Are you a seasoned Certified Fraud Examiner seeking a new career path? Discover our professionally built Certified Fraud Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

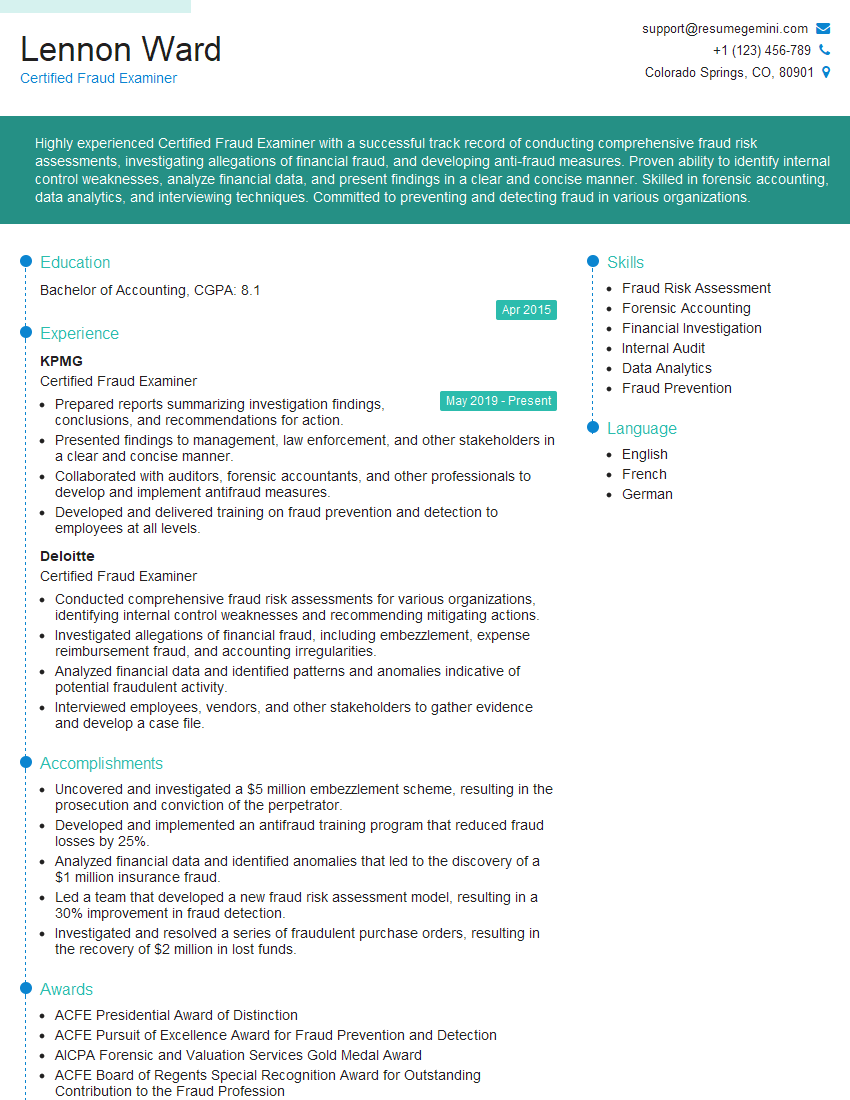

Lennon Ward

Certified Fraud Examiner

Summary

Highly experienced Certified Fraud Examiner with a successful track record of conducting comprehensive fraud risk assessments, investigating allegations of financial fraud, and developing anti-fraud measures. Proven ability to identify internal control weaknesses, analyze financial data, and present findings in a clear and concise manner. Skilled in forensic accounting, data analytics, and interviewing techniques. Committed to preventing and detecting fraud in various organizations.

Education

Bachelor of Accounting

April 2015

Skills

- Fraud Risk Assessment

- Forensic Accounting

- Financial Investigation

- Internal Audit

- Data Analytics

- Fraud Prevention

Work Experience

Certified Fraud Examiner

- Prepared reports summarizing investigation findings, conclusions, and recommendations for action.

- Presented findings to management, law enforcement, and other stakeholders in a clear and concise manner.

- Collaborated with auditors, forensic accountants, and other professionals to develop and implement antifraud measures.

- Developed and delivered training on fraud prevention and detection to employees at all levels.

Certified Fraud Examiner

- Conducted comprehensive fraud risk assessments for various organizations, identifying internal control weaknesses and recommending mitigating actions.

- Investigated allegations of financial fraud, including embezzlement, expense reimbursement fraud, and accounting irregularities.

- Analyzed financial data and identified patterns and anomalies indicative of potential fraudulent activity.

- Interviewed employees, vendors, and other stakeholders to gather evidence and develop a case file.

Accomplishments

- Uncovered and investigated a $5 million embezzlement scheme, resulting in the prosecution and conviction of the perpetrator.

- Developed and implemented an antifraud training program that reduced fraud losses by 25%.

- Analyzed financial data and identified anomalies that led to the discovery of a $1 million insurance fraud.

- Led a team that developed a new fraud risk assessment model, resulting in a 30% improvement in fraud detection.

- Investigated and resolved a series of fraudulent purchase orders, resulting in the recovery of $2 million in lost funds.

Awards

- ACFE Presidential Award of Distinction

- ACFE Pursuit of Excellence Award for Fraud Prevention and Detection

- AICPA Forensic and Valuation Services Gold Medal Award

- ACFE Board of Regents Special Recognition Award for Outstanding Contribution to the Fraud Profession

Certificates

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Internal Auditor (CIA)

- Certified Government Auditing Professional (CGAP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Fraud Examiner

- Quantify your accomplishments with specific metrics and results.

- Highlight your expertise in forensic accounting, data analytics, and interviewing techniques.

- Showcase your understanding of fraud risk assessment and internal control frameworks.

- Emphasize your commitment to ethical conduct and maintaining confidentiality.

Essential Experience Highlights for a Strong Certified Fraud Examiner Resume

- Assessed fraud risks, identified control weaknesses, and recommended mitigating actions.

- Investigated financial fraud allegations, analyzed evidence, and prepared case files.

- Collaborated with auditors, forensic accountants, and law enforcement to resolve cases and improve fraud prevention measures.

- Developed and delivered training on fraud prevention and detection, educating employees at all levels on fraud awareness and reporting mechanisms.

- Kept abreast of emerging fraud trends and best practices to enhance fraud prevention and detection strategies.

- Provided expert testimony in fraud-related cases, assisting in the prosecution of fraud perpetrators.

Frequently Asked Questions (FAQ’s) For Certified Fraud Examiner

Who can become a Certified Fraud Examiner?

Individuals with a bachelor’s degree and two years of experience in fraud-related roles, or a master’s degree and one year of experience, can apply for the CFE credential.

What are the benefits of obtaining the CFE credential?

The CFE credential enhances credibility, demonstrates expertise in fraud examination, and opens doors to career advancement opportunities.

What is the CFE exam format?

The CFE exam consists of 100 multiple-choice questions and 5 essay questions, covering four domains: Fraud Prevention and Deterrence, Fraud Detection and Investigation, Fraud Response, and Corporate Governance Elements Related to Fraud.

What is the passing score for the CFE exam?

A score of 75% is required to pass the CFE exam.

How long does it take to earn the CFE credential?

It typically takes several months to complete the CFE exam preparation and application process.

What is the salary range for Certified Fraud Examiners?

The salary range for Certified Fraud Examiners varies depending on experience, location, and industry, but generally falls between $80,000 and $120,000 annually.