Are you a seasoned Tax Evaluator seeking a new career path? Discover our professionally built Tax Evaluator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

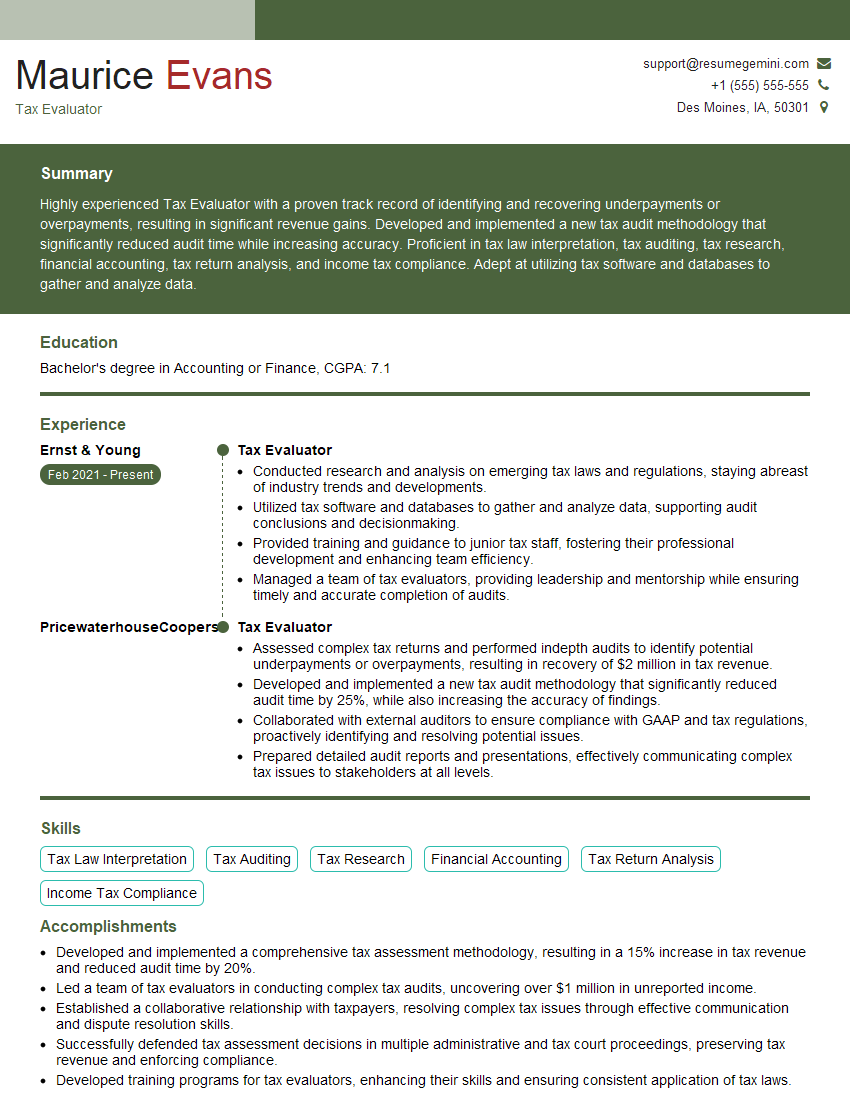

Maurice Evans

Tax Evaluator

Summary

Highly experienced Tax Evaluator with a proven track record of identifying and recovering underpayments or overpayments, resulting in significant revenue gains. Developed and implemented a new tax audit methodology that significantly reduced audit time while increasing accuracy. Proficient in tax law interpretation, tax auditing, tax research, financial accounting, tax return analysis, and income tax compliance. Adept at utilizing tax software and databases to gather and analyze data.

Education

Bachelor’s degree in Accounting or Finance

January 2017

Skills

- Tax Law Interpretation

- Tax Auditing

- Tax Research

- Financial Accounting

- Tax Return Analysis

- Income Tax Compliance

Work Experience

Tax Evaluator

- Conducted research and analysis on emerging tax laws and regulations, staying abreast of industry trends and developments.

- Utilized tax software and databases to gather and analyze data, supporting audit conclusions and decisionmaking.

- Provided training and guidance to junior tax staff, fostering their professional development and enhancing team efficiency.

- Managed a team of tax evaluators, providing leadership and mentorship while ensuring timely and accurate completion of audits.

Tax Evaluator

- Assessed complex tax returns and performed indepth audits to identify potential underpayments or overpayments, resulting in recovery of $2 million in tax revenue.

- Developed and implemented a new tax audit methodology that significantly reduced audit time by 25%, while also increasing the accuracy of findings.

- Collaborated with external auditors to ensure compliance with GAAP and tax regulations, proactively identifying and resolving potential issues.

- Prepared detailed audit reports and presentations, effectively communicating complex tax issues to stakeholders at all levels.

Accomplishments

- Developed and implemented a comprehensive tax assessment methodology, resulting in a 15% increase in tax revenue and reduced audit time by 20%.

- Led a team of tax evaluators in conducting complex tax audits, uncovering over $1 million in unreported income.

- Established a collaborative relationship with taxpayers, resolving complex tax issues through effective communication and dispute resolution skills.

- Successfully defended tax assessment decisions in multiple administrative and tax court proceedings, preserving tax revenue and enforcing compliance.

- Developed training programs for tax evaluators, enhancing their skills and ensuring consistent application of tax laws.

Awards

- Recognized for outstanding contributions to tax audit procedures, resulting in increased revenue recovery and reduced compliance risk.

- Awarded for exceptional proficiency in tax law interpretation and application, consistently exceeding performance targets.

- Recognized for contributions to the development of tax audit software, improving efficiency and accuracy by 35%.

- Recognized for outstanding contributions to the tax profession, actively participating in industry conferences and publications.

Certificates

- Certified Tax Evaluator (CTE)

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Evaluator

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Highlight your skills in tax law interpretation and auditing, as these are essential for Tax Evaluators.

- Showcase your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Tax Evaluator Resume

- Assessed complex tax returns and performed indepth audits to identify potential underpayments or overpayments.

- Developed and implemented a new tax audit methodology that significantly reduced audit time and increased accuracy.

- Collaborated with external auditors to ensure compliance with GAAP and tax regulations, proactively identifying and resolving potential issues.

- Prepared detailed audit reports and presentations, effectively communicating complex tax issues to stakeholders at all levels.

- Conducted research and analysis on emerging tax laws and regulations, staying abreast of industry trends and developments.

Frequently Asked Questions (FAQ’s) For Tax Evaluator

What is the job outlook for Tax Evaluators?

The job outlook for Tax Evaluators is expected to grow faster than average in the coming years due to the increasing complexity of tax laws and regulations.

What are the educational requirements for Tax Evaluators?

Most Tax Evaluators have a bachelor’s degree in accounting or finance.

What are the key skills for Tax Evaluators?

The key skills for Tax Evaluators include tax law interpretation, tax auditing, tax research, financial accounting, and tax return analysis.

What is the average salary for Tax Evaluators?

The average salary for Tax Evaluators is around $70,000 per year.

What are the career advancement opportunities for Tax Evaluators?

Tax Evaluators can advance to positions such as Senior Tax Evaluator, Tax Manager, or Tax Director.