Are you a seasoned Banking Teacher seeking a new career path? Discover our professionally built Banking Teacher Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

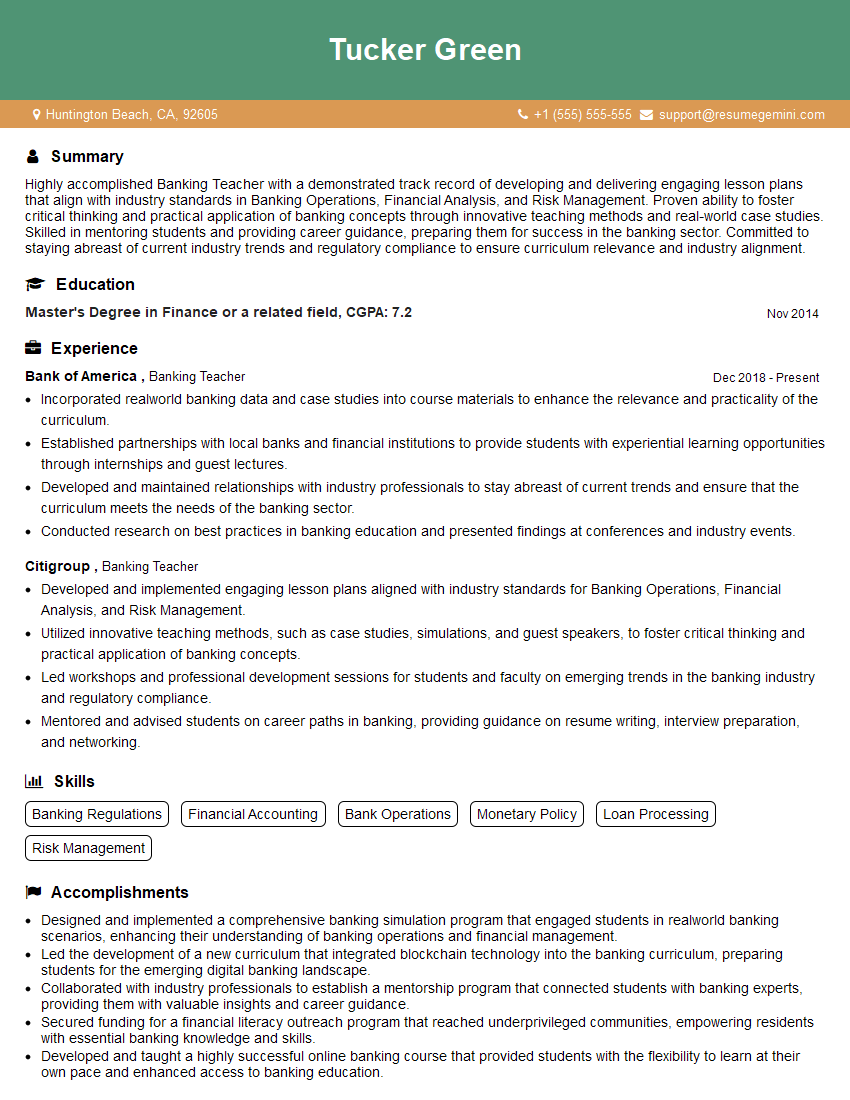

Tucker Green

Banking Teacher

Summary

Highly accomplished Banking Teacher with a demonstrated track record of developing and delivering engaging lesson plans that align with industry standards in Banking Operations, Financial Analysis, and Risk Management. Proven ability to foster critical thinking and practical application of banking concepts through innovative teaching methods and real-world case studies. Skilled in mentoring students and providing career guidance, preparing them for success in the banking sector. Committed to staying abreast of current industry trends and regulatory compliance to ensure curriculum relevance and industry alignment.

Education

Master’s Degree in Finance or a related field

November 2014

Skills

- Banking Regulations

- Financial Accounting

- Bank Operations

- Monetary Policy

- Loan Processing

- Risk Management

Work Experience

Banking Teacher

- Incorporated realworld banking data and case studies into course materials to enhance the relevance and practicality of the curriculum.

- Established partnerships with local banks and financial institutions to provide students with experiential learning opportunities through internships and guest lectures.

- Developed and maintained relationships with industry professionals to stay abreast of current trends and ensure that the curriculum meets the needs of the banking sector.

- Conducted research on best practices in banking education and presented findings at conferences and industry events.

