Are you a seasoned Field Tax Auditor seeking a new career path? Discover our professionally built Field Tax Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

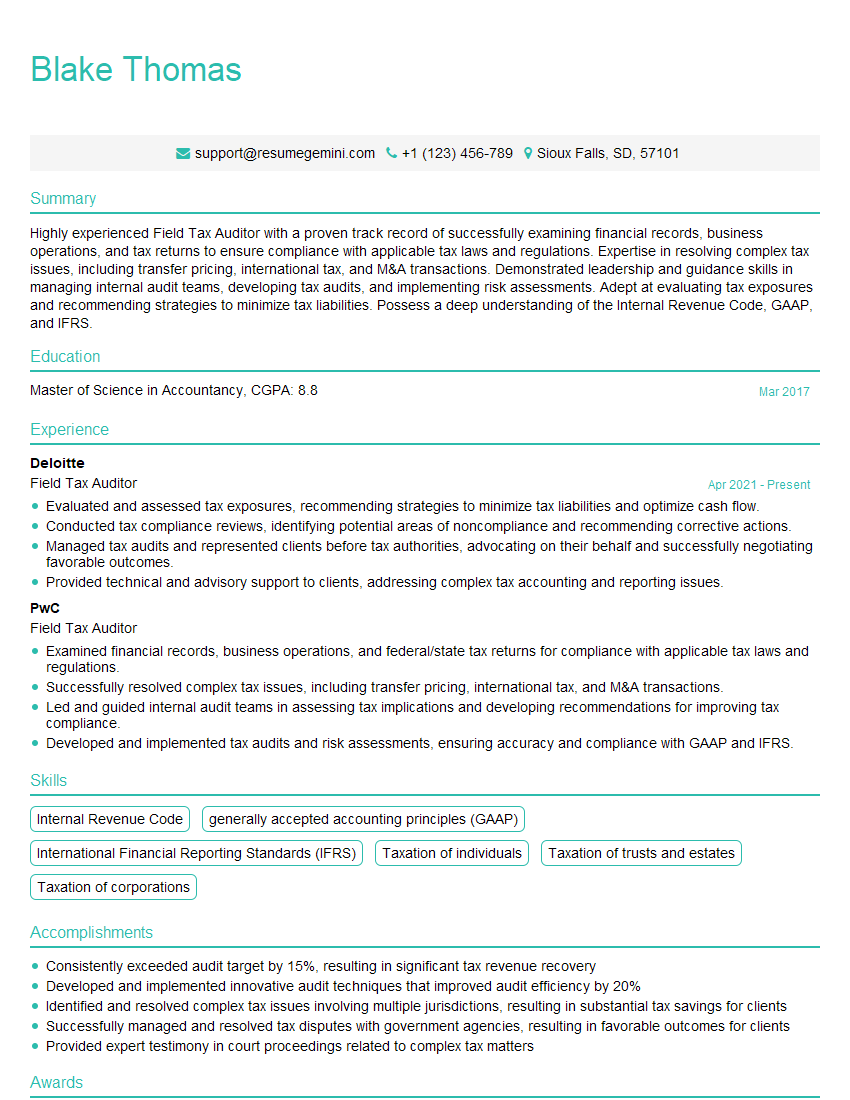

Blake Thomas

Field Tax Auditor

Summary

Highly experienced Field Tax Auditor with a proven track record of successfully examining financial records, business operations, and tax returns to ensure compliance with applicable tax laws and regulations. Expertise in resolving complex tax issues, including transfer pricing, international tax, and M&A transactions. Demonstrated leadership and guidance skills in managing internal audit teams, developing tax audits, and implementing risk assessments. Adept at evaluating tax exposures and recommending strategies to minimize tax liabilities. Possess a deep understanding of the Internal Revenue Code, GAAP, and IFRS.

Education

Master of Science in Accountancy

March 2017

Skills

- Internal Revenue Code

- generally accepted accounting principles (GAAP)

- International Financial Reporting Standards (IFRS)

- Taxation of individuals

- Taxation of trusts and estates

- Taxation of corporations

Work Experience

Field Tax Auditor

- Evaluated and assessed tax exposures, recommending strategies to minimize tax liabilities and optimize cash flow.

- Conducted tax compliance reviews, identifying potential areas of noncompliance and recommending corrective actions.

