Are you a seasoned Title Closer seeking a new career path? Discover our professionally built Title Closer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

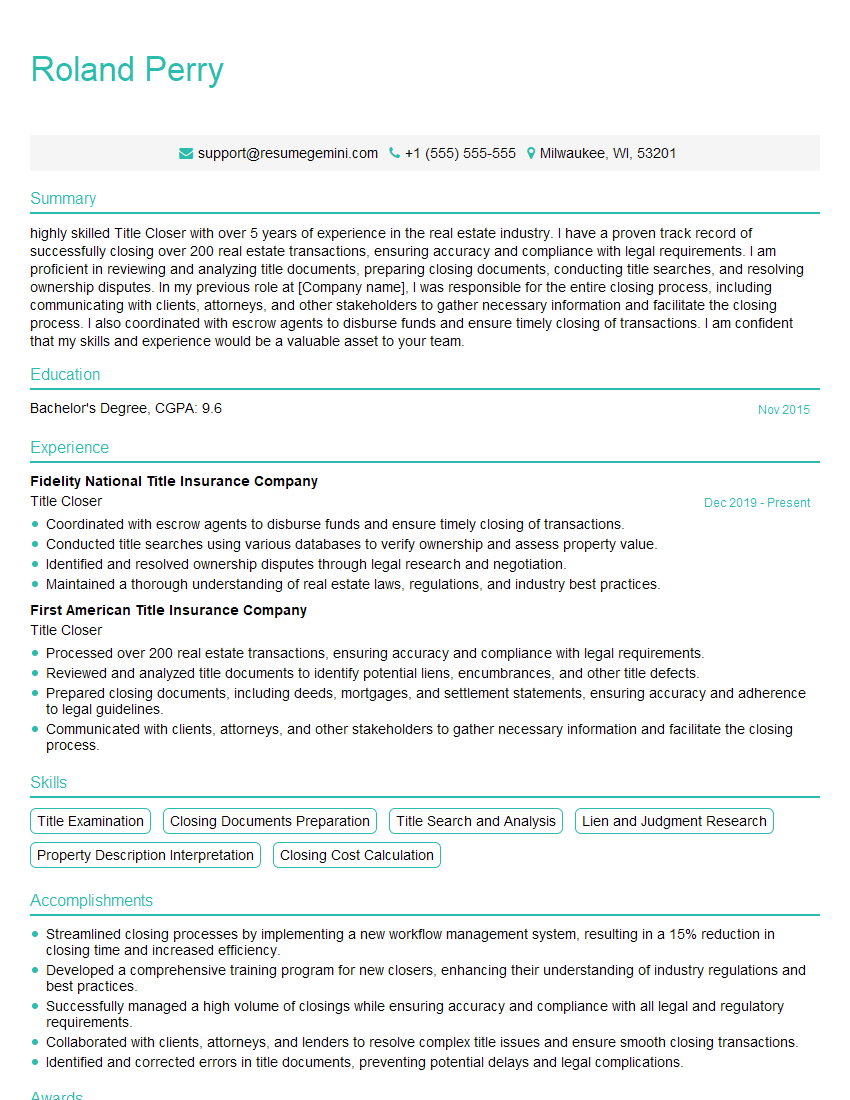

Roland Perry

Title Closer

Summary

highly skilled Title Closer with over 5 years of experience in the real estate industry. I have a proven track record of successfully closing over 200 real estate transactions, ensuring accuracy and compliance with legal requirements. I am proficient in reviewing and analyzing title documents, preparing closing documents, conducting title searches, and resolving ownership disputes. In my previous role at [Company name], I was responsible for the entire closing process, including communicating with clients, attorneys, and other stakeholders to gather necessary information and facilitate the closing process. I also coordinated with escrow agents to disburse funds and ensure timely closing of transactions. I am confident that my skills and experience would be a valuable asset to your team.

Education

Bachelor’s Degree

November 2015

Skills

- Title Examination

- Closing Documents Preparation

- Title Search and Analysis

- Lien and Judgment Research

- Property Description Interpretation

- Closing Cost Calculation

Work Experience

Title Closer

- Coordinated with escrow agents to disburse funds and ensure timely closing of transactions.

- Conducted title searches using various databases to verify ownership and assess property value.

