Are you a seasoned Internal Revenue Agent seeking a new career path? Discover our professionally built Internal Revenue Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

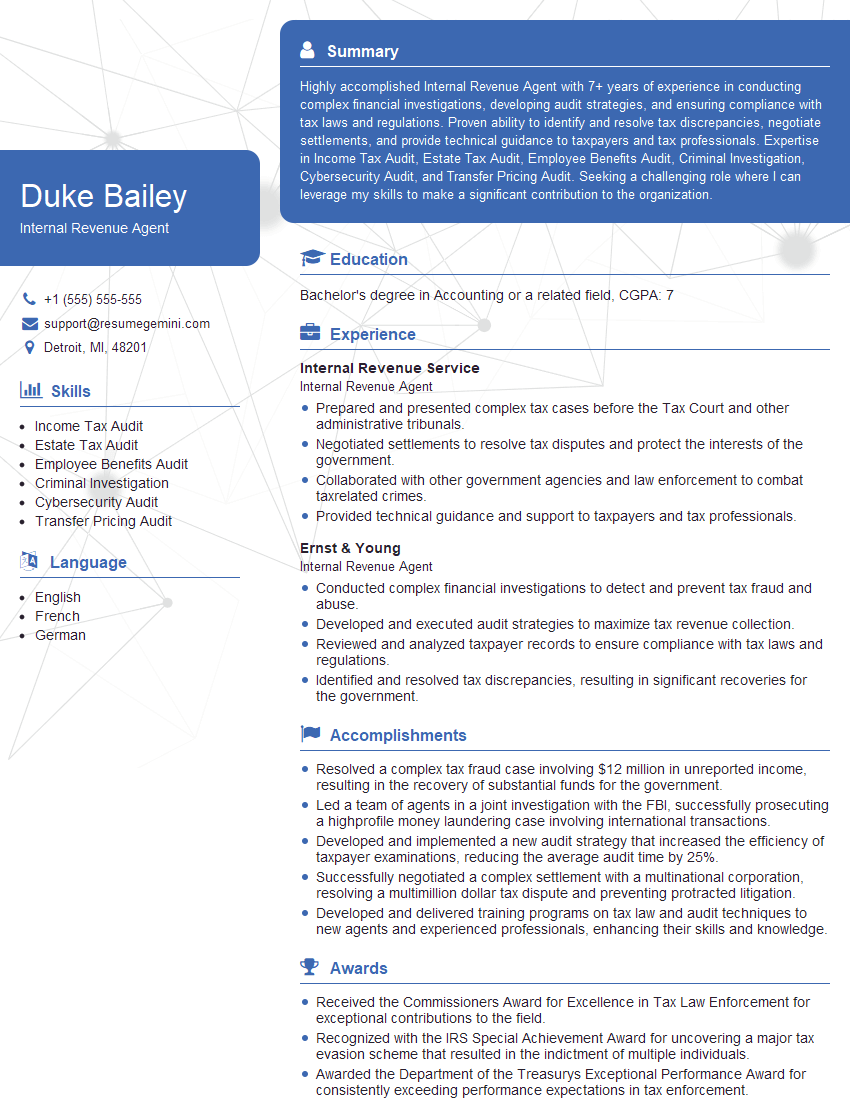

Duke Bailey

Internal Revenue Agent

Summary

Highly accomplished Internal Revenue Agent with 7+ years of experience in conducting complex financial investigations, developing audit strategies, and ensuring compliance with tax laws and regulations. Proven ability to identify and resolve tax discrepancies, negotiate settlements, and provide technical guidance to taxpayers and tax professionals. Expertise in Income Tax Audit, Estate Tax Audit, Employee Benefits Audit, Criminal Investigation, Cybersecurity Audit, and Transfer Pricing Audit. Seeking a challenging role where I can leverage my skills to make a significant contribution to the organization.

Education

Bachelor’s degree in Accounting or a related field

October 2017

Skills

- Income Tax Audit

- Estate Tax Audit

- Employee Benefits Audit

- Criminal Investigation

- Cybersecurity Audit

- Transfer Pricing Audit

Work Experience

Internal Revenue Agent

- Prepared and presented complex tax cases before the Tax Court and other administrative tribunals.

- Negotiated settlements to resolve tax disputes and protect the interests of the government.

- Collaborated with other government agencies and law enforcement to combat taxrelated crimes.

- Provided technical guidance and support to taxpayers and tax professionals.

