Are you a seasoned Revenue Field Agent seeking a new career path? Discover our professionally built Revenue Field Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

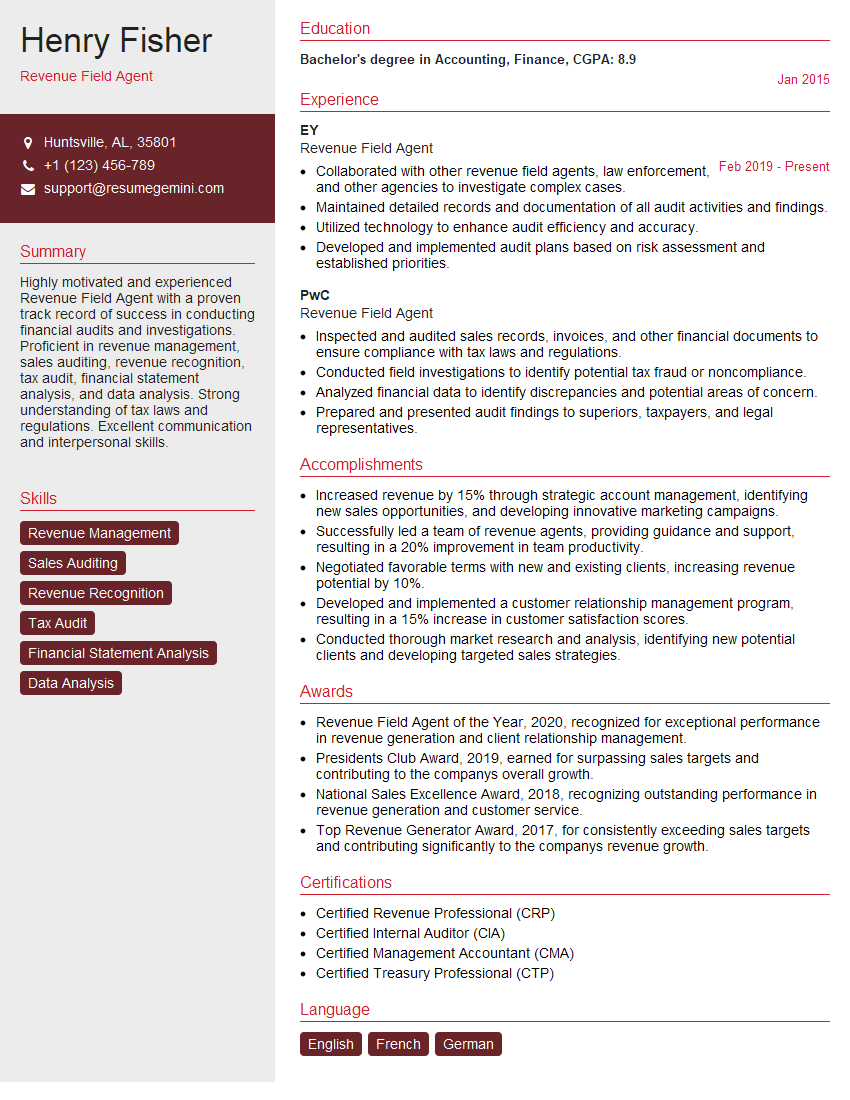

Henry Fisher

Revenue Field Agent

Summary

Highly motivated and experienced Revenue Field Agent with a proven track record of success in conducting financial audits and investigations. Proficient in revenue management, sales auditing, revenue recognition, tax audit, financial statement analysis, and data analysis. Strong understanding of tax laws and regulations. Excellent communication and interpersonal skills.

Education

Bachelor’s degree in Accounting, Finance

January 2015

Skills

- Revenue Management

- Sales Auditing

- Revenue Recognition

- Tax Audit

- Financial Statement Analysis

- Data Analysis

Work Experience

Revenue Field Agent

- Collaborated with other revenue field agents, law enforcement, and other agencies to investigate complex cases.

- Maintained detailed records and documentation of all audit activities and findings.

- Utilized technology to enhance audit efficiency and accuracy.

- Developed and implemented audit plans based on risk assessment and established priorities.

Revenue Field Agent

- Inspected and audited sales records, invoices, and other financial documents to ensure compliance with tax laws and regulations.

