Are you a seasoned Risk Control Consultant seeking a new career path? Discover our professionally built Risk Control Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

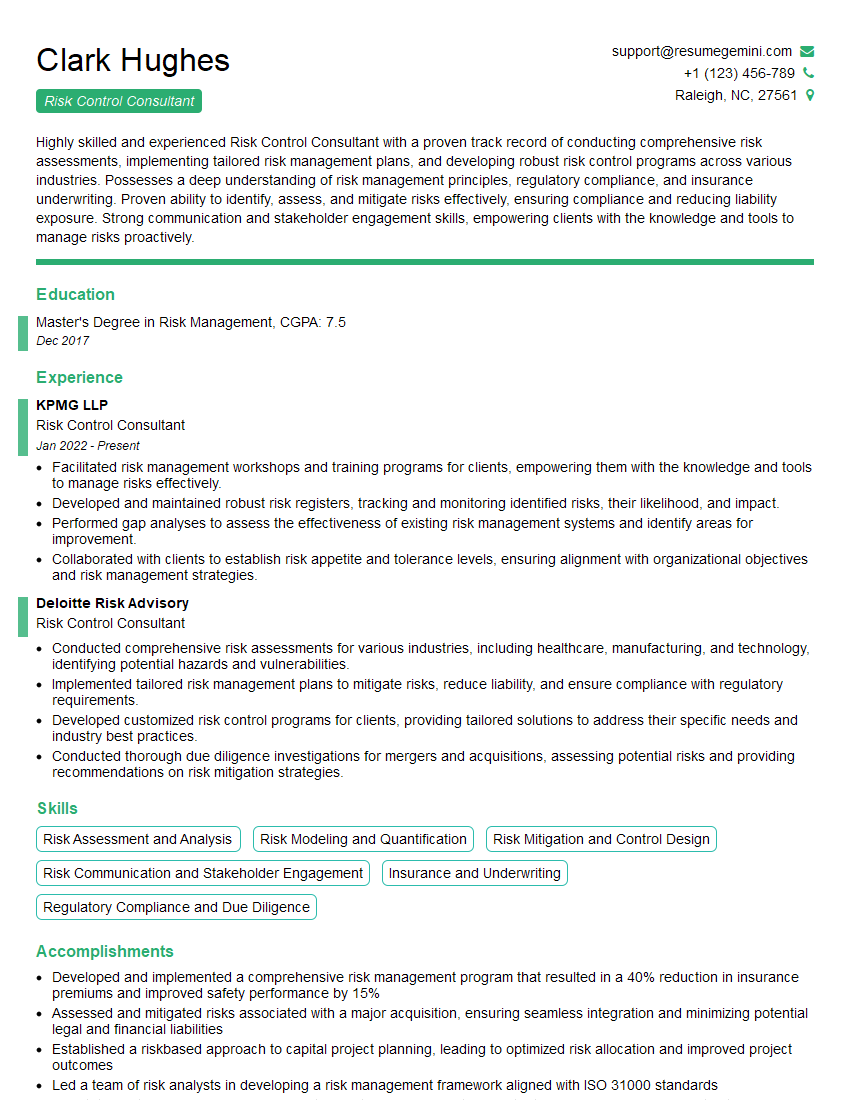

Clark Hughes

Risk Control Consultant

Summary

Highly skilled and experienced Risk Control Consultant with a proven track record of conducting comprehensive risk assessments, implementing tailored risk management plans, and developing robust risk control programs across various industries. Possesses a deep understanding of risk management principles, regulatory compliance, and insurance underwriting. Proven ability to identify, assess, and mitigate risks effectively, ensuring compliance and reducing liability exposure. Strong communication and stakeholder engagement skills, empowering clients with the knowledge and tools to manage risks proactively.

Education

Master’s Degree in Risk Management

December 2017

Skills

- Risk Assessment and Analysis

- Risk Modeling and Quantification

- Risk Mitigation and Control Design

- Risk Communication and Stakeholder Engagement

- Insurance and Underwriting

- Regulatory Compliance and Due Diligence

Work Experience

Risk Control Consultant

- Facilitated risk management workshops and training programs for clients, empowering them with the knowledge and tools to manage risks effectively.

- Developed and maintained robust risk registers, tracking and monitoring identified risks, their likelihood, and impact.

- Performed gap analyses to assess the effectiveness of existing risk management systems and identify areas for improvement.

- Collaborated with clients to establish risk appetite and tolerance levels, ensuring alignment with organizational objectives and risk management strategies.

