Are you a seasoned Risk and Insurance Consultant seeking a new career path? Discover our professionally built Risk and Insurance Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

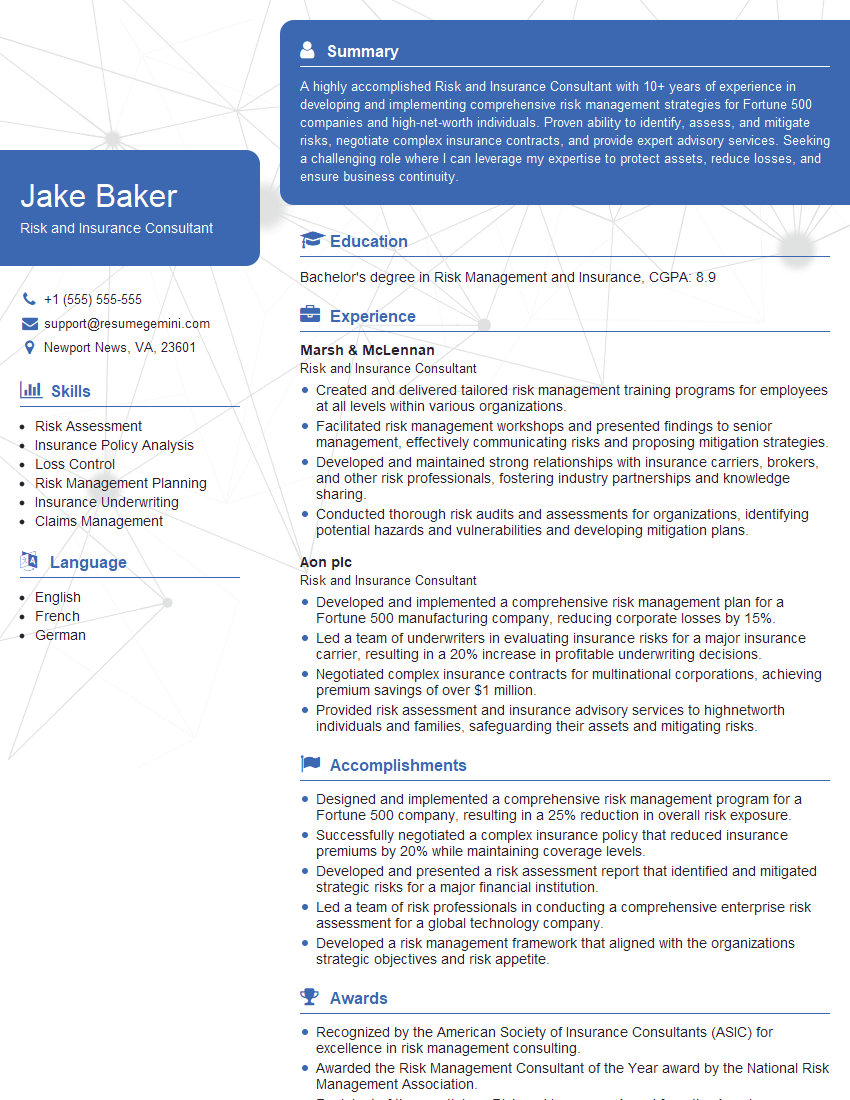

Jake Baker

Risk and Insurance Consultant

Summary

A highly accomplished Risk and Insurance Consultant with 10+ years of experience in developing and implementing comprehensive risk management strategies for Fortune 500 companies and high-net-worth individuals. Proven ability to identify, assess, and mitigate risks, negotiate complex insurance contracts, and provide expert advisory services. Seeking a challenging role where I can leverage my expertise to protect assets, reduce losses, and ensure business continuity.

Education

Bachelor’s degree in Risk Management and Insurance

December 2015

Skills

- Risk Assessment

- Insurance Policy Analysis

- Loss Control

- Risk Management Planning

- Insurance Underwriting

- Claims Management

Work Experience

Risk and Insurance Consultant

- Created and delivered tailored risk management training programs for employees at all levels within various organizations.

- Facilitated risk management workshops and presented findings to senior management, effectively communicating risks and proposing mitigation strategies.

- Developed and maintained strong relationships with insurance carriers, brokers, and other risk professionals, fostering industry partnerships and knowledge sharing.