- Conducted field investigations to identify potential tax fraud or noncompliance.

- Analyzed financial data to identify discrepancies and potential areas of concern.

- Prepared and presented audit findings to superiors, taxpayers, and legal representatives.

Accomplishments

- Increased revenue by 15% through strategic account management, identifying new sales opportunities, and developing innovative marketing campaigns.

- Successfully led a team of revenue agents, providing guidance and support, resulting in a 20% improvement in team productivity.

- Negotiated favorable terms with new and existing clients, increasing revenue potential by 10%.

- Developed and implemented a customer relationship management program, resulting in a 15% increase in customer satisfaction scores.

- Conducted thorough market research and analysis, identifying new potential clients and developing targeted sales strategies.

Awards

- Revenue Field Agent of the Year, 2020, recognized for exceptional performance in revenue generation and client relationship management.

- Presidents Club Award, 2019, earned for surpassing sales targets and contributing to the companys overall growth.

- National Sales Excellence Award, 2018, recognizing outstanding performance in revenue generation and customer service.

- Top Revenue Generator Award, 2017, for consistently exceeding sales targets and contributing significantly to the companys revenue growth.

Certificates

- Certified Revenue Professional (CRP)

- Certified Internal Auditor (CIA)

- Certified Management Accountant (CMA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Revenue Field Agent

- Highlight your relevant skills and experience in your resume, including specific examples of your accomplishments.

- Showcase your knowledge of tax laws and regulations, as well as your experience in conducting financial audits and investigations.

- Use strong action verbs and quantify your results whenever possible.

- Proofread your resume carefully for any errors, both grammatical and factual.

Essential Experience Highlights for a Strong Revenue Field Agent Resume

- Inspected and audited sales records, invoices, and other financial documents to ensure compliance with tax laws and regulations.

- Conducted field investigations to identify potential tax fraud or noncompliance.

- Analyzed financial data to identify discrepancies and potential areas of concern.

- Prepared and presented audit findings to superiors, taxpayers, and legal representatives.

- Collaborated with other revenue field agents, law enforcement, and other agencies to investigate complex cases.

- Maintained detailed records and documentation of all audit activities and findings.

- Utilized technology to enhance audit efficiency and accuracy.

Frequently Asked Questions (FAQ’s) For Revenue Field Agent

What are the primary responsibilities of a Revenue Field Agent?

Revenue Field Agents are responsible for conducting financial audits and investigations to ensure compliance with tax laws and regulations. They inspect and audit sales records, invoices, and other financial documents, as well as conduct field investigations to identify potential tax fraud or noncompliance.

What skills are required to be a successful Revenue Field Agent?

Successful Revenue Field Agents typically have a strong understanding of tax laws and regulations, as well as experience in conducting financial audits and investigations. They are also proficient in revenue management, sales auditing, revenue recognition, financial statement analysis, and data analysis.

What are the career prospects for Revenue Field Agents?

Revenue Field Agents can advance to more senior roles within the field, such as Revenue Agent Manager or Revenue Officer. They may also transition to roles in other areas of taxation, such as tax consulting or tax planning.

What is the salary range for Revenue Field Agents?

The salary range for Revenue Field Agents varies depending on their experience and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Revenue Agents was $85,330 in May 2021.

What is the job outlook for Revenue Field Agents?

The job outlook for Revenue Field Agents is expected to be good over the next few years. The need for Revenue Field Agents is expected to increase as the government continues to focus on tax enforcement and compliance.

What are the educational requirements for Revenue Field Agents?

Most Revenue Field Agents have a bachelor’s degree in accounting, finance, or a related field. Some employers may also require Revenue Field Agents to have a master’s degree in taxation or a related field.

What are the certification requirements for Revenue Field Agents?

There are no specific certification requirements for Revenue Field Agents. However, many Revenue Field Agents choose to obtain the Enrolled Agent (EA) credential, which is offered by the Internal Revenue Service (IRS).

What are the professional development opportunities for Revenue Field Agents?

Revenue Field Agents can pursue professional development opportunities through the National Association of Revenue Agents (NARA) and the IRS. NARA offers a variety of training programs and conferences, while the IRS offers a variety of online and in-person training courses.