible for developing and implementing a loan modification program, providing relief to over 100 distressed borrowers

- Developed and deployed a data analytics dashboard to monitor loan workout performance and identify potential risks

- Successfully managed a portfolio of over 500 nonperforming loans, maximizing recoveries and minimizing losses

Awards

- Received the Presidents Award for Excellence in Loan Workout Management

- Recognized for outstanding performance in resolving nonperforming loans, resulting in a 15% increase in recoveries

- Honored with the Industry Leadership Award for innovative approaches to loan restructuring

- Recognized for exceptional proficiency in analyzing and evaluating loan portfolios

Certificates

- Certified Loan Workout Officer (CLWO)

- Advanced Loan Workout Professional (ALWP)

- Certified Commercial Recovery Professional (CCRP)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Workout Officer

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your ability to build and maintain relationships with borrowers and lenders.

- Showcase your expertise in financial analysis, credit risk assessment, and foreclosure management.

- Demonstrate your understanding of the legal and regulatory environment governing loan workouts.

Essential Experience Highlights for a Strong Loan Workout Officer Resume

- Evaluate and analyze delinquent loan portfolios to identify potential workout opportunities.

- Negotiate and structure loan workout agreements, including forbearance agreements, loan modifications, and deed-in-lieu transactions.

- Manage and monitor distressed real estate assets, including cash flow analysis, property inspections, and legal proceedings.

- Collaborate with attorneys and accountants to resolve complex legal and financial issues related to loan workouts.

- Develop and implement workout strategies to maximize recovery for lenders while preserving relationships with borrowers.

- Conduct due diligence on distressed properties to determine their potential for loan workouts.

- Train and mentor junior loan workout officers.

Frequently Asked Questions (FAQ’s) For Loan Workout Officer

What are the key skills required to be a successful Loan Workout Officer?

The key skills required to be a successful Loan Workout Officer include financial analysis, credit risk assessment, negotiation, foreclosure management, and the ability to build and maintain relationships with borrowers and lenders.

What are the most common types of loan workouts?

The most common types of loan workouts include forbearance agreements, loan modifications, and deed-in-lieu transactions.

What are the benefits of loan workouts?

Loan workouts can benefit both borrowers and lenders. For borrowers, loan workouts can help them avoid foreclosure and preserve their property. For lenders, loan workouts can help them recover as much of the loan balance as possible while avoiding the costs and risks associated with foreclosure.

What are the challenges of loan workouts?

Loan workouts can be challenging due to the complex financial and legal issues involved. Additionally, loan workouts can be time-consuming and require a significant amount of negotiation and compromise.

What is the future of loan workouts?

The future of loan workouts is uncertain. However, it is likely that loan workouts will continue to be an important tool for resolving distressed loans. As the economy continues to evolve, the demand for loan workouts is likely to fluctuate.

What are the regulatory considerations for loan workouts?

Loan workouts are subject to a number of regulatory considerations. These considerations include the Truth in Lending Act, the Fair Debt Collection Practices Act, and the Real Estate Settlement Procedures Act. Loan Workout Officers must be familiar with these regulations to ensure that they are conducting loan workouts in a compliant manner.