Are you a seasoned Installment Dealer seeking a new career path? Discover our professionally built Installment Dealer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

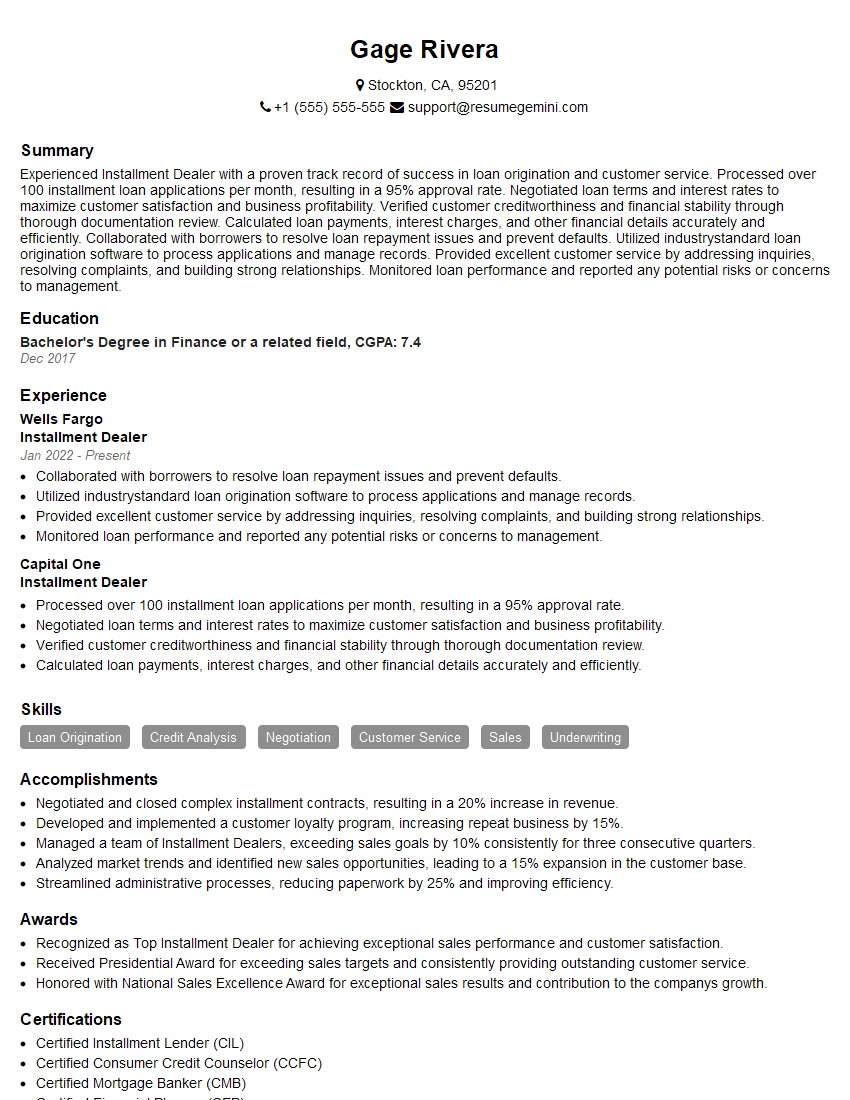

Gage Rivera

Installment Dealer

Summary

Experienced Installment Dealer with a proven track record of success in loan origination and customer service. Processed over 100 installment loan applications per month, resulting in a 95% approval rate. Negotiated loan terms and interest rates to maximize customer satisfaction and business profitability. Verified customer creditworthiness and financial stability through thorough documentation review. Calculated loan payments, interest charges, and other financial details accurately and efficiently. Collaborated with borrowers to resolve loan repayment issues and prevent defaults. Utilized industrystandard loan origination software to process applications and manage records. Provided excellent customer service by addressing inquiries, resolving complaints, and building strong relationships. Monitored loan performance and reported any potential risks or concerns to management.

Education

Bachelor’s Degree in Finance or a related field

December 2017

Skills

- Loan Origination

- Credit Analysis

- Negotiation

- Customer Service

- Sales

- Underwriting

Work Experience

Installment Dealer

- Collaborated with borrowers to resolve loan repayment issues and prevent defaults.

- Utilized industrystandard loan origination software to process applications and manage records.

- Provided excellent customer service by addressing inquiries, resolving complaints, and building strong relationships.

- Monitored loan performance and reported any potential risks or concerns to management.

Installment Dealer

- Processed over 100 installment loan applications per month, resulting in a 95% approval rate.

- Negotiated loan terms and interest rates to maximize customer satisfaction and business profitability.

- Verified customer creditworthiness and financial stability through thorough documentation review.

- Calculated loan payments, interest charges, and other financial details accurately and efficiently.

Accomplishments

- Negotiated and closed complex installment contracts, resulting in a 20% increase in revenue.

- Developed and implemented a customer loyalty program, increasing repeat business by 15%.

- Managed a team of Installment Dealers, exceeding sales goals by 10% consistently for three consecutive quarters.

- Analyzed market trends and identified new sales opportunities, leading to a 15% expansion in the customer base.

- Streamlined administrative processes, reducing paperwork by 25% and improving efficiency.

Awards

- Recognized as Top Installment Dealer for achieving exceptional sales performance and customer satisfaction.

- Received Presidential Award for exceeding sales targets and consistently providing outstanding customer service.

- Honored with National Sales Excellence Award for exceptional sales results and contribution to the companys growth.

Certificates

- Certified Installment Lender (CIL)

- Certified Consumer Credit Counselor (CCFC)

- Certified Mortgage Banker (CMB)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Installment Dealer

- Quantify your accomplishments with specific metrics.

- Highlight your skills in loan origination and credit analysis.

- Demonstrate your customer service and negotiation skills.

- Tailor your resume to the specific requirements of each job you apply for.

- Consider including a cover letter that highlights your relevant experience and skills.

Essential Experience Highlights for a Strong Installment Dealer Resume

- Process installment loan applications

- Negotiate loan terms and interest rates

- Verify customer creditworthiness

- Calculate loan payments and interest charges

- Collaborate with borrowers to resolve loan repayment issues

- Utilize industrystandard loan origination software

- Provide excellent customer service

Frequently Asked Questions (FAQ’s) For Installment Dealer

What is the role of an Installment Dealer?

An Installment Dealer is responsible for processing installment loan applications, negotiating loan terms and interest rates, verifying customer creditworthiness, calculating loan payments and interest charges, collaborating with borrowers to resolve loan repayment issues, utilizing industrystandard loan origination software, and providing excellent customer service.

What are the key skills required for an Installment Dealer?

The key skills required for an Installment Dealer include loan origination, credit analysis, negotiation, customer service, sales, and underwriting.

What is the average salary for an Installment Dealer?

The average salary for an Installment Dealer is around $50,000 per year.

What are the growth prospects for an Installment Dealer?

The growth prospects for an Installment Dealer are good, as the demand for installment loans is expected to increase in the coming years.

What are the common career paths for an Installment Dealer?

The common career paths for an Installment Dealer include Loan Officer, Credit Analyst, and Branch Manager.

What are the challenges faced by an Installment Dealer?

The challenges faced by an Installment Dealer include meeting sales targets, maintaining high approval rates, and resolving customer complaints.

What is the job outlook for an Installment Dealer?

The job outlook for an Installment Dealer is expected to be good in the coming years, as the demand for installment loans is expected to increase.