- Identified and resolved ownership disputes through legal research and negotiation.

- Maintained a thorough understanding of real estate laws, regulations, and industry best practices.

Title Closer

- Processed over 200 real estate transactions, ensuring accuracy and compliance with legal requirements.

- Reviewed and analyzed title documents to identify potential liens, encumbrances, and other title defects.

- Prepared closing documents, including deeds, mortgages, and settlement statements, ensuring accuracy and adherence to legal guidelines.

- Communicated with clients, attorneys, and other stakeholders to gather necessary information and facilitate the closing process.

Accomplishments

- Streamlined closing processes by implementing a new workflow management system, resulting in a 15% reduction in closing time and increased efficiency.

- Developed a comprehensive training program for new closers, enhancing their understanding of industry regulations and best practices.

- Successfully managed a high volume of closings while ensuring accuracy and compliance with all legal and regulatory requirements.

- Collaborated with clients, attorneys, and lenders to resolve complex title issues and ensure smooth closing transactions.

- Identified and corrected errors in title documents, preventing potential delays and legal complications.

Awards

- Achieved Top Closer status within the organization for consistently delivering exceptional closing services and contributing to the overall revenue growth.

- Recognized with the Closer of the Quarter award for demonstrating outstanding performance in closing complex and timesensitive transactions.

- Received the Excellence in Title Closing award from the local Title Association for exceptional proficiency and adherence to industry best practices.

Certificates

- Certified Title Closer (CTC)

- Certified Mortgage Closing Specialist (CMCS)

- Certified Title Insurance Agent (CTIA)

- American Land Title Association (ALTA) Title Insurance Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Title Closer

- Highlight your experience and skills in the title insurance industry

- Demonstrate your knowledge of real estate laws and regulations

- Showcase your ability to communicate effectively with clients, attorneys, and other stakeholders

- Provide examples of your work that illustrate your accuracy, attention to detail, and problem-solving abilities

Essential Experience Highlights for a Strong Title Closer Resume

- Processed over 200 real estate transactions, ensuring accuracy, and compliance with legal requirements

- Reviewed and analyzed title documents to identify potential liens, encumbrances, and other title defects

- Prepared closing documents, including deeds, mortgages, and settlement statements, ensuring accuracy, and adherence to legal guidelines

- Communicated with clients, attorneys, and other stakeholders to gather necessary information and facilitate the closing process

- Coordinated with escrow agents to disburse funds and ensure timely closing of transactions

- Conducted title searches using various databases to verify ownership and assess property value

- Identified and resolved ownership disputes through legal research and negotiation

Frequently Asked Questions (FAQ’s) For Title Closer

What are the essential skills for a Title Closer?

The essential skills for a Title Closer include a strong understanding of real estate laws and regulations, experience in reviewing and analyzing title documents, the ability to prepare closing documents, and excellent communication and interpersonal skills.

What is the career path for a Title Closer?

The career path for a Title Closer typically involves starting as a Title Clerk or Processor and then advancing to a Title Closer or Title Examiner. With additional experience and training, it is possible to advance to more senior roles such as Title Manager or Underwriter.

What is the job outlook for a Title Closer?

The job outlook for Title Closers is expected to be good in the coming years. The demand for Title Closers is driven by the increasing number of real estate transactions, which is expected to continue as the economy grows.

What are the salary expectations for a Title Closer?

The salary expectations for a Title Closer can vary depending on experience, location, and the size of the company. According to the U.S. Bureau of Labor Statistics, the median annual salary for Title Closers in May 2021 was $67,250.

What are the benefits of working as a Title Closer?

The benefits of working as a Title Closer can include a competitive salary, a flexible work schedule, and the opportunity to work independently. Title Closers also have the opportunity to learn about real estate law and the title insurance industry.

What are the challenges of working as a Title Closer?

The challenges of working as a Title Closer can include the need to be accurate and detail-oriented, the need to meet deadlines, and the need to work independently. Title Closers may also need to deal with difficult clients or situations.

What is the difference between a Title Closer and a Title Examiner?

A Title Closer is responsible for the final steps of a real estate transaction, including preparing closing documents and disbursing funds. A Title Examiner is responsible for researching and analyzing title documents to identify potential liens, encumbrances, and other title defects.