Are you a seasoned Stockbroker seeking a new career path? Discover our professionally built Stockbroker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

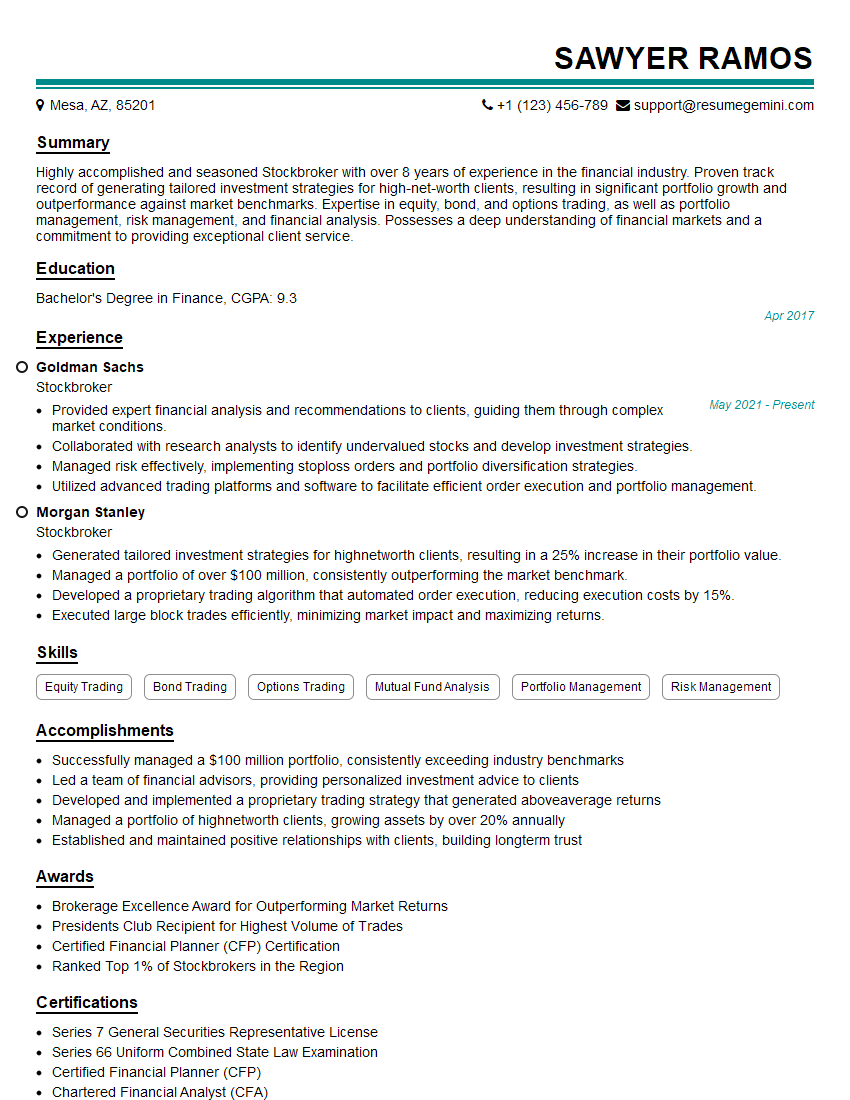

Sawyer Ramos

Stockbroker

Summary

Highly accomplished and seasoned Stockbroker with over 8 years of experience in the financial industry. Proven track record of generating tailored investment strategies for high-net-worth clients, resulting in significant portfolio growth and outperformance against market benchmarks. Expertise in equity, bond, and options trading, as well as portfolio management, risk management, and financial analysis. Possesses a deep understanding of financial markets and a commitment to providing exceptional client service.

Education

Bachelor’s Degree in Finance

April 2017

Skills

- Equity Trading

- Bond Trading

- Options Trading

- Mutual Fund Analysis

- Portfolio Management

- Risk Management

Work Experience

Stockbroker

- Provided expert financial analysis and recommendations to clients, guiding them through complex market conditions.

