Are you a seasoned Insurance Office Supervisor seeking a new career path? Discover our professionally built Insurance Office Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

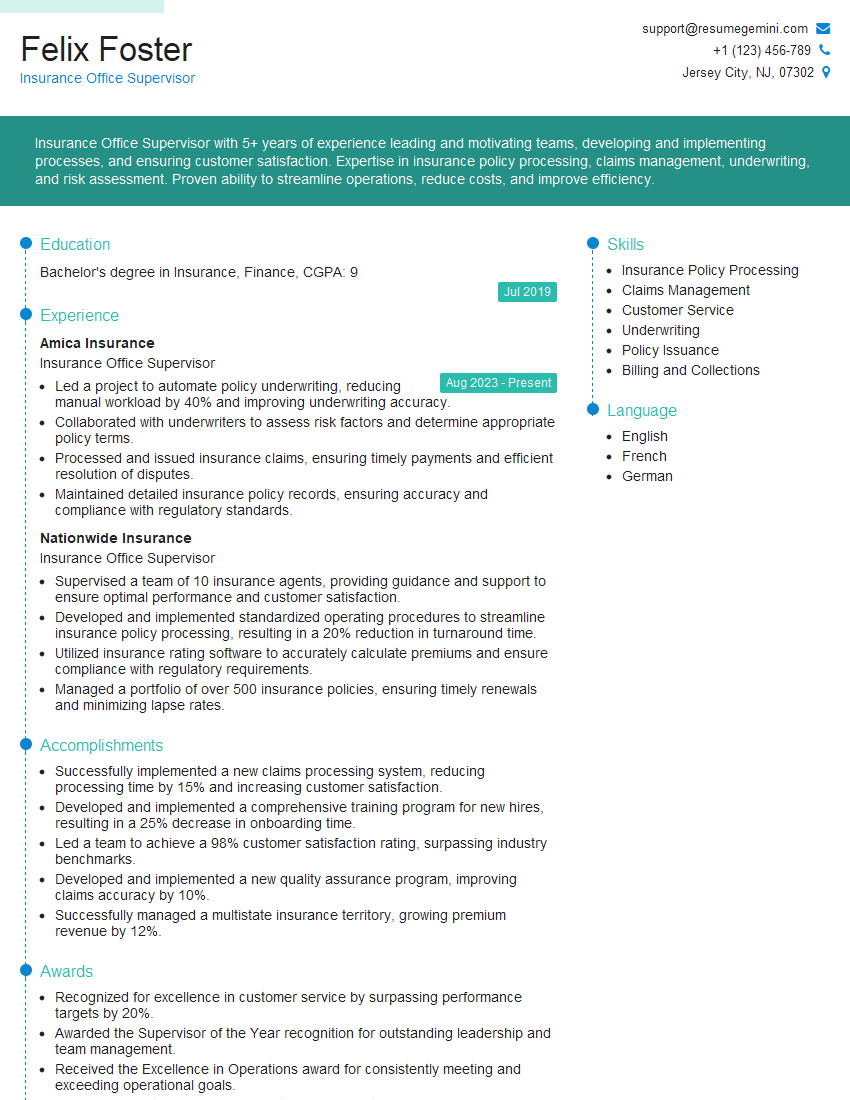

Felix Foster

Insurance Office Supervisor

Summary

Insurance Office Supervisor with 5+ years of experience leading and motivating teams, developing and implementing processes, and ensuring customer satisfaction. Expertise in insurance policy processing, claims management, underwriting, and risk assessment. Proven ability to streamline operations, reduce costs, and improve efficiency.

Education

Bachelor’s degree in Insurance, Finance

July 2019

Skills

- Insurance Policy Processing

- Claims Management

- Customer Service

- Underwriting

- Policy Issuance

- Billing and Collections

Work Experience

Insurance Office Supervisor

- Led a project to automate policy underwriting, reducing manual workload by 40% and improving underwriting accuracy.

- Collaborated with underwriters to assess risk factors and determine appropriate policy terms.

- Processed and issued insurance claims, ensuring timely payments and efficient resolution of disputes.

- Maintained detailed insurance policy records, ensuring accuracy and compliance with regulatory standards.

Insurance Office Supervisor

- Supervised a team of 10 insurance agents, providing guidance and support to ensure optimal performance and customer satisfaction.

- Developed and implemented standardized operating procedures to streamline insurance policy processing, resulting in a 20% reduction in turnaround time.