Internal Revenue Agent

- Conducted complex financial investigations to detect and prevent tax fraud and abuse.

- Developed and executed audit strategies to maximize tax revenue collection.

- Reviewed and analyzed taxpayer records to ensure compliance with tax laws and regulations.

- Identified and resolved tax discrepancies, resulting in significant recoveries for the government.

Accomplishments

- Resolved a complex tax fraud case involving $12 million in unreported income, resulting in the recovery of substantial funds for the government.

- Led a team of agents in a joint investigation with the FBI, successfully prosecuting a highprofile money laundering case involving international transactions.

- Developed and implemented a new audit strategy that increased the efficiency of taxpayer examinations, reducing the average audit time by 25%.

- Successfully negotiated a complex settlement with a multinational corporation, resolving a multimillion dollar tax dispute and preventing protracted litigation.

- Developed and delivered training programs on tax law and audit techniques to new agents and experienced professionals, enhancing their skills and knowledge.

Awards

- Received the Commissioners Award for Excellence in Tax Law Enforcement for exceptional contributions to the field.

- Recognized with the IRS Special Achievement Award for uncovering a major tax evasion scheme that resulted in the indictment of multiple individuals.

- Awarded the Department of the Treasurys Exceptional Performance Award for consistently exceeding performance expectations in tax enforcement.

- Recognized as an IRS Master Tax Specialist in International Tax Law, demonstrating expert knowledge and proficiency in international tax matters.

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Internal Revenue Agent

- Highlight your technical skills in Income Tax Audit, Estate Tax Audit, and other relevant areas.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Emphasize your ability to work independently and as part of a team.

- Showcase your communication and interpersonal skills, as you will be interacting with taxpayers, attorneys, and other professionals.

Essential Experience Highlights for a Strong Internal Revenue Agent Resume

- Conducted complex financial investigations to detect and prevent tax fraud and abuse.

- Developed and executed audit strategies to maximize tax revenue collection.

- Reviewed and analyzed taxpayer records to ensure compliance with tax laws and regulations.

- Identified and resolved tax discrepancies, resulting in significant recoveries for the government.

- Prepared and presented complex tax cases before the Tax Court and other administrative tribunals.

- Negotiated settlements to resolve tax disputes and protect the interests of the government.

- Collaborated with other government agencies and law enforcement to combat tax-related crimes.

Frequently Asked Questions (FAQ’s) For Internal Revenue Agent

What are the key skills required for an Internal Revenue Agent?

The key skills required for an Internal Revenue Agent include strong analytical and problem-solving abilities, attention to detail, and a thorough understanding of tax laws and regulations. Excellent communication and interpersonal skills are also essential, as you will be interacting with taxpayers, attorneys, and other professionals.

What is the career path for an Internal Revenue Agent?

The career path for an Internal Revenue Agent typically involves starting as a Revenue Agent and then progressing to a Senior Revenue Agent or Supervisory Revenue Agent. With experience and additional qualifications, you may be able to advance to management or executive roles within the IRS or other organizations.

What is the salary range for an Internal Revenue Agent?

The salary range for an Internal Revenue Agent can vary depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Examiners, Collectors, and Revenue Agents was $66,490 in May 2021.

What is the work environment like for an Internal Revenue Agent?

Internal Revenue Agents typically work in an office setting and may travel for audits or investigations. The work can be challenging and demanding, but it can also be rewarding, as you are making a difference by ensuring compliance with tax laws and regulations.

What are the benefits of working as an Internal Revenue Agent?

The benefits of working as an Internal Revenue Agent include a competitive salary, comprehensive benefits package, and the opportunity to make a difference in your community. You will also have the chance to develop your skills and knowledge in the field of taxation.

What are the challenges of working as an Internal Revenue Agent?

The challenges of working as an Internal Revenue Agent include the high workload, the need to keep up with constantly changing tax laws and regulations, and the potential for dealing with uncooperative or hostile taxpayers.

What is the job outlook for Internal Revenue Agents?

The job outlook for Internal Revenue Agents is expected to be good over the next few years. The IRS is constantly looking for qualified candidates to fill vacancies due to retirements and promotions.

How can I prepare for a career as an Internal Revenue Agent?

To prepare for a career as an Internal Revenue Agent, you should earn a bachelor’s degree in accounting or a related field. You should also develop strong analytical and problem-solving skills, attention to detail, and a thorough understanding of tax laws and regulations. You can also gain experience by volunteering with tax preparation organizations or interning with the IRS.