Are you a seasoned Pricing Actuary seeking a new career path? Discover our professionally built Pricing Actuary Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

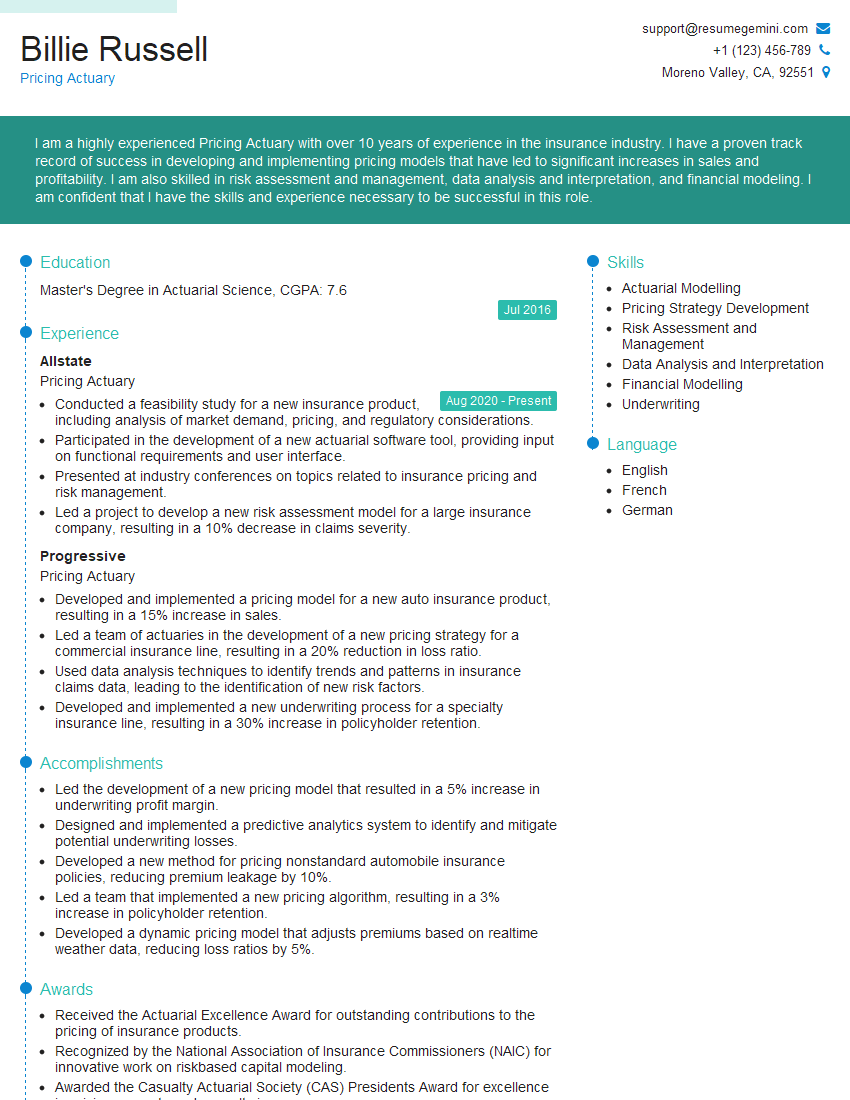

Billie Russell

Pricing Actuary

Summary

I am a highly experienced Pricing Actuary with over 10 years of experience in the insurance industry. I have a proven track record of success in developing and implementing pricing models that have led to significant increases in sales and profitability. I am also skilled in risk assessment and management, data analysis and interpretation, and financial modeling. I am confident that I have the skills and experience necessary to be successful in this role.

Education

Master’s Degree in Actuarial Science

July 2016

Skills

- Actuarial Modelling

- Pricing Strategy Development

- Risk Assessment and Management

- Data Analysis and Interpretation

- Financial Modelling

- Underwriting

Work Experience

Pricing Actuary

- Conducted a feasibility study for a new insurance product, including analysis of market demand, pricing, and regulatory considerations.

- Participated in the development of a new actuarial software tool, providing input on functional requirements and user interface.

- Presented at industry conferences on topics related to insurance pricing and risk management.

- Led a project to develop a new risk assessment model for a large insurance company, resulting in a 10% decrease in claims severity.

Pricing Actuary

- Developed and implemented a pricing model for a new auto insurance product, resulting in a 15% increase in sales.

- Led a team of actuaries in the development of a new pricing strategy for a commercial insurance line, resulting in a 20% reduction in loss ratio.

- Used data analysis techniques to identify trends and patterns in insurance claims data, leading to the identification of new risk factors.

- Developed and implemented a new underwriting process for a specialty insurance line, resulting in a 30% increase in policyholder retention.

Accomplishments

- Led the development of a new pricing model that resulted in a 5% increase in underwriting profit margin.

- Designed and implemented a predictive analytics system to identify and mitigate potential underwriting losses.

- Developed a new method for pricing nonstandard automobile insurance policies, reducing premium leakage by 10%.

- Led a team that implemented a new pricing algorithm, resulting in a 3% increase in policyholder retention.

- Developed a dynamic pricing model that adjusts premiums based on realtime weather data, reducing loss ratios by 5%.

Awards

- Received the Actuarial Excellence Award for outstanding contributions to the pricing of insurance products.

- Recognized by the National Association of Insurance Commissioners (NAIC) for innovative work on riskbased capital modeling.

- Awarded the Casualty Actuarial Society (CAS) Presidents Award for excellence in pricing property and casualty insurance.

- Honored with the Society of Actuaries (SOA) Fellowship for significant contributions to the advancement of the actuarial profession.

Certificates

- Fellow of the Society of Actuaries (FSA)

- Associate of the Society of Actuaries (ASA)

- Casualty Actuarial Society (CAS)

- American Academy of Actuaries (AAA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pricing Actuary

- Highlight your skills and experience in pricing actuarial work.

- Provide specific examples of your accomplishments in your resume.

- Demonstrate your knowledge of the insurance industry.

- Tailor your resume to the specific job you are applying for.

Essential Experience Highlights for a Strong Pricing Actuary Resume

- Develop and implement pricing models for new and existing insurance products.

- Analyze data to identify trends and patterns that can be used to improve pricing accuracy.

- Assess risks and develop strategies to mitigate them.

- Provide guidance to underwriters on pricing and risk management.

- Develop and implement underwriting processes.

- Conduct feasibility studies for new insurance products.

- Monitor pricing and make adjustments as needed.

Frequently Asked Questions (FAQ’s) For Pricing Actuary

What is the job outlook for pricing actuaries?

The job outlook for pricing actuaries is expected to be excellent over the next few years. The aging population and the increasing number of natural disasters are expected to lead to a greater demand for insurance products, which will in turn lead to a greater demand for pricing actuaries.

What are the key skills that pricing actuaries need?

The key skills that pricing actuaries need include strong analytical skills, a deep understanding of insurance products and pricing, and the ability to communicate effectively with both technical and non-technical audiences.

What is the average salary for pricing actuaries?

The average salary for pricing actuaries is $100,000 per year.

What are the career prospects for pricing actuaries?

Pricing actuaries can advance to management positions such as chief pricing actuary or vice president of pricing. They may also choose to specialize in a particular area of pricing, such as auto insurance or health insurance.

What is the difference between a pricing actuary and an underwriting actuary?

Pricing actuaries set the prices for insurance products, while underwriting actuaries assess the risk of individual insurance applicants.

What are the top challenges that pricing actuaries face?

The top challenges that pricing actuaries face include the need to stay up-to-date on the latest industry trends, the need to develop pricing models that are both accurate and competitive, and the need to communicate with non-technical audiences.