- Utilized insurance rating software to accurately calculate premiums and ensure compliance with regulatory requirements.

- Managed a portfolio of over 500 insurance policies, ensuring timely renewals and minimizing lapse rates.

Accomplishments

- Successfully implemented a new claims processing system, reducing processing time by 15% and increasing customer satisfaction.

- Developed and implemented a comprehensive training program for new hires, resulting in a 25% decrease in onboarding time.

- Led a team to achieve a 98% customer satisfaction rating, surpassing industry benchmarks.

- Developed and implemented a new quality assurance program, improving claims accuracy by 10%.

- Successfully managed a multistate insurance territory, growing premium revenue by 12%.

Awards

- Recognized for excellence in customer service by surpassing performance targets by 20%.

- Awarded the Supervisor of the Year recognition for outstanding leadership and team management.

- Received the Excellence in Operations award for consistently meeting and exceeding operational goals.

- Recognized by the carrier for exceptional underwriting performance, consistently maintaining a loss ratio below industry average.

Certificates

- Certified Insurance Counselor (CIC)

- Associate in Risk Management (ARM)

- Certified Professional Insurance Agent (CPIA)

- Fellow of the Life Management Institute (FLMI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Office Supervisor

- Highlight your expertise in insurance operations, including policy processing, claims management, and underwriting.

- Quantify your accomplishments with specific metrics and results, such as the percentage reduction in turnaround time or cost savings achieved.

- Demonstrate your leadership and management skills by describing your experience in supervising and developing teams.

- Showcase your knowledge of insurance regulations and compliance requirements.

- Emphasize the value you can bring to an organization in terms of improving efficiency, reducing costs, and enhancing customer satisfaction.

Essential Experience Highlights for a Strong Insurance Office Supervisor Resume

- Supervise and develop a team of insurance agents, providing guidance and support to ensure optimal performance and customer satisfaction.

- Develop and implement standardized operating procedures to streamline insurance policy processing, reducing turnaround time and improving efficiency.

- Utilize insurance rating software to accurately calculate premiums and ensure compliance with regulatory requirements.

- Review and manage a portfolio of insurance policies, monitoring renewals and lapse rates, working closely with clients, agents, underwriters, and the legal team to ensure all policies are in compliance and up to date.

- Maintain detailed insurance policy records, ensuring accuracy, completeness, and compliance with regulatory standards.

- Lead projects to automate and improve insurance processes, reducing manual workload and turnaround time.

- Collaborate with underwriters and other insurance professionals to assess risk factors and determine appropriate policy terms.

- Process and issue insurance claims, ensuring timely payments and efficient resolution of disputes.

Frequently Asked Questions (FAQ’s) For Insurance Office Supervisor

What are the key responsibilities of an Insurance Office Supervisor?

An Insurance Office Supervisor is responsible for supervising and leading a team of insurance agents, developing and implementing policies and procedures, ensuring customer satisfaction, underwriting risks, processing claims, and maintaining records in compliance with regulatory standards.

What qualifications are typically required to become an Insurance Office Supervisor?

Typically, an Insurance Office Supervisor requires a Bachelor’s degree in Insurance, Finance, or a related field, along with several years of experience in the insurance industry, including experience in policy processing, underwriting, claims management, and risk assessment.

What are the career prospects for an Insurance Office Supervisor?

An experienced Insurance Office Supervisor can advance to roles such as Insurance Manager, Underwriting Manager, or Claims Manager. With further experience and education, they may also qualify for executive-level positions within the insurance industry.

What are the challenges faced by Insurance Office Supervisors?

Insurance Office Supervisors face challenges such as keeping up with regulatory changes, managing a team effectively, ensuring customer satisfaction, staying abreast of industry trends, and mitigating risks.

What are the most important skills for an Insurance Office Supervisor?

The most important skills for an Insurance Office Supervisor include leadership, communication, organizational abilities, attention to detail, problem-solving, and a strong understanding of the insurance industry.

What is the average salary for an Insurance Office Supervisor?

The average salary for an Insurance Office Supervisor in the United States is around $75,000 per year, according to Salary.com.

What are the benefits of working as an Insurance Office Supervisor?

Benefits of working as an Insurance Office Supervisor include job stability, opportunities for career advancement, a competitive salary and benefits package, and the chance to make a positive impact on the lives of others.

What is the job outlook for Insurance Office Supervisors?

The job outlook for Insurance Office Supervisors is expected to grow faster than average over the next decade due to the increasing demand for insurance products and services.