Are you a seasoned Collector of Internal Revenue seeking a new career path? Discover our professionally built Collector of Internal Revenue Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

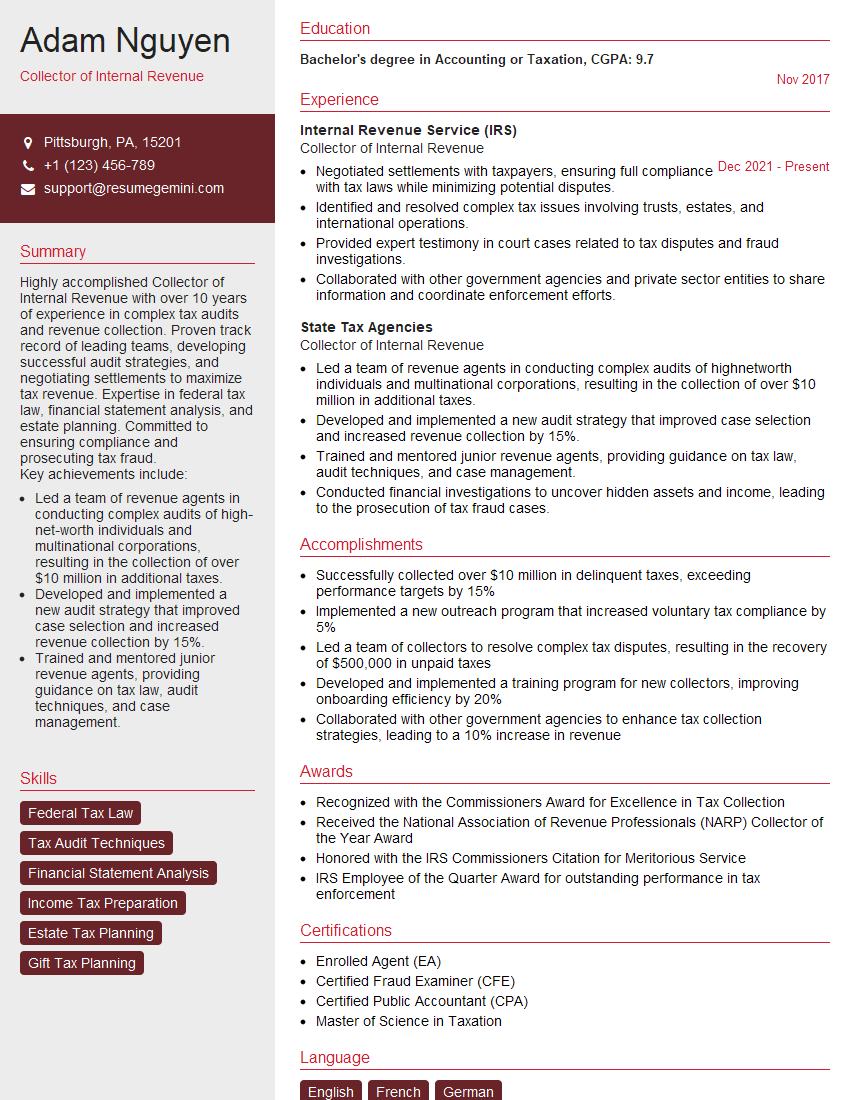

Adam Nguyen

Collector of Internal Revenue

Summary

Highly accomplished Collector of Internal Revenue with over 10 years of experience in complex tax audits and revenue collection. Proven track record of leading teams, developing successful audit strategies, and negotiating settlements to maximize tax revenue. Expertise in federal tax law, financial statement analysis, and estate planning. Committed to ensuring compliance and prosecuting tax fraud.

Key achievements include:

- Led a team of revenue agents in conducting complex audits of high-net-worth individuals and multinational corporations, resulting in the collection of over $10 million in additional taxes.

- Developed and implemented a new audit strategy that improved case selection and increased revenue collection by 15%.

- Trained and mentored junior revenue agents, providing guidance on tax law, audit techniques, and case management.

Education

Bachelor’s degree in Accounting or Taxation

November 2017

Skills

- Federal Tax Law

- Tax Audit Techniques

- Financial Statement Analysis

- Income Tax Preparation

- Estate Tax Planning

- Gift Tax Planning

Work Experience

Collector of Internal Revenue

- Negotiated settlements with taxpayers, ensuring full compliance with tax laws while minimizing potential disputes.