Banking Teacher

- Developed and implemented engaging lesson plans aligned with industry standards for Banking Operations, Financial Analysis, and Risk Management.

- Utilized innovative teaching methods, such as case studies, simulations, and guest speakers, to foster critical thinking and practical application of banking concepts.

- Led workshops and professional development sessions for students and faculty on emerging trends in the banking industry and regulatory compliance.

- Mentored and advised students on career paths in banking, providing guidance on resume writing, interview preparation, and networking.

Accomplishments

- Designed and implemented a comprehensive banking simulation program that engaged students in realworld banking scenarios, enhancing their understanding of banking operations and financial management.

- Led the development of a new curriculum that integrated blockchain technology into the banking curriculum, preparing students for the emerging digital banking landscape.

- Collaborated with industry professionals to establish a mentorship program that connected students with banking experts, providing them with valuable insights and career guidance.

- Secured funding for a financial literacy outreach program that reached underprivileged communities, empowering residents with essential banking knowledge and skills.

- Developed and taught a highly successful online banking course that provided students with the flexibility to learn at their own pace and enhanced access to banking education.

Awards

- Received the Outstanding Banking Teacher of the Year Award from the American Bankers Association for developing and implementing innovative teaching methods that significantly improved student understanding of banking concepts.

- Recognized with the Distinguished Educator Award from the National Council on Economic Education for incorporating financial literacy principles into the banking curriculum, enhancing students financial knowledge and decisionmaking skills.

- Honored with the Excellence in Teaching Award from the local chapter of the American Finance Association for fostering a dynamic learning environment that promotes critical thinking and prepares students for careers in finance.

- Awarded the Presidents Award for Outstanding Teaching by the college for consistently exceeding expectations and inspiring students in the banking field.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banking Teacher

- Highlight your experience in developing and delivering engaging lesson plans that meet industry standards.

- Showcase your ability to incorporate innovative teaching methods and real-world case studies to foster critical thinking.

- Emphasize your mentoring and advising skills, demonstrating your commitment to student success.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your teaching.

Essential Experience Highlights for a Strong Banking Teacher Resume

- Develop and implement lesson plans that meet industry standards and best practices in Banking Operations, Financial Analysis, and Risk Management.

- Incorporate innovative teaching methods, such as case studies, simulations, guest speakers, and experiential learning opportunities, to promote critical thinking and practical application of banking concepts.

- Lead workshops and professional development sessions for students and faculty on emerging trends in the banking industry and regulatory compliance.

- Mentor and advise students on career paths in banking, assisting with resume writing, interview preparation, and networking strategies.

- Establish and maintain relationships with industry professionals to stay updated on current trends and ensure curriculum relevance to the banking sector.

- Conduct research on best practices in banking education and present findings at conferences and industry events.

Frequently Asked Questions (FAQ’s) For Banking Teacher

What are the key skills required for a successful Banking Teacher?

The key skills for a successful Banking Teacher include a deep understanding of banking principles, proficiency in developing and delivering lesson plans, and a strong ability to mentor and guide students. Additional skills in financial analysis, risk management, and regulatory compliance are highly advantageous.

What are the career prospects for Banking Teachers?

Banking Teachers are in high demand due to the increasing need for skilled professionals in the banking sector. They can advance to roles such as Curriculum Developer, Training Manager, or even move into management positions within banks and financial institutions.

What qualifications are needed to become a Banking Teacher?

Typically, a Master’s Degree in Finance or a related field is required to become a Banking Teacher. Additionally, certification in banking or financial analysis is highly beneficial.

How can I enhance my resume as a Banking Teacher?

To enhance your resume, highlight your experience in developing and delivering engaging lesson plans, incorporating innovative teaching methods, and mentoring students. Quantify your accomplishments using specific metrics, and consider obtaining industry certifications to demonstrate your expertise.

What are the personal qualities of a successful Banking Teacher?

Successful Banking Teachers are passionate about banking and finance, have excellent communication and interpersonal skills, and are committed to helping students succeed. They are also adaptable, enthusiastic, and possess a growth mindset.

How can I stay updated on the latest trends in the banking industry?

To stay updated on the latest trends in the banking industry, attend industry conferences, read industry publications, and connect with professionals in the field. Additionally, pursuing professional development opportunities, such as workshops and courses, can help you stay abreast of emerging trends and best practices.