Are you a seasoned Relationship Banker seeking a new career path? Discover our professionally built Relationship Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

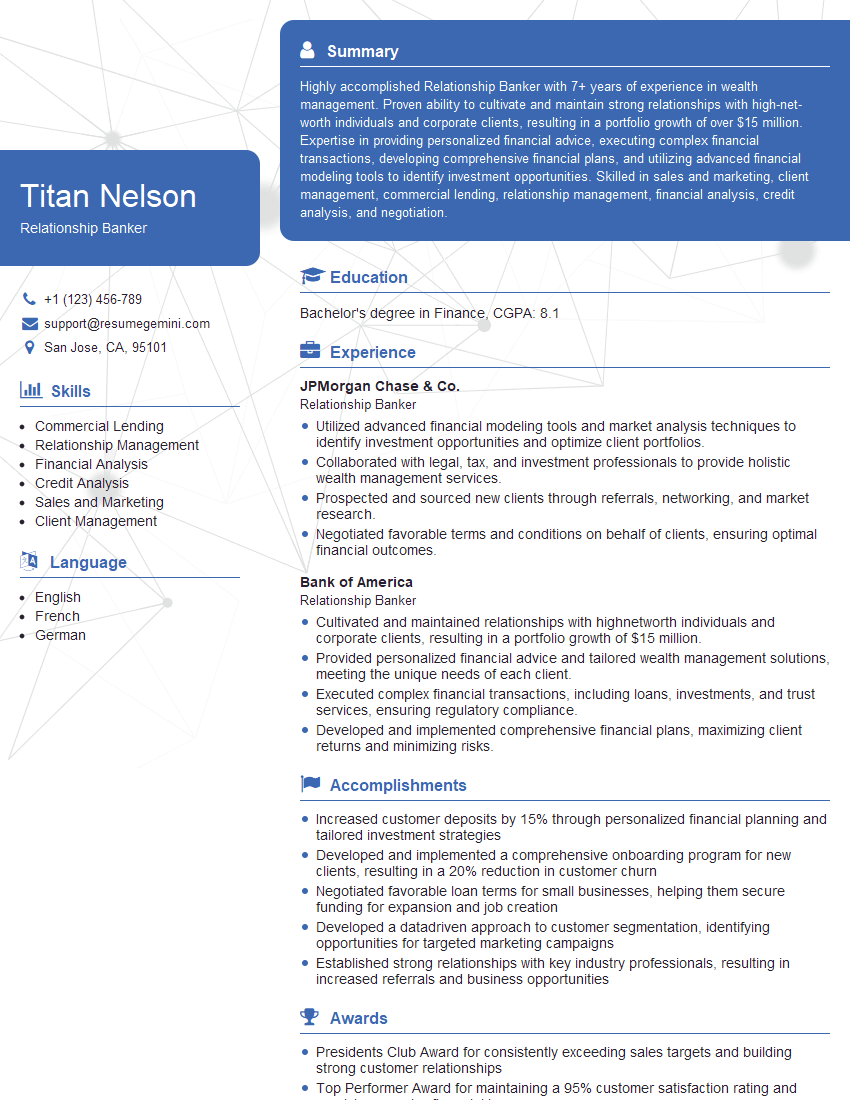

Titan Nelson

Relationship Banker

Summary

Highly accomplished Relationship Banker with 7+ years of experience in wealth management. Proven ability to cultivate and maintain strong relationships with high-net-worth individuals and corporate clients, resulting in a portfolio growth of over $15 million. Expertise in providing personalized financial advice, executing complex financial transactions, developing comprehensive financial plans, and utilizing advanced financial modeling tools to identify investment opportunities. Skilled in sales and marketing, client management, commercial lending, relationship management, financial analysis, credit analysis, and negotiation.

Education

Bachelor’s degree in Finance

May 2016

Skills

- Commercial Lending

- Relationship Management

- Financial Analysis

- Credit Analysis

- Sales and Marketing

- Client Management

Work Experience

Relationship Banker

- Utilized advanced financial modeling tools and market analysis techniques to identify investment opportunities and optimize client portfolios.