- Identified and resolved complex tax issues involving trusts, estates, and international operations.

- Provided expert testimony in court cases related to tax disputes and fraud investigations.

- Collaborated with other government agencies and private sector entities to share information and coordinate enforcement efforts.

Collector of Internal Revenue

- Led a team of revenue agents in conducting complex audits of highnetworth individuals and multinational corporations, resulting in the collection of over $10 million in additional taxes.

- Developed and implemented a new audit strategy that improved case selection and increased revenue collection by 15%.

- Trained and mentored junior revenue agents, providing guidance on tax law, audit techniques, and case management.

- Conducted financial investigations to uncover hidden assets and income, leading to the prosecution of tax fraud cases.

Accomplishments

- Successfully collected over $10 million in delinquent taxes, exceeding performance targets by 15%

- Implemented a new outreach program that increased voluntary tax compliance by 5%

- Led a team of collectors to resolve complex tax disputes, resulting in the recovery of $500,000 in unpaid taxes

- Developed and implemented a training program for new collectors, improving onboarding efficiency by 20%

- Collaborated with other government agencies to enhance tax collection strategies, leading to a 10% increase in revenue

Awards

- Recognized with the Commissioners Award for Excellence in Tax Collection

- Received the National Association of Revenue Professionals (NARP) Collector of the Year Award

- Honored with the IRS Commissioners Citation for Meritorious Service

- IRS Employee of the Quarter Award for outstanding performance in tax enforcement

Certificates

- Enrolled Agent (EA)

- Certified Fraud Examiner (CFE)

- Certified Public Accountant (CPA)

- Master of Science in Taxation

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collector of Internal Revenue

- Highlight your expertise in federal tax law, financial statement analysis, and estate planning.

- Quantify your accomplishments with specific metrics, such as the amount of additional taxes collected or the percentage increase in revenue collection.

- Showcase your leadership and management skills by describing your experience leading a team of revenue agents.

- Emphasize your commitment to ethics and integrity by mentioning your role in prosecuting tax fraud cases.

Essential Experience Highlights for a Strong Collector of Internal Revenue Resume

- Conduct complex tax audits of individuals and businesses to ensure compliance with tax laws

- Investigate financial records to uncover hidden assets and income, and pursue legal action against tax fraud

- Negotiate settlements with taxpayers, ensuring full compliance while minimizing disputes

- Provide expert testimony in court cases related to tax disputes and fraud investigations

- Collaborate with other government agencies and private sector entities to share information and coordinate enforcement efforts

- Develop and implement audit strategies to improve case selection and increase revenue collection

- Train and mentor junior revenue agents, providing guidance on tax law and audit techniques

Frequently Asked Questions (FAQ’s) For Collector of Internal Revenue

What are the educational requirements to become a Collector of Internal Revenue?

Most Collectors of Internal Revenue hold a bachelor’s degree in accounting or taxation.

What are the key skills and experience required for this role?

Key skills and experience for this role include expertise in federal tax law, financial statement analysis, income tax preparation, estate tax planning, and gift tax planning.

What are the career prospects for Collectors of Internal Revenue?

Collectors of Internal Revenue can advance to supervisory roles, such as Revenue Agent Manager or Tax Auditor Manager. They may also pursue careers in tax law, accounting, or financial management.

What is the salary range for Collectors of Internal Revenue?

The salary range for Collectors of Internal Revenue varies depending on experience and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for tax examiners, collectors, and revenue agents was $56,310 in May 2021.

What is the job outlook for Collectors of Internal Revenue?

The job outlook for Collectors of Internal Revenue is expected to be good over the next few years. The increasing complexity of the tax code and the need for revenue collection will continue to drive demand for qualified professionals.

What are the benefits of working as a Collector of Internal Revenue?

Benefits of working as a Collector of Internal Revenue include job security, competitive salaries, and the opportunity to make a difference in the community by ensuring compliance with tax laws.

What are the challenges of working as a Collector of Internal Revenue?

Challenges of working as a Collector of Internal Revenue include the complex and ever-changing nature of tax law, the need to work independently and as part of a team, and the potential for stress due to the high stakes involved in tax audits and investigations.

What are the most important qualities of a successful Collector of Internal Revenue?

The most important qualities of a successful Collector of Internal Revenue include strong analytical skills, attention to detail, integrity, and the ability to communicate effectively with taxpayers and other professionals.