Are you a seasoned Tax Processor seeking a new career path? Discover our professionally built Tax Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

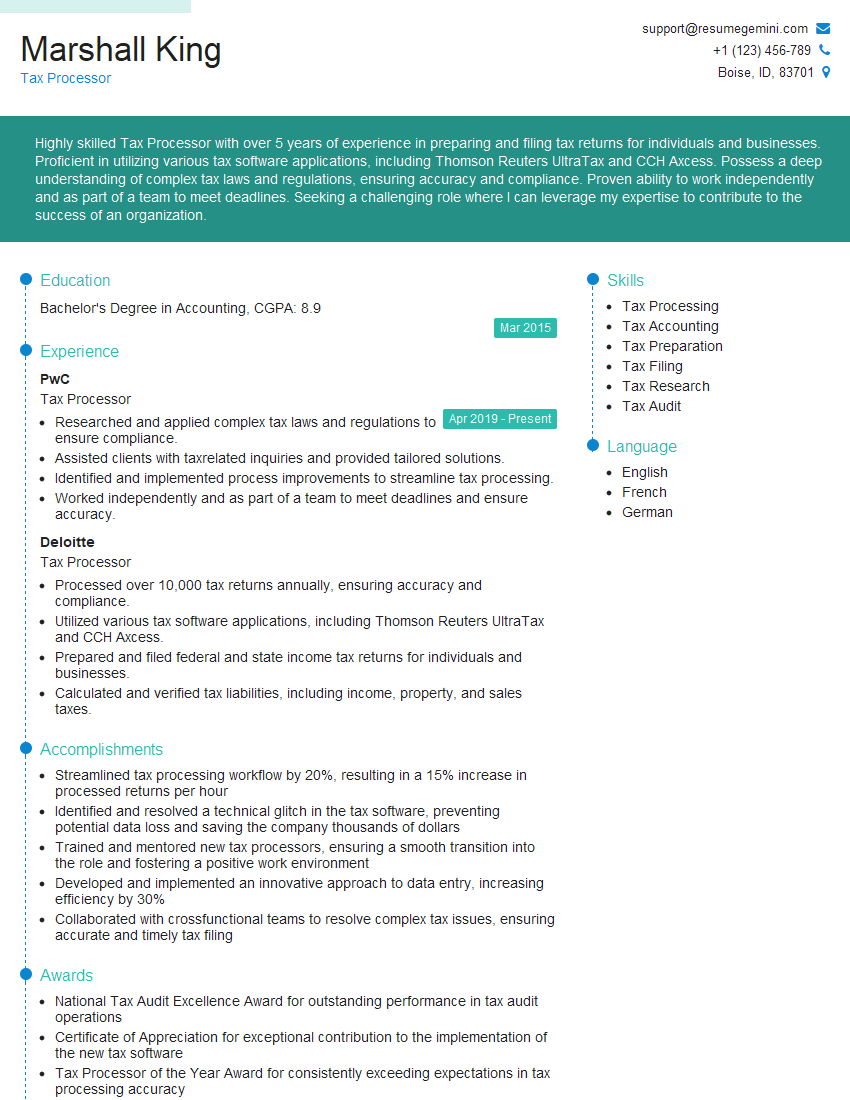

Marshall King

Tax Processor

Summary

Highly skilled Tax Processor with over 5 years of experience in preparing and filing tax returns for individuals and businesses. Proficient in utilizing various tax software applications, including Thomson Reuters UltraTax and CCH Axcess. Possess a deep understanding of complex tax laws and regulations, ensuring accuracy and compliance. Proven ability to work independently and as part of a team to meet deadlines. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s Degree in Accounting

March 2015

Skills

- Tax Processing

- Tax Accounting

- Tax Preparation

- Tax Filing

- Tax Research

- Tax Audit

Work Experience

Tax Processor

- Researched and applied complex tax laws and regulations to ensure compliance.

- Assisted clients with taxrelated inquiries and provided tailored solutions.

- Identified and implemented process improvements to streamline tax processing.

