Are you a seasoned Surety Bond Agent seeking a new career path? Discover our professionally built Surety Bond Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

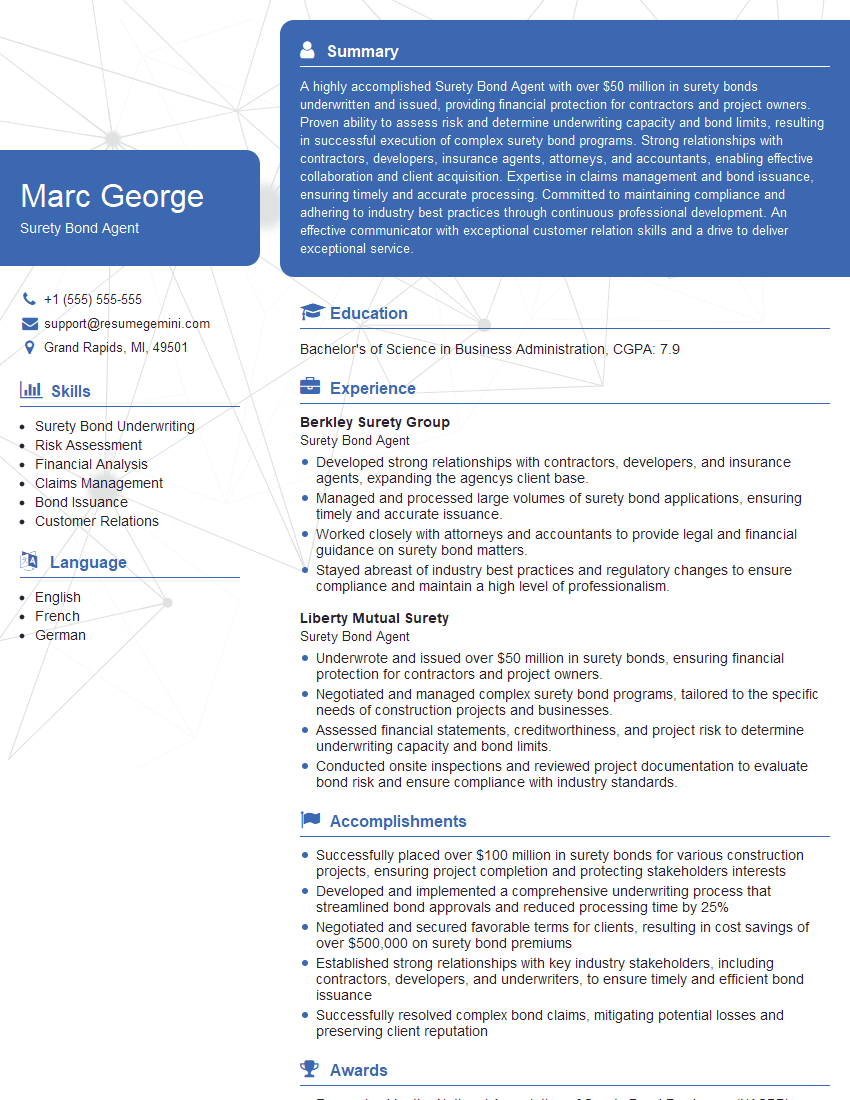

Marc George

Surety Bond Agent

Summary

A highly accomplished Surety Bond Agent with over $50 million in surety bonds underwritten and issued, providing financial protection for contractors and project owners. Proven ability to assess risk and determine underwriting capacity and bond limits, resulting in successful execution of complex surety bond programs. Strong relationships with contractors, developers, insurance agents, attorneys, and accountants, enabling effective collaboration and client acquisition. Expertise in claims management and bond issuance, ensuring timely and accurate processing. Committed to maintaining compliance and adhering to industry best practices through continuous professional development. An effective communicator with exceptional customer relation skills and a drive to deliver exceptional service.

Education

Bachelor’s of Science in Business Administration

June 2018

Skills

- Surety Bond Underwriting

- Risk Assessment

- Financial Analysis

- Claims Management

- Bond Issuance

- Customer Relations

Work Experience

Surety Bond Agent

- Developed strong relationships with contractors, developers, and insurance agents, expanding the agencys client base.

- Managed and processed large volumes of surety bond applications, ensuring timely and accurate issuance.

- Worked closely with attorneys and accountants to provide legal and financial guidance on surety bond matters.

- Stayed abreast of industry best practices and regulatory changes to ensure compliance and maintain a high level of professionalism.

