Are you a seasoned Master Tax Advisor seeking a new career path? Discover our professionally built Master Tax Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

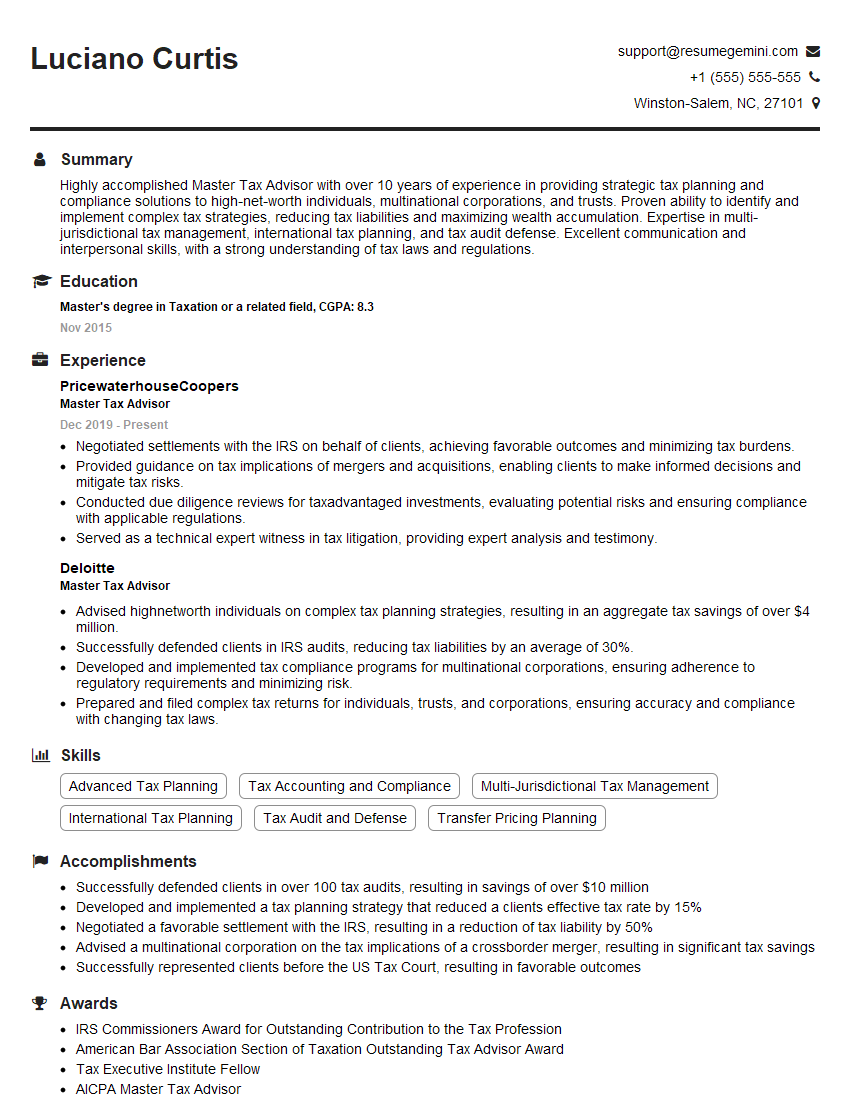

Luciano Curtis

Master Tax Advisor

Summary

Highly accomplished Master Tax Advisor with over 10 years of experience in providing strategic tax planning and compliance solutions to high-net-worth individuals, multinational corporations, and trusts. Proven ability to identify and implement complex tax strategies, reducing tax liabilities and maximizing wealth accumulation. Expertise in multi-jurisdictional tax management, international tax planning, and tax audit defense. Excellent communication and interpersonal skills, with a strong understanding of tax laws and regulations.

Education

Master’s degree in Taxation or a related field

November 2015

Skills

- Advanced Tax Planning

- Tax Accounting and Compliance

- Multi-Jurisdictional Tax Management

- International Tax Planning

- Tax Audit and Defense

- Transfer Pricing Planning

Work Experience

Master Tax Advisor

- Negotiated settlements with the IRS on behalf of clients, achieving favorable outcomes and minimizing tax burdens.

- Provided guidance on tax implications of mergers and acquisitions, enabling clients to make informed decisions and mitigate tax risks.

