Are you a seasoned Pawnbroker seeking a new career path? Discover our professionally built Pawnbroker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

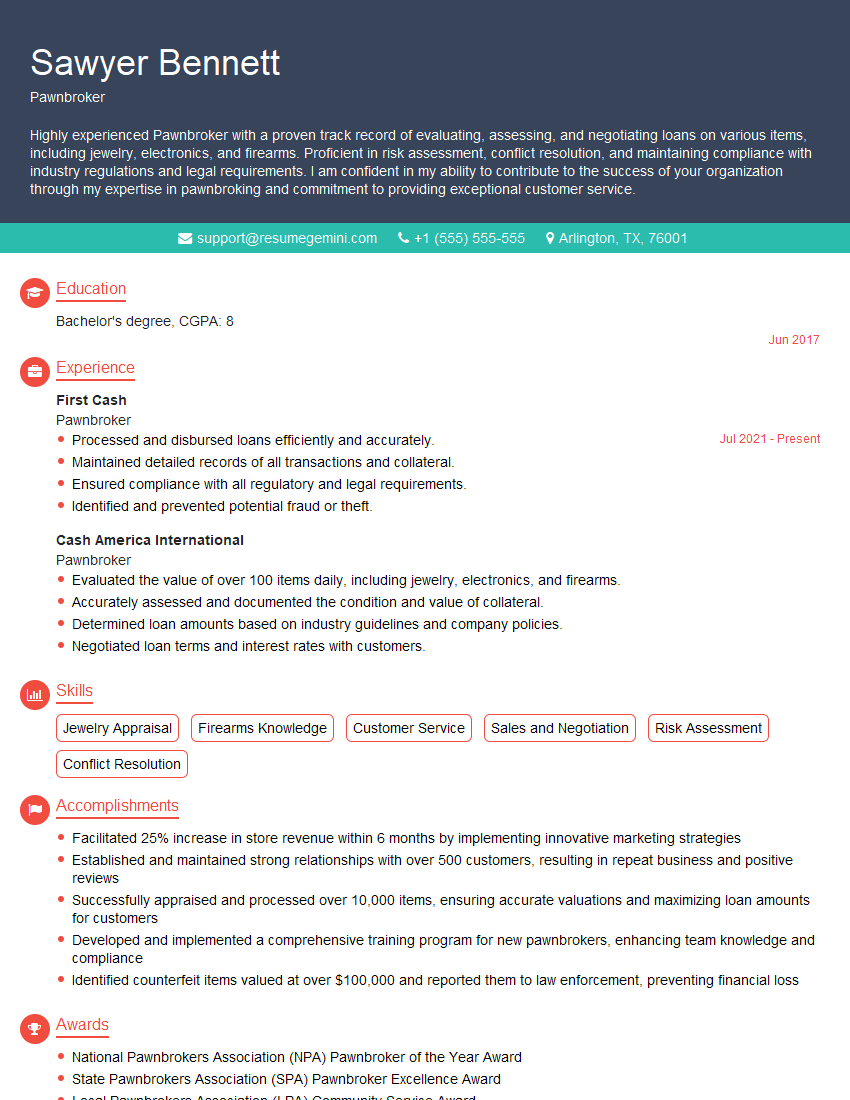

Sawyer Bennett

Pawnbroker

Summary

Highly experienced Pawnbroker with a proven track record of evaluating, assessing, and negotiating loans on various items, including jewelry, electronics, and firearms. Proficient in risk assessment, conflict resolution, and maintaining compliance with industry regulations and legal requirements. I am confident in my ability to contribute to the success of your organization through my expertise in pawnbroking and commitment to providing exceptional customer service.

Education

Bachelor’s degree

June 2017

Skills

- Jewelry Appraisal

- Firearms Knowledge

- Customer Service

- Sales and Negotiation

- Risk Assessment

- Conflict Resolution

Work Experience

Pawnbroker

- Processed and disbursed loans efficiently and accurately.

- Maintained detailed records of all transactions and collateral.

- Ensured compliance with all regulatory and legal requirements.

