Are you a seasoned Income Tax Consultant seeking a new career path? Discover our professionally built Income Tax Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

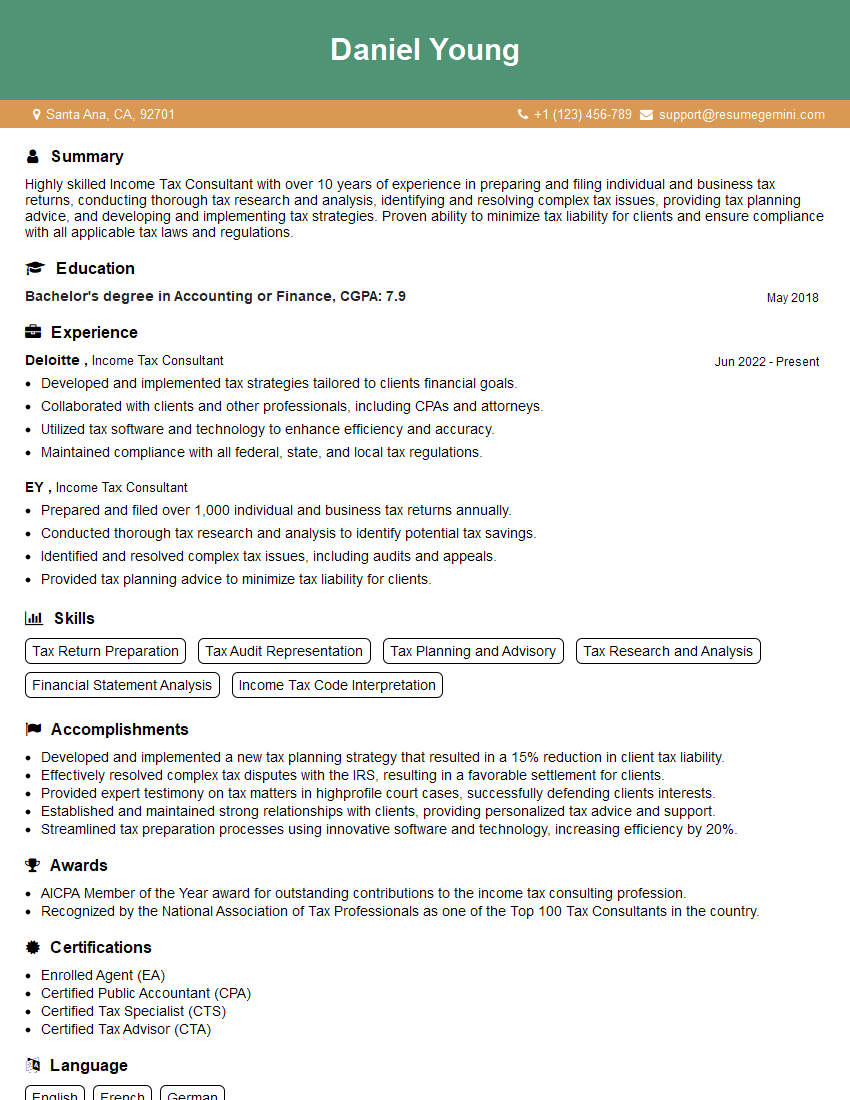

Daniel Young

Income Tax Consultant

Summary

Highly skilled Income Tax Consultant with over 10 years of experience in preparing and filing individual and business tax returns, conducting thorough tax research and analysis, identifying and resolving complex tax issues, providing tax planning advice, and developing and implementing tax strategies. Proven ability to minimize tax liability for clients and ensure compliance with all applicable tax laws and regulations.

Education

Bachelor’s degree in Accounting or Finance

May 2018

Skills

- Tax Return Preparation

- Tax Audit Representation

- Tax Planning and Advisory

- Tax Research and Analysis

- Financial Statement Analysis

- Income Tax Code Interpretation

Work Experience

Income Tax Consultant

- Developed and implemented tax strategies tailored to clients financial goals.

- Collaborated with clients and other professionals, including CPAs and attorneys.

- Utilized tax software and technology to enhance efficiency and accuracy.

- Maintained compliance with all federal, state, and local tax regulations.

Income Tax Consultant

- Prepared and filed over 1,000 individual and business tax returns annually.

- Conducted thorough tax research and analysis to identify potential tax savings.

- Identified and resolved complex tax issues, including audits and appeals.

- Provided tax planning advice to minimize tax liability for clients.

Accomplishments

- Developed and implemented a new tax planning strategy that resulted in a 15% reduction in client tax liability.

- Effectively resolved complex tax disputes with the IRS, resulting in a favorable settlement for clients.

- Provided expert testimony on tax matters in highprofile court cases, successfully defending clients interests.

- Established and maintained strong relationships with clients, providing personalized tax advice and support.

- Streamlined tax preparation processes using innovative software and technology, increasing efficiency by 20%.

Awards

- AICPA Member of the Year award for outstanding contributions to the income tax consulting profession.

- Recognized by the National Association of Tax Professionals as one of the Top 100 Tax Consultants in the country.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Tax Specialist (CTS)

- Certified Tax Advisor (CTA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Income Tax Consultant

- Highlight your technical skills and knowledge of tax laws and regulations.

- Showcase your ability to analyze complex tax issues and identify opportunities for tax savings.

- Emphasize your communication and interpersonal skills, as you will be working closely with clients and other professionals.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

Essential Experience Highlights for a Strong Income Tax Consultant Resume

- Prepare and file individual and business tax returns accurately and efficiently.

- Conduct thorough tax research and analysis to identify potential tax savings and optimize tax strategies.

- Identify and resolve complex tax issues, including audits and appeals, to protect clients’ interests.

- Provide tax planning advice to help clients minimize their tax liability and achieve their financial goals.

- Develop and implement customized tax strategies tailored to each client’s individual circumstances and objectives.

- Collaborate with clients, CPAs, attorneys, and other professionals to ensure a comprehensive approach to tax planning and compliance.

- Utilize tax software and technology to enhance efficiency, accuracy, and compliance with tax regulations.

Frequently Asked Questions (FAQ’s) For Income Tax Consultant

What are the key skills required to be an Income Tax Consultant?

Strong technical skills in tax laws and regulations, proficiency in tax preparation software, analytical and problem-solving abilities, excellent communication and interpersonal skills.

What are the career prospects for Income Tax Consultants?

Income Tax Consultants are in high demand due to the increasing complexity of tax laws and regulations. With experience and expertise, you can advance into management roles or specialize in specific areas of taxation.

What are the challenges faced by Income Tax Consultants?

Keeping up with constantly changing tax laws and regulations, dealing with complex tax issues, meeting deadlines during tax season, and managing multiple client relationships.

What is the average salary for Income Tax Consultants?

The average salary for Income Tax Consultants varies depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Preparers was $56,890 in May 2021.

What are the educational requirements to become an Income Tax Consultant?

Most Income Tax Consultants have at least a bachelor’s degree in accounting, finance, or a related field. Some employers may prefer candidates with a Master’s degree in Taxation or a related field.

What is the work environment like for Income Tax Consultants?

Income Tax Consultants typically work in an office setting, often during tax season. The work can be fast-paced and demanding, but also rewarding.