Are you a seasoned Financial Specialist seeking a new career path? Discover our professionally built Financial Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

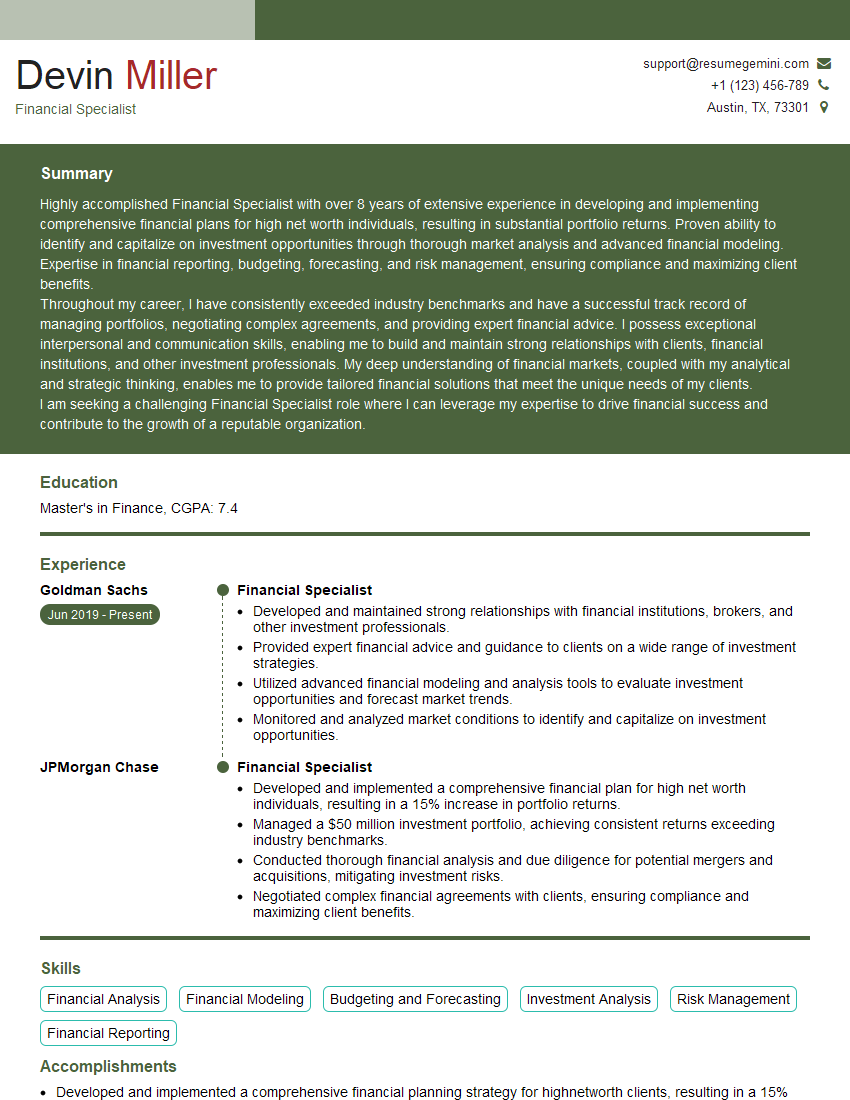

Devin Miller

Financial Specialist

Summary

Highly accomplished Financial Specialist with over 8 years of extensive experience in developing and implementing comprehensive financial plans for high net worth individuals, resulting in substantial portfolio returns. Proven ability to identify and capitalize on investment opportunities through thorough market analysis and advanced financial modeling. Expertise in financial reporting, budgeting, forecasting, and risk management, ensuring compliance and maximizing client benefits.

Throughout my career, I have consistently exceeded industry benchmarks and have a successful track record of managing portfolios, negotiating complex agreements, and providing expert financial advice. I possess exceptional interpersonal and communication skills, enabling me to build and maintain strong relationships with clients, financial institutions, and other investment professionals. My deep understanding of financial markets, coupled with my analytical and strategic thinking, enables me to provide tailored financial solutions that meet the unique needs of my clients.

