Are you a seasoned Tax Compliance Representative seeking a new career path? Discover our professionally built Tax Compliance Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

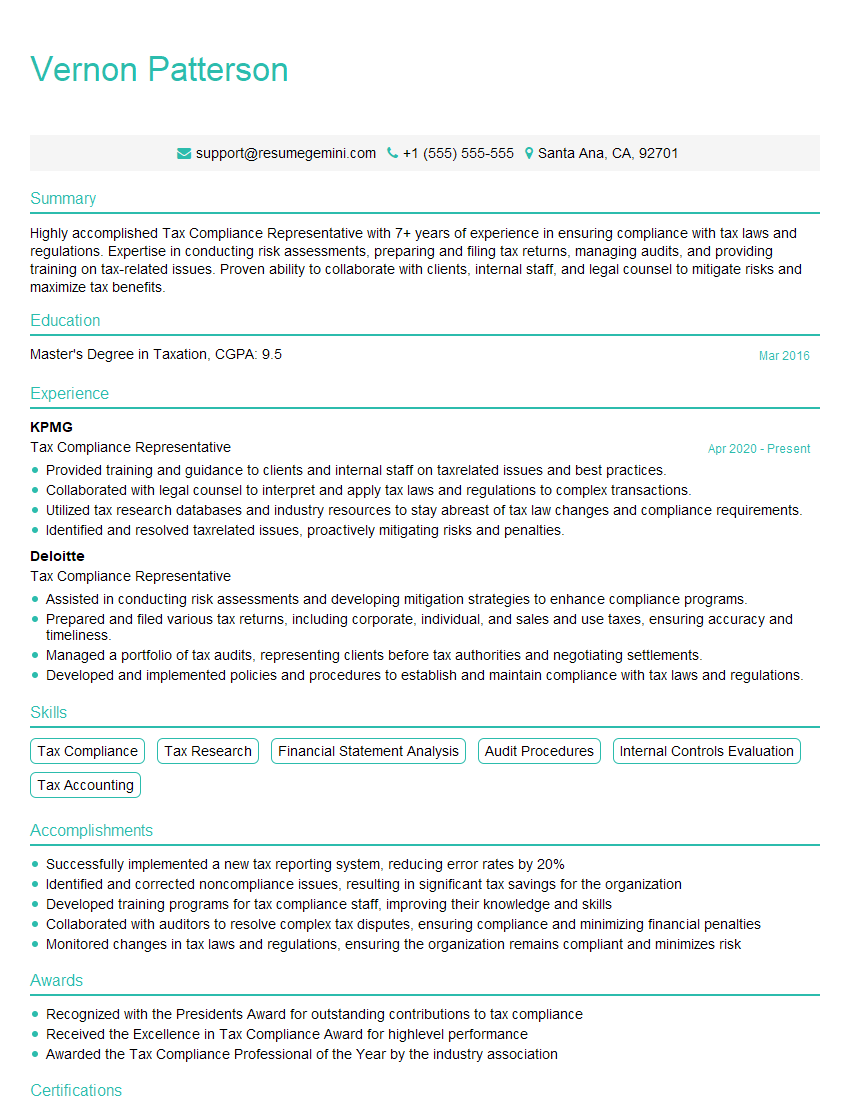

Vernon Patterson

Tax Compliance Representative

Summary

Highly accomplished Tax Compliance Representative with 7+ years of experience in ensuring compliance with tax laws and regulations. Expertise in conducting risk assessments, preparing and filing tax returns, managing audits, and providing training on tax-related issues. Proven ability to collaborate with clients, internal staff, and legal counsel to mitigate risks and maximize tax benefits.

Education

Master’s Degree in Taxation

March 2016

Skills

- Tax Compliance

- Tax Research

- Financial Statement Analysis

- Audit Procedures

- Internal Controls Evaluation

- Tax Accounting

Work Experience

Tax Compliance Representative

- Provided training and guidance to clients and internal staff on taxrelated issues and best practices.

- Collaborated with legal counsel to interpret and apply tax laws and regulations to complex transactions.

- Utilized tax research databases and industry resources to stay abreast of tax law changes and compliance requirements.

- Identified and resolved taxrelated issues, proactively mitigating risks and penalties.

Tax Compliance Representative

- Assisted in conducting risk assessments and developing mitigation strategies to enhance compliance programs.

- Prepared and filed various tax returns, including corporate, individual, and sales and use taxes, ensuring accuracy and timeliness.

- Managed a portfolio of tax audits, representing clients before tax authorities and negotiating settlements.

- Developed and implemented policies and procedures to establish and maintain compliance with tax laws and regulations.

Accomplishments

- Successfully implemented a new tax reporting system, reducing error rates by 20%

- Identified and corrected noncompliance issues, resulting in significant tax savings for the organization

- Developed training programs for tax compliance staff, improving their knowledge and skills

- Collaborated with auditors to resolve complex tax disputes, ensuring compliance and minimizing financial penalties

- Monitored changes in tax laws and regulations, ensuring the organization remains compliant and minimizes risk

Awards

- Recognized with the Presidents Award for outstanding contributions to tax compliance

- Received the Excellence in Tax Compliance Award for highlevel performance

- Awarded the Tax Compliance Professional of the Year by the industry association

Certificates

- Certified Tax Specialist (CTS)

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Compliance Representative

- Highlight your expertise in tax compliance and research.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your ability to work independently and as part of a team.

- Showcase your communication and interpersonal skills.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Tax Compliance Representative Resume

- Assessed risks and developed mitigation strategies to enhance compliance programs.

- Prepared and filed various tax returns, including corporate, individual, and sales and use taxes, ensuring accuracy and timeliness.

- Managed a portfolio of tax audits, representing clients before tax authorities and negotiating settlements.

- Developed and implemented policies and procedures to establish and maintain compliance with tax laws and regulations.

- Provided training and guidance to clients and internal staff on tax-related issues and best practices.

- Collaborated with legal counsel to interpret and apply tax laws and regulations to complex transactions.

- Utilized tax research databases and industry resources to stay abreast of tax law changes and compliance requirements.

Frequently Asked Questions (FAQ’s) For Tax Compliance Representative

What are the key skills required to be a successful Tax Compliance Representative?

Strong understanding of tax laws and regulations, proficiency in tax research, financial statement analysis, and internal controls evaluation, as well as excellent communication and interpersonal skills.

What are the career growth opportunities for Tax Compliance Representatives?

Advancement opportunities include Tax Manager, Tax Director, and Chief Financial Officer.

What are the common challenges faced by Tax Compliance Representatives?

Staying up-to-date with ever-changing tax laws and regulations, managing complex tax audits, and ensuring compliance with various tax authorities.

What is the job outlook for Tax Compliance Representatives?

The job outlook is positive due to the increasing need for compliance with tax laws and regulations.

What are the top industries for Tax Compliance Representatives?

Accounting, finance, and legal.

What are the salary expectations for Tax Compliance Representatives?

Salaries vary depending on experience, location, and company size.

What are the educational requirements to become a Tax Compliance Representative?

A bachelor’s or master’s degree in accounting, taxation, or a related field is typically required.