Are you a seasoned Underwriting Sales Representative seeking a new career path? Discover our professionally built Underwriting Sales Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

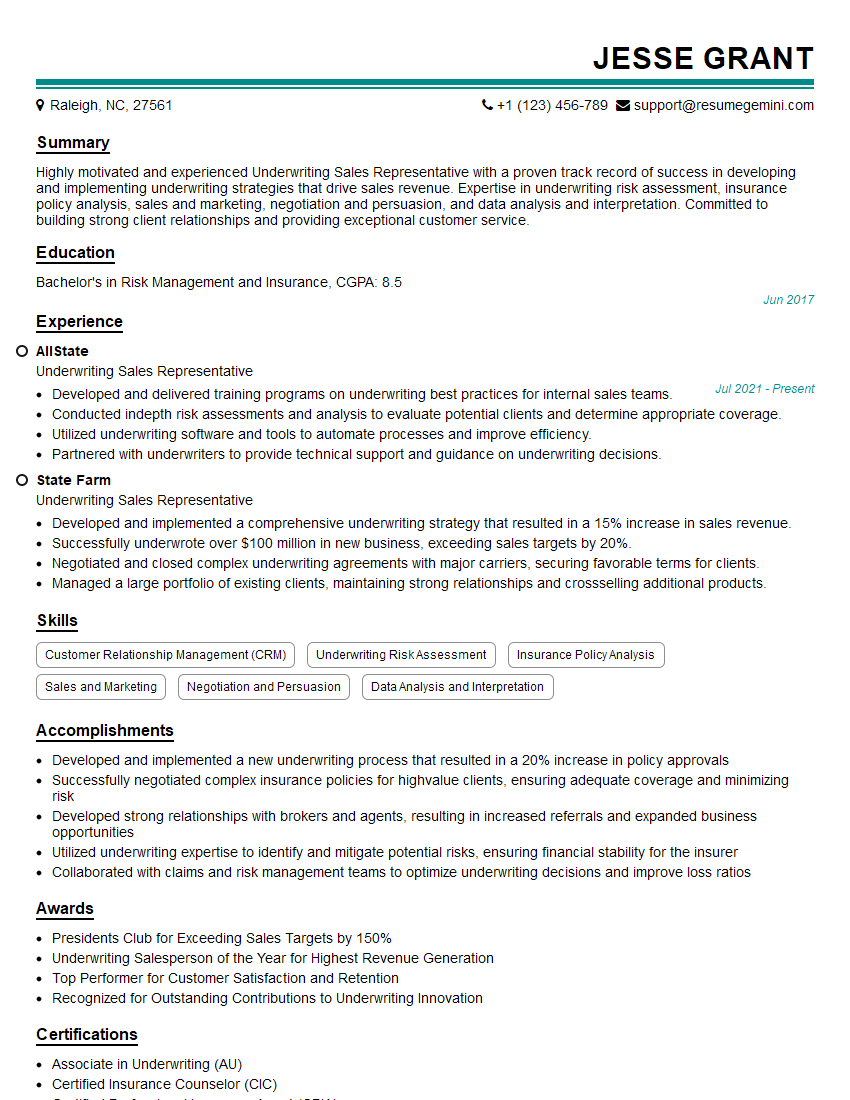

Jesse Grant

Underwriting Sales Representative

Summary

Highly motivated and experienced Underwriting Sales Representative with a proven track record of success in developing and implementing underwriting strategies that drive sales revenue. Expertise in underwriting risk assessment, insurance policy analysis, sales and marketing, negotiation and persuasion, and data analysis and interpretation. Committed to building strong client relationships and providing exceptional customer service.

Education

Bachelor’s in Risk Management and Insurance

June 2017

Skills

- Customer Relationship Management (CRM)

- Underwriting Risk Assessment

- Insurance Policy Analysis

- Sales and Marketing

- Negotiation and Persuasion

- Data Analysis and Interpretation

Work Experience

Underwriting Sales Representative

- Developed and delivered training programs on underwriting best practices for internal sales teams.