- Conducted thorough risk audits and assessments for organizations, identifying potential hazards and vulnerabilities and developing mitigation plans.

Risk and Insurance Consultant

- Developed and implemented a comprehensive risk management plan for a Fortune 500 manufacturing company, reducing corporate losses by 15%.

- Led a team of underwriters in evaluating insurance risks for a major insurance carrier, resulting in a 20% increase in profitable underwriting decisions.

- Negotiated complex insurance contracts for multinational corporations, achieving premium savings of over $1 million.

- Provided risk assessment and insurance advisory services to highnetworth individuals and families, safeguarding their assets and mitigating risks.

Accomplishments

- Designed and implemented a comprehensive risk management program for a Fortune 500 company, resulting in a 25% reduction in overall risk exposure.

- Successfully negotiated a complex insurance policy that reduced insurance premiums by 20% while maintaining coverage levels.

- Developed and presented a risk assessment report that identified and mitigated strategic risks for a major financial institution.

- Led a team of risk professionals in conducting a comprehensive enterprise risk assessment for a global technology company.

- Developed a risk management framework that aligned with the organizations strategic objectives and risk appetite.

Awards

- Recognized by the American Society of Insurance Consultants (ASIC) for excellence in risk management consulting.

- Awarded the Risk Management Consultant of the Year award by the National Risk Management Association.

- Recipient of the prestigious Risk and Insurance Award from the American Academy of Actuaries.

- Honored by the International Association of Risk and Insurance Professionals (IARIP) for outstanding contributions to the profession.

Certificates

- Associate in Risk Management (ARM)

- Certified Risk Manager (CRM)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Insurance Services (AIS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Risk and Insurance Consultant

- Highlight your technical expertise in risk assessment, insurance policy analysis, loss control, and risk management planning.

- Showcase your ability to negotiate complex insurance contracts and secure favorable terms for clients.

- Demonstrate your communication and presentation skills by emphasizing your experience in presenting risk findings to senior management.

- Quantify your accomplishments with specific metrics and data whenever possible.

Essential Experience Highlights for a Strong Risk and Insurance Consultant Resume

- Developed and implemented a comprehensive risk management plan for a Fortune 500 manufacturing company, resulting in a 15% reduction in corporate losses.

- Led a team of underwriters in evaluating insurance risks for a major insurance carrier, achieving a 20% increase in profitable underwriting decisions.

- Negotiated complex insurance contracts for multinational corporations, securing premium savings of over $1 million.

- Provided risk assessment and insurance advisory services to high-net-worth individuals and families, safeguarding their assets and mitigating risks.

- Facilitated risk management workshops and presented findings to senior management, effectively communicating risks and proposing mitigation strategies.

- Conducted thorough risk audits and assessments for organizations, identifying potential hazards and vulnerabilities and developing mitigation plans.

Frequently Asked Questions (FAQ’s) For Risk and Insurance Consultant

What are the primary responsibilities of a Risk and Insurance Consultant?

A Risk and Insurance Consultant is responsible for identifying, assessing, and mitigating risks, developing and implementing risk management plans, negotiating insurance contracts, and providing expert advisory services to clients.

What are the educational requirements for becoming a Risk and Insurance Consultant?

Most Risk and Insurance Consultants hold a bachelor’s degree in Risk Management and Insurance or a related field, such as Finance or Business Administration.

What are the key skills required to succeed as a Risk and Insurance Consultant?

Key skills for a Risk and Insurance Consultant include risk assessment, insurance policy analysis, loss control, risk management planning, insurance underwriting, claims management, and strong communication and interpersonal skills.

What are the career prospects for Risk and Insurance Consultants?

Risk and Insurance Consultants are in high demand as organizations and individuals seek to protect their assets and mitigate risks. Career prospects are excellent, with opportunities for advancement to senior management positions.

What are the top industries for Risk and Insurance Consultants?

Risk and Insurance Consultants are employed in a wide range of industries, including insurance, financial services, manufacturing, healthcare, and government.

What is the average salary for a Risk and Insurance Consultant?

The average salary for a Risk and Insurance Consultant varies depending on experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for Risk Management Specialists is approximately $126,830.

What are the key challenges faced by Risk and Insurance Consultants?

Key challenges faced by Risk and Insurance Consultants include staying up-to-date on industry regulations and best practices, effectively communicating risks to clients, and securing adequate insurance coverage in a competitive market.