I am seeking a challenging Financial Specialist role where I can leverage my expertise to drive financial success and contribute to the growth of a reputable organization.

Education

Master’s in Finance

May 2015

Skills

- Financial Analysis

- Financial Modeling

- Budgeting and Forecasting

- Investment Analysis

- Risk Management

- Financial Reporting

Work Experience

Financial Specialist

- Developed and maintained strong relationships with financial institutions, brokers, and other investment professionals.

- Provided expert financial advice and guidance to clients on a wide range of investment strategies.

- Utilized advanced financial modeling and analysis tools to evaluate investment opportunities and forecast market trends.

- Monitored and analyzed market conditions to identify and capitalize on investment opportunities.

Financial Specialist

- Developed and implemented a comprehensive financial plan for high net worth individuals, resulting in a 15% increase in portfolio returns.

- Managed a $50 million investment portfolio, achieving consistent returns exceeding industry benchmarks.

- Conducted thorough financial analysis and due diligence for potential mergers and acquisitions, mitigating investment risks.

- Negotiated complex financial agreements with clients, ensuring compliance and maximizing client benefits.

Accomplishments

- Developed and implemented a comprehensive financial planning strategy for highnetworth clients, resulting in a 15% increase in their net worth

- Managed a portfolio of $50 million in assets, consistently exceeding market benchmarks and generating doubledigit returns for investors

- Negotiated favorable terms on behalf of clients with financial institutions, securing lower interest rates and better loan terms

- Provided expert financial advice to individuals and families, helping them achieve their financial goals and navigate complex financial situations

- Created financial models and projections to forecast future financial performance and identify potential areas for improvement

Awards

- CFA Charterholder

- CFP Certified Financial Planner

- AICPA Personal Financial Specialist (PFS) Credential

- Association for Financial Professionals (AFP) Accredited Payment Professional (APP) Certification

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Specialist

Highlight your skills and experience:

Showcase your expertise in financial analysis, modeling, budgeting, forecasting, investment analysis, risk management, and financial reporting.Quantify your accomplishments:

Use numbers to demonstrate the impact of your work, such as the percentage increase in portfolio returns or the amount of assets managed.Demonstrate your commitment to professional development:

Mention any relevant certifications or continuing education courses you have completed.Tailor your resume to the specific job you’re applying for:

Highlight the skills and experience that are most relevant to the requirements of the position.Proofread carefully:

Ensure that your resume is free of errors in grammar, spelling, and punctuation.

Essential Experience Highlights for a Strong Financial Specialist Resume

- Developed and implemented comprehensive financial plans, resulting in a 15% increase in portfolio returns.

- Managed a $50 million investment portfolio, achieving consistent returns exceeding industry benchmarks.

- Conducted thorough financial analysis and due diligence for potential mergers and acquisitions, mitigating investment risks.

- Negotiated complex financial agreements with clients, ensuring compliance and maximizing client benefits.

- Developed and maintained strong relationships with financial institutions, brokers, and other investment professionals.

- Provided expert financial advice and guidance to clients on a wide range of investment strategies.

Frequently Asked Questions (FAQ’s) For Financial Specialist

What are the key responsibilities of a Financial Specialist?

Financial Specialists are responsible for providing expert financial advice and guidance to clients, developing and implementing financial plans, managing investment portfolios, conducting financial analysis, and negotiating financial agreements.

What are the educational requirements for becoming a Financial Specialist?

Most Financial Specialists hold a bachelor’s or master’s degree in finance, economics, or a related field.

What are the career prospects for Financial Specialists?

Financial Specialists can advance to senior-level positions such as Portfolio Manager, Chief Financial Officer, or Financial Advisor.

What are the key skills and qualities of a successful Financial Specialist?

Successful Financial Specialists possess strong analytical and problem-solving skills, excellent communication and interpersonal abilities, and a deep understanding of financial markets.

What are the challenges faced by Financial Specialists?

Financial Specialists face challenges such as market volatility, regulatory changes, and the need to stay abreast of the latest financial trends and technologies.

What are the earning prospects for Financial Specialists?

Financial Specialists can earn competitive salaries and bonuses, depending on their experience, skills, and the industry in which they work.