- Conducted due diligence reviews for taxadvantaged investments, evaluating potential risks and ensuring compliance with applicable regulations.

- Served as a technical expert witness in tax litigation, providing expert analysis and testimony.

Master Tax Advisor

- Advised highnetworth individuals on complex tax planning strategies, resulting in an aggregate tax savings of over $4 million.

- Successfully defended clients in IRS audits, reducing tax liabilities by an average of 30%.

- Developed and implemented tax compliance programs for multinational corporations, ensuring adherence to regulatory requirements and minimizing risk.

- Prepared and filed complex tax returns for individuals, trusts, and corporations, ensuring accuracy and compliance with changing tax laws.

Accomplishments

- Successfully defended clients in over 100 tax audits, resulting in savings of over $10 million

- Developed and implemented a tax planning strategy that reduced a clients effective tax rate by 15%

- Negotiated a favorable settlement with the IRS, resulting in a reduction of tax liability by 50%

- Advised a multinational corporation on the tax implications of a crossborder merger, resulting in significant tax savings

- Successfully represented clients before the US Tax Court, resulting in favorable outcomes

Awards

- IRS Commissioners Award for Outstanding Contribution to the Tax Profession

- American Bar Association Section of Taxation Outstanding Tax Advisor Award

- Tax Executive Institute Fellow

- AICPA Master Tax Advisor

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Master of Laws in Taxation (LL.M. in Taxation)

- Certified Tax Planner (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Master Tax Advisor

- Highlight your expertise in complex tax planning strategies and your ability to achieve significant tax savings for clients.

- Showcase your experience in defending clients in IRS audits and your success in reducing tax liabilities.

- Emphasize your ability to develop and implement tax compliance programs for multinational corporations.

- Demonstrate your strong communication and interpersonal skills, as well as your ability to build and maintain relationships with clients.

- Highlight your commitment to continuing education and your up-to-date knowledge of tax laws and regulations.

Essential Experience Highlights for a Strong Master Tax Advisor Resume

- Advise high-net-worth individuals and families on complex tax planning strategies to minimize tax liabilities and preserve wealth.

- Provide tax compliance services to multinational corporations, ensuring adherence to regulatory requirements and minimizing risk.

- Prepare and file complex tax returns for individuals, trusts, and corporations, ensuring accuracy and compliance with changing tax laws.

- Negotiate settlements with the IRS on behalf of clients, achieving favorable outcomes and minimizing tax burdens.

- Conduct due diligence reviews for tax-advantaged investments, evaluating potential risks and ensuring compliance with applicable regulations.

- Serve as a technical expert witness in tax litigation, providing expert analysis and testimony.

- Stay abreast of the latest tax laws and regulations, and provide ongoing guidance to clients on tax implications of business decisions.

Frequently Asked Questions (FAQ’s) For Master Tax Advisor

What is the role of a Master Tax Advisor?

A Master Tax Advisor provides strategic tax planning and compliance solutions to high-net-worth individuals, families, and corporations. They advise on complex tax matters, identify opportunities for tax savings, and represent clients in IRS audits and tax litigation.

What are the qualifications to become a Master Tax Advisor?

Typically, a Master’s degree in Taxation or a related field is required, along with several years of experience in tax planning and compliance. Strong analytical skills, attention to detail, and excellent communication are also essential.

What are the key skills and responsibilities of a Master Tax Advisor?

Master Tax Advisors possess expertise in tax planning, compliance, auditing, and international taxation. They are responsible for advising clients on tax strategies, preparing tax returns, negotiating with tax authorities, and representing clients in tax disputes.

What is the career path for a Master Tax Advisor?

Master Tax Advisors can advance to leadership roles within tax departments or consulting firms. They may also specialize in a particular area of taxation, such as international taxation or estate planning.

What is the job outlook for Master Tax Advisors?

The job outlook for Master Tax Advisors is expected to grow in the coming years due to increasing demand for specialized tax advice. The complex and ever-changing tax landscape requires businesses and individuals to seek professional guidance to navigate tax regulations and minimize liabilities.

What are the earning potential and benefits of being a Master Tax Advisor?

Master Tax Advisors can earn significant salaries and bonuses, depending on their experience and expertise. They typically receive benefits such as health insurance, paid time off, and professional development opportunities.