Risk Control Consultant

- Conducted comprehensive risk assessments for various industries, including healthcare, manufacturing, and technology, identifying potential hazards and vulnerabilities.

- Implemented tailored risk management plans to mitigate risks, reduce liability, and ensure compliance with regulatory requirements.

- Developed customized risk control programs for clients, providing tailored solutions to address their specific needs and industry best practices.

- Conducted thorough due diligence investigations for mergers and acquisitions, assessing potential risks and providing recommendations on risk mitigation strategies.

Accomplishments

- Developed and implemented a comprehensive risk management program that resulted in a 40% reduction in insurance premiums and improved safety performance by 15%

- Assessed and mitigated risks associated with a major acquisition, ensuring seamless integration and minimizing potential legal and financial liabilities

- Established a riskbased approach to capital project planning, leading to optimized risk allocation and improved project outcomes

- Led a team of risk analysts in developing a risk management framework aligned with ISO 31000 standards

- Facilitated enterprisewide risk assessments, identifying and prioritizing potential risks and developing mitigation strategies

Awards

- Received the Risk Manager of the Year Award from the Risk and Insurance Management Society (RIMS)

- Recognized with the Outstanding Achievement Award for Risk Management Excellence from the American Society of Safety Professionals (ASSP)

- Conferred the Risk Management Champion Award by the National Safety Council (NSC)

- Honored with the Distinguished Risk Professional Award from the International Association of Risk Managers (IARM)

Certificates

- Certified Risk Manager (CRM)

- Associate in Risk Management (ARM)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Risk Control Consultant

- Highlight your quantitative and analytical skills, including experience in risk modeling and quantification.

- Showcase your understanding of regulatory compliance and the ability to interpret and apply relevant laws and regulations.

- Emphasize your strong written and verbal communication skills, as well as your ability to effectively engage with stakeholders at all levels.

- Consider obtaining professional certifications in risk management, such as the Certified Risk Manager (CRM) or the Associate in Risk Management (ARM) credential.

Essential Experience Highlights for a Strong Risk Control Consultant Resume

- Conducted comprehensive risk assessments to identify potential hazards, vulnerabilities, and threats across multiple industries.

- Developed and implemented customized risk management plans tailored to clients’ specific needs and industry best practices.

- Performed thorough due diligence investigations for mergers and acquisitions, assessing potential risks and providing recommendations on risk mitigation strategies.

- Facilitated risk management workshops and training programs, empowering clients with the knowledge and tools to manage risks effectively.

- Tracked and monitored identified risks, their likelihood, and impact, through the development and maintenance of robust risk registers.

- Collaborated with clients to establish risk appetite and tolerance levels, ensuring alignment with organizational objectives and risk management strategies.

Frequently Asked Questions (FAQ’s) For Risk Control Consultant

What are the key responsibilities of a Risk Control Consultant?

Risk Control Consultants are responsible for identifying, assessing, and mitigating risks within an organization. They work with clients to develop and implement risk management plans, conduct risk assessments, and provide training on risk management best practices.

What are the educational requirements for becoming a Risk Control Consultant?

A Master’s Degree in Risk Management or a related field is typically required to become a Risk Control Consultant. Additionally, many Risk Control Consultants hold professional certifications, such as the Certified Risk Manager (CRM) or the Associate in Risk Management (ARM) credential.

What industries do Risk Control Consultants work in?

Risk Control Consultants work in a variety of industries, including healthcare, manufacturing, technology, and financial services. They may also work as independent consultants or for consulting firms that specialize in risk management.

What are the career prospects for Risk Control Consultants?

The career prospects for Risk Control Consultants are strong. As organizations become increasingly aware of the importance of risk management, the demand for qualified Risk Control Consultants is expected to grow in the coming years.

What are the key skills and qualities of a successful Risk Control Consultant?

Successful Risk Control Consultants typically have a strong understanding of risk management principles, regulatory compliance, and insurance underwriting. They are also skilled in communication, stakeholder engagement, and problem-solving.

What are the challenges of being a Risk Control Consultant?

The challenges of being a Risk Control Consultant include the need to stay up-to-date on the latest risk management trends and regulations, as well as the need to be able to effectively communicate with stakeholders at all levels of an organization.

What are the rewards of being a Risk Control Consultant?

The rewards of being a Risk Control Consultant include the opportunity to make a real difference in an organization’s ability to manage risk, as well as the opportunity to work with a variety of clients and industries.