Surety Bond Agent

- Underwrote and issued over $50 million in surety bonds, ensuring financial protection for contractors and project owners.

- Negotiated and managed complex surety bond programs, tailored to the specific needs of construction projects and businesses.

- Assessed financial statements, creditworthiness, and project risk to determine underwriting capacity and bond limits.

- Conducted onsite inspections and reviewed project documentation to evaluate bond risk and ensure compliance with industry standards.

Accomplishments

- Successfully placed over $100 million in surety bonds for various construction projects, ensuring project completion and protecting stakeholders interests

- Developed and implemented a comprehensive underwriting process that streamlined bond approvals and reduced processing time by 25%

- Negotiated and secured favorable terms for clients, resulting in cost savings of over $500,000 on surety bond premiums

- Established strong relationships with key industry stakeholders, including contractors, developers, and underwriters, to ensure timely and efficient bond issuance

- Successfully resolved complex bond claims, mitigating potential losses and preserving client reputation

Awards

- Recognized by the National Association of Surety Bond Producers (NASBP) as a Top 5% Producer

- Received the Surety Bond Agent of the Year award from the American Association of Insurance Services (AAIS)

- Honored with the Certified Surety Bond Professional (CSP) designation from the Surety & Fidelity Association of America (SFAA)

Certificates

- Certified Surety Bond Producer (CSP)

- Associate in Surety Bonding (ASB)

- Certified Insurance Counselor (CIC)

- Certified Professional in Insurance (CPI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Surety Bond Agent

- Showcase your understanding of the surety bond industry and its underwriting process.

- Highlight your quantitative skills and ability to analyze financial data and project risk.

- Emphasize your communication and interpersonal skills, as building relationships is crucial in this role.

- Consider obtaining professional certifications, such as the Associate in Surety Bonding (ASB) or Certified Surety Agent (CSA).

- Demonstrate your commitment to ethical conduct and maintaining high standards of professionalism.

Essential Experience Highlights for a Strong Surety Bond Agent Resume

- Underwrite, issue, and negotiate surety bonds tailored to specific project and business needs.

- Assess financial statements, creditworthiness, and project risk to determine underwriting capacity and bond limits.

- Conduct onsite inspections and review project documentation to evaluate bond risk and ensure compliance.

- Cultivate relationships with contractors, developers, and insurance agents to expand client base and drive growth.

- Manage and process surety bond applications efficiently, ensuring timely and accurate issuance.

- Provide legal and financial guidance on surety bond matters in collaboration with attorneys and accountants.

- Stay updated on industry regulations, best practices, and emerging trends to maintain compliance and professionalism.

Frequently Asked Questions (FAQ’s) For Surety Bond Agent

What is the primary role of a Surety Bond Agent?

A Surety Bond Agent acts as an intermediary between contractors or businesses seeking surety bonds and insurance companies that issue them. They assess risk, determine underwriting capacity, and negotiate bond terms to provide financial protection for project owners and contractors.

What is the difference between a surety bond and insurance?

Insurance protects against financial loss due to unforeseen events, while surety bonds guarantee the performance of a specific obligation, such as completing a construction project or fulfilling a contractual agreement. Surety bonds provide financial assurance to third parties that the bonded party will meet their obligations.

What are the key factors considered when underwriting a surety bond?

Underwriters evaluate the financial strength, creditworthiness, experience, and reputation of the applicant, as well as the nature and risk associated with the project or obligation being bonded.

What are the different types of surety bonds?

There are various types of surety bonds, including contract bonds (e.g., bid, performance, and payment bonds), commercial bonds (e.g., license and permit bonds), and miscellaneous bonds (e.g., court and fiduciary bonds).

What is the importance of maintaining strong relationships in this profession?

Building and maintaining relationships with contractors, developers, insurance agents, and other industry professionals is crucial for Surety Bond Agents. These relationships facilitate access to potential clients, enable information sharing, and enhance the overall success and reputation of the agent.

How can I enhance my credibility as a Surety Bond Agent?

Obtaining professional certifications, attending industry events, and actively participating in professional organizations can enhance your credibility and demonstrate your commitment to the field.

What are the career advancement opportunities for Surety Bond Agents?

Surety Bond Agents with experience and proven success can advance to leadership roles within their organizations, such as Underwriting Manager or Branch Manager. They may also transition to related fields within the insurance industry, such as Risk Management or Commercial Underwriting.