Are you a seasoned Corporate Tax Preparer seeking a new career path? Discover our professionally built Corporate Tax Preparer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

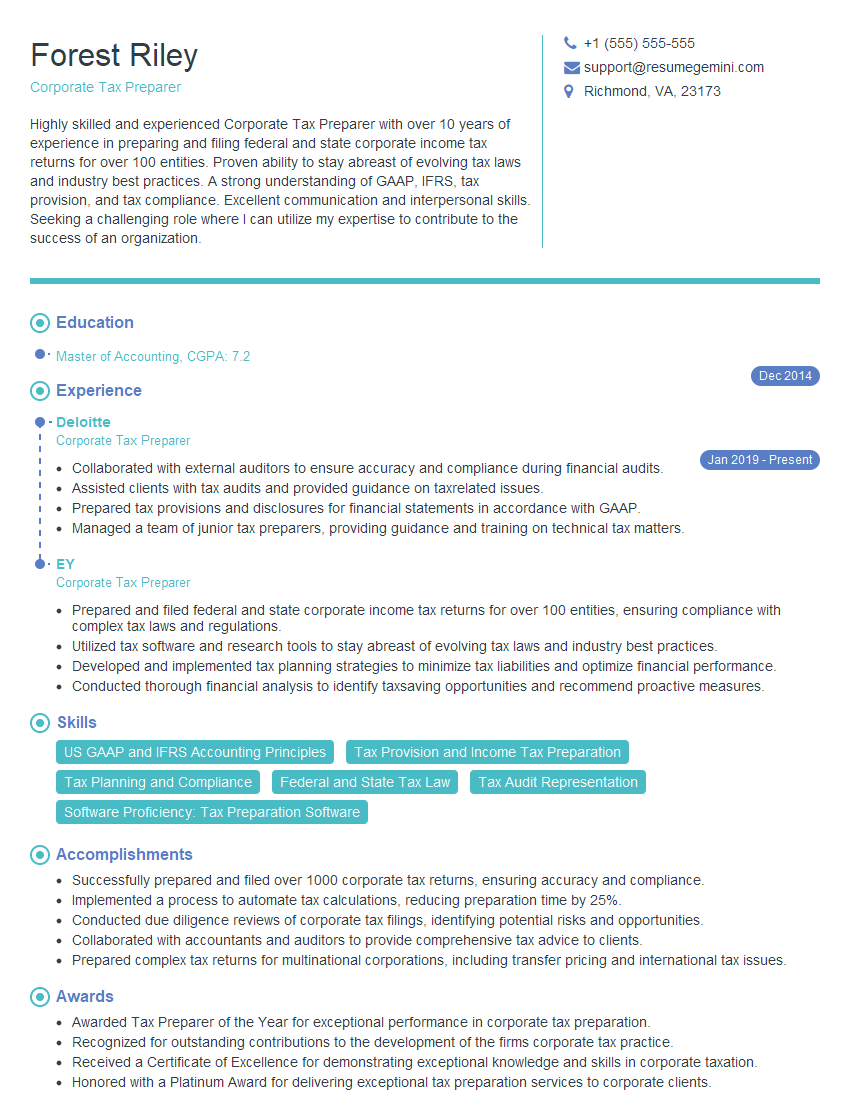

Forest Riley

Corporate Tax Preparer

Summary

Highly skilled and experienced Corporate Tax Preparer with over 10 years of experience in preparing and filing federal and state corporate income tax returns for over 100 entities. Proven ability to stay abreast of evolving tax laws and industry best practices. A strong understanding of GAAP, IFRS, tax provision, and tax compliance. Excellent communication and interpersonal skills. Seeking a challenging role where I can utilize my expertise to contribute to the success of an organization.

Education

Master of Accounting

December 2014

Skills

- US GAAP and IFRS Accounting Principles

- Tax Provision and Income Tax Preparation

- Tax Planning and Compliance

- Federal and State Tax Law

- Tax Audit Representation

- Software Proficiency: Tax Preparation Software

Work Experience

Corporate Tax Preparer

- Collaborated with external auditors to ensure accuracy and compliance during financial audits.