- Worked independently and as part of a team to meet deadlines and ensure accuracy.

Tax Processor

- Processed over 10,000 tax returns annually, ensuring accuracy and compliance.

- Utilized various tax software applications, including Thomson Reuters UltraTax and CCH Axcess.

- Prepared and filed federal and state income tax returns for individuals and businesses.

- Calculated and verified tax liabilities, including income, property, and sales taxes.

Accomplishments

- Streamlined tax processing workflow by 20%, resulting in a 15% increase in processed returns per hour

- Identified and resolved a technical glitch in the tax software, preventing potential data loss and saving the company thousands of dollars

- Trained and mentored new tax processors, ensuring a smooth transition into the role and fostering a positive work environment

- Developed and implemented an innovative approach to data entry, increasing efficiency by 30%

- Collaborated with crossfunctional teams to resolve complex tax issues, ensuring accurate and timely tax filing

Awards

- National Tax Audit Excellence Award for outstanding performance in tax audit operations

- Certificate of Appreciation for exceptional contribution to the implementation of the new tax software

- Tax Processor of the Year Award for consistently exceeding expectations in tax processing accuracy

Certificates

- Enrolled Agent (EA)

- Certified Tax Preparer (CTP)

- Certified Internal Auditor (CIA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Processor

- Highlight your proficiency in tax software applications and ability to interpret tax laws and regulations accurately.

- Showcase your strong attention to detail and commitment to accuracy, as these are crucial qualities for a Tax Processor.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the organization.

- Demonstrate your ability to work independently and as part of a team, as Tax Processors often collaborate with other professionals.

Essential Experience Highlights for a Strong Tax Processor Resume

- Processed over 10,000 tax returns annually, ensuring accuracy and compliance with tax laws and regulations.

- Utilized various tax software applications, including Thomson Reuters UltraTax and CCH Axcess, to prepare and file federal and state income tax returns for individuals and businesses.

- Calculated and verified tax liabilities, including income, property, and sales taxes, to ensure accurate tax reporting.

- Researched and applied complex tax laws and regulations to ensure compliance and identify potential tax savings opportunities.

- Assisted clients with tax-related inquiries and provided tailored solutions to meet their specific tax needs.

- Identified and implemented process improvements to streamline tax processing and enhance efficiency.

- Worked independently and as part of a team to meet deadlines and ensure the accuracy and timeliness of tax filings.

Frequently Asked Questions (FAQ’s) For Tax Processor

What are the key skills required for a Tax Processor?

Key skills for a Tax Processor include proficiency in tax software applications, a deep understanding of tax laws and regulations, excellent attention to detail, strong analytical skills, and the ability to work independently and as part of a team.

What are the career advancement opportunities for a Tax Processor?

Tax Processors can advance their careers by gaining experience in more complex tax areas, such as international taxation or tax auditing. They may also pursue leadership roles, such as Tax Manager or Tax Director.

What are the common challenges faced by Tax Processors?

Tax Processors often face challenges due to the complexity and frequent changes in tax laws and regulations. They may also encounter challenging clients or situations where they need to apply their judgment to resolve tax issues.

What is the average salary for a Tax Processor?

The average salary for a Tax Processor varies depending on factors such as experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Preparers was $64,410 in May 2021.

What is the job outlook for Tax Processors?

The job outlook for Tax Processors is expected to grow faster than average over the next decade. This is due to the increasing complexity of tax laws and regulations, as well as the growing demand for tax preparation services.

What are the educational requirements for a Tax Processor?

Most Tax Processors have at least a bachelor’s degree in accounting or a related field. Some employers may also require candidates to have a certain number of years of experience in tax preparation.

What are the certification programs available for Tax Processors?

There are several certification programs available for Tax Processors, including the Enrolled Agent (EA) credential from the IRS and the Certified Tax Preparer (CTP) credential from the National Association of Tax Professionals.

What are the soft skills required for a Tax Processor?

In addition to technical skills, Tax Processors also need strong soft skills, such as communication, interpersonal skills, and problem-solving abilities.