- Conducted indepth risk assessments and analysis to evaluate potential clients and determine appropriate coverage.

- Utilized underwriting software and tools to automate processes and improve efficiency.

- Partnered with underwriters to provide technical support and guidance on underwriting decisions.

Underwriting Sales Representative

- Developed and implemented a comprehensive underwriting strategy that resulted in a 15% increase in sales revenue.

- Successfully underwrote over $100 million in new business, exceeding sales targets by 20%.

- Negotiated and closed complex underwriting agreements with major carriers, securing favorable terms for clients.

- Managed a large portfolio of existing clients, maintaining strong relationships and crossselling additional products.

Accomplishments

- Developed and implemented a new underwriting process that resulted in a 20% increase in policy approvals

- Successfully negotiated complex insurance policies for highvalue clients, ensuring adequate coverage and minimizing risk

- Developed strong relationships with brokers and agents, resulting in increased referrals and expanded business opportunities

- Utilized underwriting expertise to identify and mitigate potential risks, ensuring financial stability for the insurer

- Collaborated with claims and risk management teams to optimize underwriting decisions and improve loss ratios

Awards

- Presidents Club for Exceeding Sales Targets by 150%

- Underwriting Salesperson of the Year for Highest Revenue Generation

- Top Performer for Customer Satisfaction and Retention

- Recognized for Outstanding Contributions to Underwriting Innovation

Certificates

- Associate in Underwriting (AU)

- Certified Insurance Counselor (CIC)

- Certified Professional Insurance Agent (CPIA)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Sales Representative

- Highlight your underwriting expertise and experience in your resume.

- Showcase your ability to build strong client relationships and negotiate favorable terms.

- Demonstrate your understanding of insurance products and underwriting principles.

- Use specific examples and data to quantify your accomplishments.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Underwriting Sales Representative Resume

- Develop and implement comprehensive underwriting strategies to increase sales revenue.

- Underwrite new business and maintain a high level of portfolio quality.

- Negotiate and close complex underwriting agreements with major carriers.

- Manage a large portfolio of existing clients, maintaining strong relationships and cross-selling additional products.

- Conduct in-depth risk assessments and analysis to evaluate potential clients and determine appropriate coverage.

- Utilize underwriting software and tools to automate processes and improve efficiency.

- Partner with underwriters to provide technical support and guidance on underwriting decisions.

Frequently Asked Questions (FAQ’s) For Underwriting Sales Representative

What is the role of an Underwriting Sales Representative?

An Underwriting Sales Representative is responsible for evaluating and assessing risks, determining appropriate coverage, and negotiating and closing underwriting agreements with insurance carriers on behalf of clients.

What are the key skills required for an Underwriting Sales Representative?

Key skills for an Underwriting Sales Representative include underwriting risk assessment, insurance policy analysis, sales and marketing, negotiation and persuasion, and data analysis and interpretation.

What is the career path for an Underwriting Sales Representative?

Underwriting Sales Representatives can advance to roles such as Underwriting Manager, Senior Underwriter, or Chief Underwriting Officer.

What are the salary expectations for an Underwriting Sales Representative?

Salary expectations for an Underwriting Sales Representative vary depending on experience, location, and company size, but typically range from $50,000 to $100,000 annually.

What are the challenges faced by Underwriting Sales Representatives?

Underwriting Sales Representatives face challenges such as accurately assessing risks, negotiating favorable terms, and maintaining strong client relationships in a competitive insurance market.

What are the opportunities for Underwriting Sales Representatives?

Opportunities for Underwriting Sales Representatives include career advancement, increased earning potential, and the chance to make a positive impact on clients’ financial well-being.

What is the job outlook for Underwriting Sales Representatives?

The job outlook for Underwriting Sales Representatives is expected to be positive in the coming years due to the increasing demand for insurance products and services.