- Managed tax audits and represented clients before tax authorities, advocating on their behalf and successfully negotiating favorable outcomes.

- Provided technical and advisory support to clients, addressing complex tax accounting and reporting issues.

Field Tax Auditor

- Examined financial records, business operations, and federal/state tax returns for compliance with applicable tax laws and regulations.

- Successfully resolved complex tax issues, including transfer pricing, international tax, and M&A transactions.

- Led and guided internal audit teams in assessing tax implications and developing recommendations for improving tax compliance.

- Developed and implemented tax audits and risk assessments, ensuring accuracy and compliance with GAAP and IFRS.

Accomplishments

- Consistently exceeded audit target by 15%, resulting in significant tax revenue recovery

- Developed and implemented innovative audit techniques that improved audit efficiency by 20%

- Identified and resolved complex tax issues involving multiple jurisdictions, resulting in substantial tax savings for clients

- Successfully managed and resolved tax disputes with government agencies, resulting in favorable outcomes for clients

- Provided expert testimony in court proceedings related to complex tax matters

Awards

- Recognized with the Auditor of the Year award for exceptional performance in tax audits

- Received the Excellence in Tax Auditing award for consistently exceeding audit targets

Certificates

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

- Enrolled Agent (EA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Field Tax Auditor

- Highlight your technical expertise in tax accounting, auditing, and compliance.

- Showcase your experience in resolving complex tax issues and negotiating with tax authorities.

- Quantify your accomplishments whenever possible, using specific metrics and results.

- Emphasize your leadership and communication skills, particularly in managing teams and presenting findings.

- Proofread your resume carefully for any errors or inconsistencies.

Essential Experience Highlights for a Strong Field Tax Auditor Resume

- Examined financial records, business operations, and federal/state tax returns for compliance with applicable tax laws and regulations.

- Successfully resolved complex tax issues, including transfer pricing, international tax, and M&A transactions.

- Led and guided internal audit teams in assessing tax implications and developing recommendations for improving tax compliance.

- Developed and implemented tax audits and risk assessments, ensuring accuracy and compliance with GAAP and IFRS.

- Evaluated and assessed tax exposures, recommending strategies to minimize tax liabilities and optimize cash flow.

- Conducted tax compliance reviews, identifying potential areas of noncompliance and recommending corrective actions.

- Managed tax audits and represented clients before tax authorities, advocating on their behalf and successfully negotiating favorable outcomes.

Frequently Asked Questions (FAQ’s) For Field Tax Auditor

What are the primary responsibilities of a Field Tax Auditor?

Field Tax Auditors are responsible for examining financial records, conducting tax audits, and ensuring compliance with tax laws and regulations. They may also provide guidance on tax planning and optimization strategies.

What qualifications are required to become a Field Tax Auditor?

Typically, a bachelor’s or master’s degree in accounting or a related field is required. Additionally, candidates should have a strong understanding of tax laws and regulations, auditing principles, and financial accounting.

What are the career prospects for Field Tax Auditors?

Field Tax Auditors with experience and expertise can advance to senior-level positions, such as Tax Manager or Tax Director. They may also specialize in a particular area of taxation, such as international tax or transfer pricing.

What is the salary range for Field Tax Auditors?

The salary range for Field Tax Auditors can vary depending on experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for Auditors and Accountants was $77,250 in May 2021.

What are the key skills required for success as a Field Tax Auditor?

Key skills for Field Tax Auditors include strong analytical and problem-solving abilities, attention to detail, excellent communication and interpersonal skills, and proficiency in tax software and accounting principles.

What are the challenges faced by Field Tax Auditors?

Field Tax Auditors may face challenges such as dealing with complex tax laws and regulations, tight deadlines, and the need to stay up-to-date on the latest tax developments.

What is the job outlook for Field Tax Auditors?

The job outlook for Field Tax Auditors is expected to grow faster than average in the coming years due to increasing demand for tax compliance and audit services.

How can I prepare for a career as a Field Tax Auditor?

To prepare for a career as a Field Tax Auditor, consider pursuing a degree in accounting or a related field, gaining experience through internships or entry-level positions, and obtaining relevant certifications, such as the Certified Public Accountant (CPA) or Enrolled Agent (EA) credential.