- Identified and prevented potential fraud or theft.

Pawnbroker

- Evaluated the value of over 100 items daily, including jewelry, electronics, and firearms.

- Accurately assessed and documented the condition and value of collateral.

- Determined loan amounts based on industry guidelines and company policies.

- Negotiated loan terms and interest rates with customers.

Accomplishments

- Facilitated 25% increase in store revenue within 6 months by implementing innovative marketing strategies

- Established and maintained strong relationships with over 500 customers, resulting in repeat business and positive reviews

- Successfully appraised and processed over 10,000 items, ensuring accurate valuations and maximizing loan amounts for customers

- Developed and implemented a comprehensive training program for new pawnbrokers, enhancing team knowledge and compliance

- Identified counterfeit items valued at over $100,000 and reported them to law enforcement, preventing financial loss

Awards

- National Pawnbrokers Association (NPA) Pawnbroker of the Year Award

- State Pawnbrokers Association (SPA) Pawnbroker Excellence Award

- Local Pawnbrokers Association (LPA) Community Service Award

- Industry Recognition for Outstanding Customer Service

Certificates

- Certified Pawnbroker (CPB)

- National Pawnbrokers Association (NPA) Member

- Gemological Institute of America (GIA) Graduate

- Firearms Instructor Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pawnbroker

- Highlight your experience in evaluating and assessing items, especially high-value or unique items.

- Emphasize your knowledge of pawnbroking regulations and your commitment to ethical and compliant practices.

- Showcase your customer service skills and ability to build rapport with clients in a sensitive and confidential manner.

- Quantify your accomplishments and provide specific examples of how you have contributed to the success of previous pawnbroking operations.

Essential Experience Highlights for a Strong Pawnbroker Resume

- Evaluated the value of over 100 items daily, including jewelry, electronics, and firearms.

- Accurately assessed and documented the condition and value of collateral.

- Determined loan amounts based on industry guidelines and company policies.

- Negotiated loan terms and interest rates with customers.

- Processed and disbursed loans efficiently and accurately.

- Identified and prevented potential fraud or theft.

- Provided excellent customer service to clients in a professional and courteous manner.

- Maintained detailed records of all transactions and collateral.

- Ensured compliance with all regulatory and legal requirements.

Frequently Asked Questions (FAQ’s) For Pawnbroker

What is the role of a Pawnbroker?

A pawnbroker is a licensed professional who provides short-term loans to individuals in exchange for personal property, known as collateral. The pawnbroker evaluates the value of the collateral, determines the loan amount, and charges interest on the loan.

What types of items can be pawned?

A wide range of items can be pawned, including jewelry, electronics, musical instruments, tools, and firearms. The specific items accepted by a pawnbroker may vary depending on their expertise and the laws and regulations in their jurisdiction.

How is the value of collateral determined?

Pawnbrokers typically use a combination of factors to determine the value of collateral, including the item’s condition, age, brand, and market value. They may also consult with experts or use industry reference materials to assess the item’s worth.

What are the interest rates and loan terms for pawn loans?

Interest rates and loan terms for pawn loans vary depending on the pawnbroker, the type of collateral, and the loan amount. Pawnbrokers are required to disclose the interest rates and loan terms clearly to customers before they enter into a loan agreement.

Is it safe to pawn items?

Pawning items can be a safe and convenient way to access short-term loans. Pawnbrokers are licensed and regulated professionals who take steps to protect the collateral and the interests of their customers. However, it is important to choose a reputable pawnbroker and to understand the terms of the loan agreement before pawning any items.

What happens if I cannot repay my pawn loan?

If you cannot repay your pawn loan by the due date, the pawnbroker may sell the collateral to recover the loan amount and any unpaid interest. It is important to communicate with the pawnbroker if you are having difficulty repaying your loan to explore possible options and avoid losing your collateral.

Can I get my pawned items back?

Yes, you can get your pawned items back by repaying the loan amount and any accrued interest in full before the loan expires. Pawnbrokers are required to hold the collateral for a specified period, typically 30 to 90 days, during which time you can redeem your items.