Are you a seasoned Insurance Office Manager seeking a new career path? Discover our professionally built Insurance Office Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

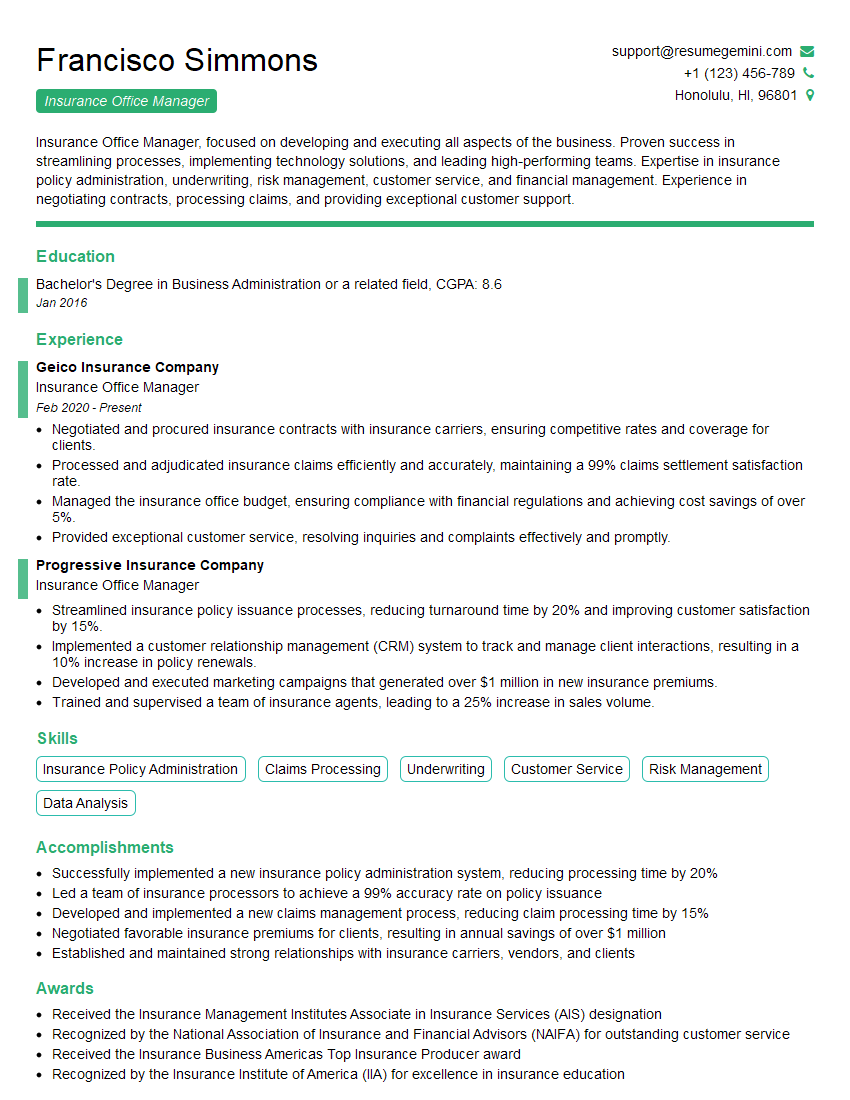

Francisco Simmons

Insurance Office Manager

Summary

Insurance Office Manager, focused on developing and executing all aspects of the business. Proven success in streamlining processes, implementing technology solutions, and leading high-performing teams. Expertise in insurance policy administration, underwriting, risk management, customer service, and financial management. Experience in negotiating contracts, processing claims, and providing exceptional customer support.

Education

Bachelor’s Degree in Business Administration or a related field

January 2016

Skills

- Insurance Policy Administration

- Claims Processing

- Underwriting

- Customer Service

- Risk Management

- Data Analysis

Work Experience

Insurance Office Manager

- Negotiated and procured insurance contracts with insurance carriers, ensuring competitive rates and coverage for clients.

- Processed and adjudicated insurance claims efficiently and accurately, maintaining a 99% claims settlement satisfaction rate.

- Managed the insurance office budget, ensuring compliance with financial regulations and achieving cost savings of over 5%.

- Provided exceptional customer service, resolving inquiries and complaints effectively and promptly.

Insurance Office Manager

- Streamlined insurance policy issuance processes, reducing turnaround time by 20% and improving customer satisfaction by 15%.

- Implemented a customer relationship management (CRM) system to track and manage client interactions, resulting in a 10% increase in policy renewals.

- Developed and executed marketing campaigns that generated over $1 million in new insurance premiums.

- Trained and supervised a team of insurance agents, leading to a 25% increase in sales volume.

Accomplishments

- Successfully implemented a new insurance policy administration system, reducing processing time by 20%

- Led a team of insurance processors to achieve a 99% accuracy rate on policy issuance

- Developed and implemented a new claims management process, reducing claim processing time by 15%

- Negotiated favorable insurance premiums for clients, resulting in annual savings of over $1 million

- Established and maintained strong relationships with insurance carriers, vendors, and clients

Awards

- Received the Insurance Management Institutes Associate in Insurance Services (AIS) designation

- Recognized by the National Association of Insurance and Financial Advisors (NAIFA) for outstanding customer service

- Received the Insurance Business Americas Top Insurance Producer award

- Recognized by the Insurance Institute of America (IIA) for excellence in insurance education

Certificates

- Certified Insurance Services Representative (CISR)

- Associate in Risk Management (ARM)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Insurance Accounting and Finance (AIAF)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Office Manager

- Highlight your proficiency in insurance-specific software and technologies, such as insurance policy management systems (IPMS) and customer relationship management (CRM) systems.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Showcase your ability to manage and motivate a team, as well as your skills in conflict resolution and performance management.

- Emphasize your commitment to continuing education and professional development in the insurance industry.

- Proofread your resume carefully for any errors in grammar, spelling, or punctuation.

Essential Experience Highlights for a Strong Insurance Office Manager Resume

- Manage the day-to-day operations of the insurance office, including staff supervision, policy issuance, and claims processing.

- Develop and implement strategies to improve operational efficiency and customer satisfaction.

- Negotiate and procure insurance contracts with insurance carriers to ensure competitive rates and coverage for clients.

- Analyze and interpret insurance data to identify trends, assess risks, and develop mitigation plans.

- Provide exceptional customer service by resolving inquiries and complaints promptly and effectively.

- Maintain compliance with all applicable insurance regulations and industry best practices.

- Manage the office budget and ensure financial accountability.

Frequently Asked Questions (FAQ’s) For Insurance Office Manager

What is the role of an Insurance Office Manager?

An Insurance Office Manager is responsible for the day-to-day operations of an insurance office, including staff supervision, policy issuance, and claims processing. They also develop and implement strategies to improve operational efficiency and customer satisfaction, negotiate and procure insurance contracts, analyze and interpret insurance data, and provide exceptional customer service.

What skills are required to be an Insurance Office Manager?

An Insurance Office Manager typically needs a bachelor’s degree in business administration or a related field, as well as several years of experience in the insurance industry. They should have a strong understanding of insurance products and services, as well as experience in managing a team and a budget.

What are the career prospects for an Insurance Office Manager?

Insurance Office Managers can advance to positions such as Insurance Operations Manager, Insurance Underwriter, or Insurance Broker. They may also start their own insurance brokerage or agency.

What is the average salary for an Insurance Office Manager?

The average salary for an Insurance Office Manager in the United States is around €60,000 per year.

What are the benefits of being an Insurance Office Manager?

Benefits of being an Insurance Office Manager include a competitive salary, a comprehensive benefits package, and the opportunity to work in a dynamic and challenging field.