- Collaborated with legal, tax, and investment professionals to provide holistic wealth management services.

- Prospected and sourced new clients through referrals, networking, and market research.

- Negotiated favorable terms and conditions on behalf of clients, ensuring optimal financial outcomes.

Relationship Banker

- Cultivated and maintained relationships with highnetworth individuals and corporate clients, resulting in a portfolio growth of $15 million.

- Provided personalized financial advice and tailored wealth management solutions, meeting the unique needs of each client.

- Executed complex financial transactions, including loans, investments, and trust services, ensuring regulatory compliance.

- Developed and implemented comprehensive financial plans, maximizing client returns and minimizing risks.

Accomplishments

- Increased customer deposits by 15% through personalized financial planning and tailored investment strategies

- Developed and implemented a comprehensive onboarding program for new clients, resulting in a 20% reduction in customer churn

- Negotiated favorable loan terms for small businesses, helping them secure funding for expansion and job creation

- Developed a datadriven approach to customer segmentation, identifying opportunities for targeted marketing campaigns

- Established strong relationships with key industry professionals, resulting in increased referrals and business opportunities

Awards

- Presidents Club Award for consistently exceeding sales targets and building strong customer relationships

- Top Performer Award for maintaining a 95% customer satisfaction rating and resolving complex financial issues

- Excellence in Relationship Management Award for consistently meeting and exceeding customer expectations

- Sales Star Award for achieving outstanding results in generating new leads and closing deals

Certificates

- Certified Relationship Banker (CRB)

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Financial Management Advisor (FMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Relationship Banker

- Highlight your experience in relationship management, financial analysis, and sales.

- Quantify your accomplishments whenever possible to demonstrate your impact.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant.

- Proofread your resume carefully before submitting it to ensure that it is free of errors.

Essential Experience Highlights for a Strong Relationship Banker Resume

- Cultivate and maintain relationships with high-net-worth individuals and corporate clients.

- Provide personalized financial advice and tailored wealth management solutions.

- Execute complex financial transactions, including loans, investments, and trust services.

- Develop and implement comprehensive financial plans, maximizing client returns and minimizing risks.

- Utilize advanced financial modeling tools and market analysis techniques to identify investment opportunities.

- Collaborate with legal, tax, and investment professionals to provide holistic wealth management services.

- Manage a portfolio of clients, providing ongoing support and guidance.

Frequently Asked Questions (FAQ’s) For Relationship Banker

What is the primary role of a Relationship Banker?

The primary role of a Relationship Banker is to manage and grow relationships with high-net-worth individuals and corporate clients, providing them with personalized financial advice and tailored wealth management solutions.

What are the key skills required to be a successful Relationship Banker?

Key skills required to be a successful Relationship Banker include strong communication and interpersonal skills, financial analysis and planning expertise, sales and marketing proficiency, and a deep understanding of the financial markets.

What is the career path for Relationship Bankers?

Relationship Bankers can advance to more senior positions within their organizations, such as Private Wealth Advisor, Portfolio Manager, or Head of Wealth Management.

What is the average salary for Relationship Bankers?

The average salary for Relationship Bankers varies depending on experience, location, and company size, but it typically ranges from $70,000 to $150,000 per year.

What are the challenges faced by Relationship Bankers?

Relationship Bankers face challenges such as managing client expectations, staying up-to-date on financial market trends, and navigating regulatory and compliance requirements.

What is the future of Relationship Banking?

The future of Relationship Banking is expected to be driven by technological advancements, increasing client demand for personalized advice, and the growing complexity of financial markets.

What are the opportunities for Relationship Bankers?

Relationship Bankers have opportunities to work with a diverse range of clients, develop deep expertise in wealth management, and make a significant impact on their clients’ financial lives.

What are the common mistakes made by Relationship Bankers?

Common mistakes made by Relationship Bankers include failing to build strong relationships with clients, not understanding their clients’ needs, and making investment recommendations that are not in their best interests.