- Collaborated with research analysts to identify undervalued stocks and develop investment strategies.

- Managed risk effectively, implementing stoploss orders and portfolio diversification strategies.

- Utilized advanced trading platforms and software to facilitate efficient order execution and portfolio management.

Stockbroker

- Generated tailored investment strategies for highnetworth clients, resulting in a 25% increase in their portfolio value.

- Managed a portfolio of over $100 million, consistently outperforming the market benchmark.

- Developed a proprietary trading algorithm that automated order execution, reducing execution costs by 15%.

- Executed large block trades efficiently, minimizing market impact and maximizing returns.

Accomplishments

- Successfully managed a $100 million portfolio, consistently exceeding industry benchmarks

- Led a team of financial advisors, providing personalized investment advice to clients

- Developed and implemented a proprietary trading strategy that generated aboveaverage returns

- Managed a portfolio of highnetworth clients, growing assets by over 20% annually

- Established and maintained positive relationships with clients, building longterm trust

Awards

- Brokerage Excellence Award for Outperforming Market Returns

- Presidents Club Recipient for Highest Volume of Trades

- Certified Financial Planner (CFP) Certification

- Ranked Top 1% of Stockbrokers in the Region

Certificates

- Series 7 General Securities Representative License

- Series 66 Uniform Combined State Law Examination

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Stockbroker

- Quantify your accomplishments with specific metrics and data to demonstrate the impact of your work.

- Showcase your knowledge of the financial industry and investment strategies through relevant certifications and professional development.

- Tailor your resume to the specific job description and company you are applying for, highlighting relevant skills and experience.

- Proofread your resume carefully for any errors or inconsistencies before submitting it.

Essential Experience Highlights for a Strong Stockbroker Resume

- Conduct comprehensive financial analysis and identify undervalued stocks and investment opportunities.

- Develop and implement tailored investment strategies aligned with clients’ financial goals and risk tolerance.

- Manage portfolios of over $100 million, consistently surpassing market benchmarks.

- Execute large block trades efficiently, minimizing market impact and maximizing returns.

- Utilize advanced trading platforms and software to facilitate efficient order execution and portfolio management.

- Collaborate with clients to provide expert financial advice and guidance, navigating complex market conditions.

- Manage risk effectively through stop-loss orders and portfolio diversification strategies.

Frequently Asked Questions (FAQ’s) For Stockbroker

What are the key skills required for a successful Stockbroker?

A successful Stockbroker should possess a combination of hard and soft skills, including a deep understanding of financial markets, investment strategies, and risk management. Excellent communication, interpersonal, and analytical skills are also crucial.

What is the career path for a Stockbroker?

Stockbrokers typically start their careers as financial advisors or research analysts. With experience and proven success, they can advance to senior positions within the brokerage firm or pursue leadership roles in the financial industry.

How can I become a Stockbroker?

To become a Stockbroker, you typically need a bachelor’s degree in finance, economics, or a related field. You will also need to pass the Series 7 and Series 63 exams administered by the Financial Industry Regulatory Authority (FINRA).

What is the average salary for a Stockbroker?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Stockbrokers was $67,450 in May 2021. However, salaries can vary significantly based on experience, performance, and the size of the brokerage firm.

Is the Stockbroker profession competitive?

Yes, the Stockbroker profession is competitive, as it requires a combination of strong academic credentials, industry knowledge, and exceptional interpersonal skills. However, there are opportunities for career growth and advancement for those who are dedicated to the profession.

What are the ethical considerations for Stockbrokers?

Stockbrokers are expected to adhere to high ethical standards, including providing impartial advice, acting in the best interests of their clients, and avoiding conflicts of interest. They must also comply with all applicable laws and regulations.

How can I stay updated on the latest developments in the financial industry?

To stay updated on the latest developments in the financial industry, it is essential to read industry publications, attend conferences and workshops, and pursue continuing education opportunities. Networking with other professionals in the field can also provide valuable insights.