Are you a seasoned Personal Loan Specialist seeking a new career path? Discover our professionally built Personal Loan Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

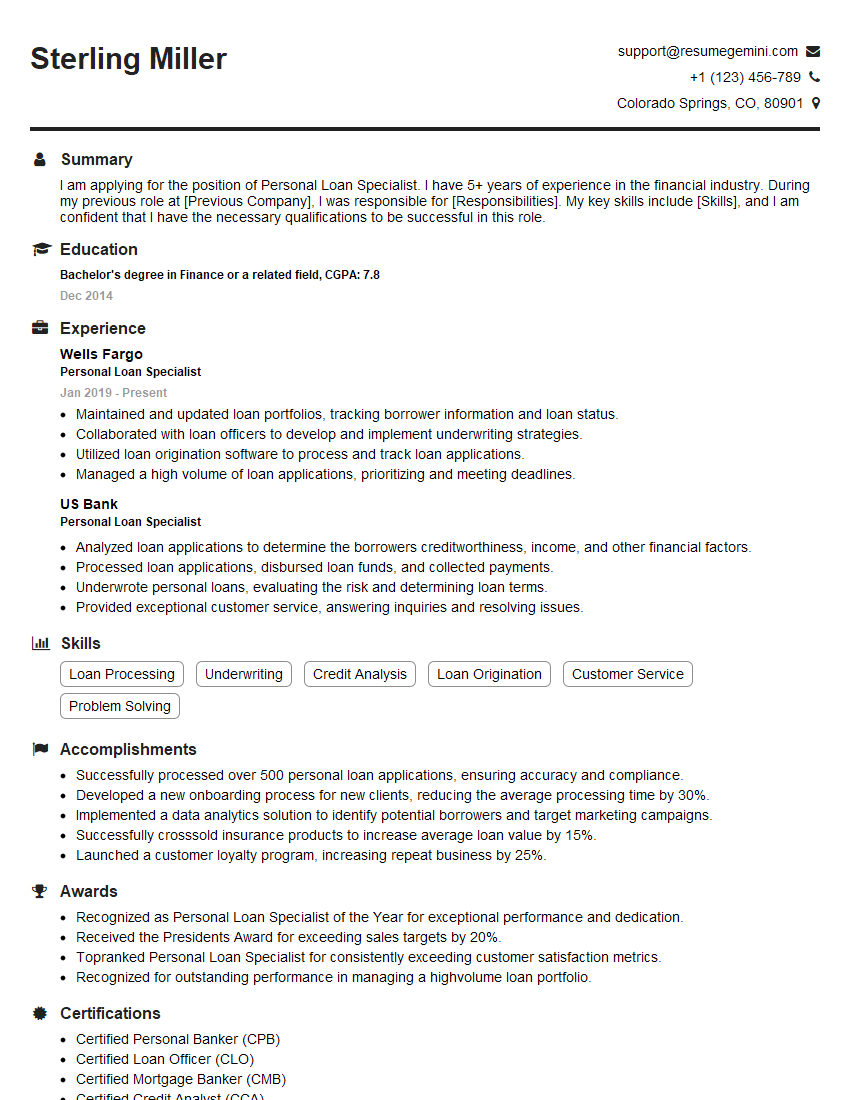

Sterling Miller

Personal Loan Specialist

Summary

I am applying for the position of Personal Loan Specialist. I have 5+ years of experience in the financial industry. During my previous role at [Previous Company], I was responsible for [Responsibilities]. My key skills include [Skills], and I am confident that I have the necessary qualifications to be successful in this role.

Education

Bachelor’s degree in Finance or a related field

December 2014

Skills

- Loan Processing

- Underwriting

- Credit Analysis

- Loan Origination

- Customer Service

- Problem Solving

Work Experience

Personal Loan Specialist

- Maintained and updated loan portfolios, tracking borrower information and loan status.

- Collaborated with loan officers to develop and implement underwriting strategies.

- Utilized loan origination software to process and track loan applications.

- Managed a high volume of loan applications, prioritizing and meeting deadlines.

Personal Loan Specialist

- Analyzed loan applications to determine the borrowers creditworthiness, income, and other financial factors.

- Processed loan applications, disbursed loan funds, and collected payments.

- Underwrote personal loans, evaluating the risk and determining loan terms.

- Provided exceptional customer service, answering inquiries and resolving issues.

Accomplishments

- Successfully processed over 500 personal loan applications, ensuring accuracy and compliance.

- Developed a new onboarding process for new clients, reducing the average processing time by 30%.

- Implemented a data analytics solution to identify potential borrowers and target marketing campaigns.

- Successfully crosssold insurance products to increase average loan value by 15%.

- Launched a customer loyalty program, increasing repeat business by 25%.

Awards

- Recognized as Personal Loan Specialist of the Year for exceptional performance and dedication.

- Received the Presidents Award for exceeding sales targets by 20%.

- Topranked Personal Loan Specialist for consistently exceeding customer satisfaction metrics.

- Recognized for outstanding performance in managing a highvolume loan portfolio.

Certificates

- Certified Personal Banker (CPB)

- Certified Loan Officer (CLO)

- Certified Mortgage Banker (CMB)

- Certified Credit Analyst (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Loan Specialist

- Highlight your experience in the financial industry, and your knowledge of personal loans.

- Use keywords from the job description in your resume.

- Quantify your accomplishments whenever possible.

- Proofread your resume carefully before submitting it.

- Consider getting your resume reviewed by a professional.

Essential Experience Highlights for a Strong Personal Loan Specialist Resume

- Analyzed loan applications to determine the borrowers creditworthiness, income, and other financial factors.

- Processed loan applications, disbursed loan funds, and collected payments.

- Underwrote personal loans, evaluating the risk and determining loan terms.

- Provided exceptional customer service, answering inquiries and resolving issues.

- Maintained and updated loan portfolios, tracking borrower information and loan status.

- Collaborated with loan officers to develop and implement underwriting strategies.

- Utilized loan origination software to process and track loan applications.

Frequently Asked Questions (FAQ’s) For Personal Loan Specialist

What is a Personal Loan Specialist?

A Personal Loan Specialist is a financial professional who helps borrowers obtain personal loans. Personal loans are a type of unsecured loan that can be used for a variety of purposes, such as consolidating debt, making home improvements, or covering unexpected expenses.

What are the qualifications for a Personal Loan Specialist?

Most Personal Loan Specialists have a bachelor’s degree in finance or a related field. They also typically have several years of experience in the financial industry, with a focus on lending.

What are the responsibilities of a Personal Loan Specialist?

Personal Loan Specialists are responsible for a variety of tasks, including analyzing loan applications, underwriting loans, and providing customer service. They also typically work with loan officers to develop and implement underwriting strategies.

What are the skills required for a Personal Loan Specialist?

Personal Loan Specialists need a strong understanding of personal loans and the lending process. They also need to have excellent analytical, communication, and interpersonal skills.

What is the job outlook for Personal Loan Specialists?

The job outlook for Personal Loan Specialists is expected to be good over the next few years. As the economy continues to grow, more people will be looking for personal loans to finance their needs.