- Assisted clients with tax audits and provided guidance on taxrelated issues.

- Prepared tax provisions and disclosures for financial statements in accordance with GAAP.

- Managed a team of junior tax preparers, providing guidance and training on technical tax matters.

Corporate Tax Preparer

- Prepared and filed federal and state corporate income tax returns for over 100 entities, ensuring compliance with complex tax laws and regulations.

- Utilized tax software and research tools to stay abreast of evolving tax laws and industry best practices.

- Developed and implemented tax planning strategies to minimize tax liabilities and optimize financial performance.

- Conducted thorough financial analysis to identify taxsaving opportunities and recommend proactive measures.

Accomplishments

- Successfully prepared and filed over 1000 corporate tax returns, ensuring accuracy and compliance.

- Implemented a process to automate tax calculations, reducing preparation time by 25%.

- Conducted due diligence reviews of corporate tax filings, identifying potential risks and opportunities.

- Collaborated with accountants and auditors to provide comprehensive tax advice to clients.

- Prepared complex tax returns for multinational corporations, including transfer pricing and international tax issues.

Awards

- Awarded Tax Preparer of the Year for exceptional performance in corporate tax preparation.

- Recognized for outstanding contributions to the development of the firms corporate tax practice.

- Received a Certificate of Excellence for demonstrating exceptional knowledge and skills in corporate taxation.

- Honored with a Platinum Award for delivering exceptional tax preparation services to corporate clients.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Master’s Degree in Taxation

- IRS Advanced Certification in Corporate Tax Law

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Corporate Tax Preparer

- Highlight your experience in preparing and filing corporate income tax returns for various entities.

- Showcase your knowledge of GAAP, IFRS, and tax laws and regulations.

- Emphasize your ability to identify tax-saving opportunities and develop tax planning strategies.

- Demonstrate your proficiency in using tax software and research tools.

- Include quantifiable results to demonstrate your impact on the organization.

Essential Experience Highlights for a Strong Corporate Tax Preparer Resume

- Prepared and filed federal and state corporate income tax returns for over 100 entities, ensuring compliance with complex tax laws and regulations.

- Utilized tax software and research tools to stay abreast of evolving tax laws and industry best practices.

- Developed and implemented tax planning strategies to minimize tax liabilities and optimize financial performance.

- Conducted thorough financial analysis to identify tax-saving opportunities and recommend proactive measures.

- Collaborated with external auditors to ensure accuracy and compliance during financial audits.

- Assisted clients with tax audits and provided guidance on tax-related issues.

- Prepared tax provisions and disclosures for financial statements in accordance with GAAP.

Frequently Asked Questions (FAQ’s) For Corporate Tax Preparer

What are the key responsibilities of a Corporate Tax Preparer?

The key responsibilities of a Corporate Tax Preparer include preparing and filing corporate income tax returns, staying abreast of tax laws and regulations, developing tax planning strategies, identifying tax-saving opportunities, and assisting with tax audits.

What qualifications are required to become a Corporate Tax Preparer?

To become a Corporate Tax Preparer, you typically need a bachelor’s or master’s degree in accounting, finance, or taxation. You also need to be proficient in tax software and research tools.

What are the career prospects for Corporate Tax Preparers?

Corporate Tax Preparers have excellent career prospects. The demand for skilled tax professionals is expected to grow in the coming years.

What are the key skills required for a Corporate Tax Preparer?

The key skills required for a Corporate Tax Preparer include strong analytical and problem-solving skills, attention to detail, and excellent communication skills.

What is the average salary for a Corporate Tax Preparer?

The average salary for a Corporate Tax Preparer varies depending on experience and location. However, it is typically around $60,000 per year.

What are the top companies that hire Corporate Tax Preparers?

Some of the top companies that hire Corporate Tax Preparers include Deloitte, EY, PwC, and KPMG.