Are you a seasoned Credit and Loan Collections Supervisor seeking a new career path? Discover our professionally built Credit and Loan Collections Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

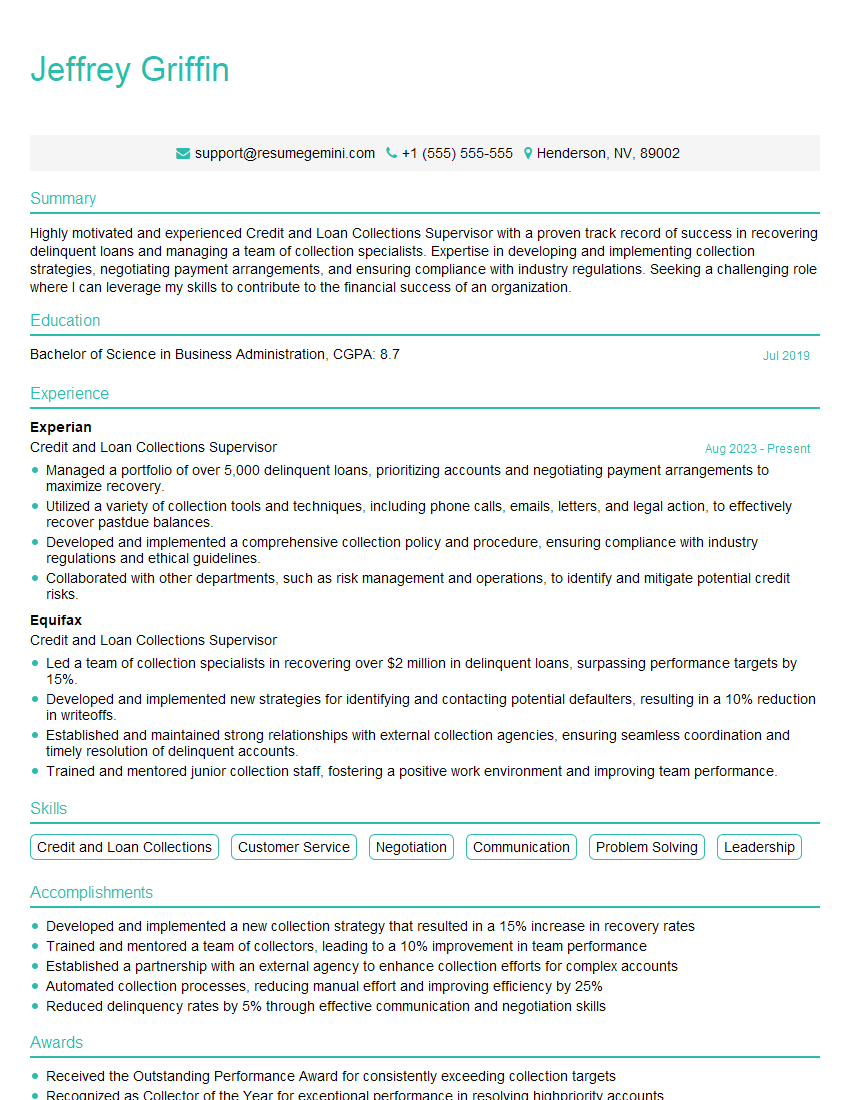

Jeffrey Griffin

Credit and Loan Collections Supervisor

Summary

Highly motivated and experienced Credit and Loan Collections Supervisor with a proven track record of success in recovering delinquent loans and managing a team of collection specialists. Expertise in developing and implementing collection strategies, negotiating payment arrangements, and ensuring compliance with industry regulations. Seeking a challenging role where I can leverage my skills to contribute to the financial success of an organization.

Education

Bachelor of Science in Business Administration

July 2019

Skills

- Credit and Loan Collections

- Customer Service

- Negotiation

- Communication

- Problem Solving

- Leadership

Work Experience

Credit and Loan Collections Supervisor

- Managed a portfolio of over 5,000 delinquent loans, prioritizing accounts and negotiating payment arrangements to maximize recovery.

- Utilized a variety of collection tools and techniques, including phone calls, emails, letters, and legal action, to effectively recover pastdue balances.

- Developed and implemented a comprehensive collection policy and procedure, ensuring compliance with industry regulations and ethical guidelines.

- Collaborated with other departments, such as risk management and operations, to identify and mitigate potential credit risks.

Credit and Loan Collections Supervisor

- Led a team of collection specialists in recovering over $2 million in delinquent loans, surpassing performance targets by 15%.

- Developed and implemented new strategies for identifying and contacting potential defaulters, resulting in a 10% reduction in writeoffs.

- Established and maintained strong relationships with external collection agencies, ensuring seamless coordination and timely resolution of delinquent accounts.

- Trained and mentored junior collection staff, fostering a positive work environment and improving team performance.

Accomplishments

- Developed and implemented a new collection strategy that resulted in a 15% increase in recovery rates

- Trained and mentored a team of collectors, leading to a 10% improvement in team performance

- Established a partnership with an external agency to enhance collection efforts for complex accounts

- Automated collection processes, reducing manual effort and improving efficiency by 25%

- Reduced delinquency rates by 5% through effective communication and negotiation skills

Awards

- Received the Outstanding Performance Award for consistently exceeding collection targets

- Recognized as Collector of the Year for exceptional performance in resolving highpriority accounts

- Awarded the Excellence in Leadership award for fostering a positive and productive work environment

- Recognized as Employee of the Quarter for exceptional contributions to the department

Certificates

- Certified Credit and Collections Professional (CCCP)

- Certified Financial Crime Investigator (CFCS)

- Certified Collections Manager (CCM)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit and Loan Collections Supervisor

- Highlight your experience in credit and loan collections, including specific metrics and accomplishments that demonstrate your success.

- Emphasize your negotiation and communication skills, as well as your ability to build and maintain relationships.

- Showcase your knowledge of collection laws and regulations, as well as your ability to manage a team effectively.

- Quantify your results whenever possible, using specific numbers to demonstrate the impact of your work.

Essential Experience Highlights for a Strong Credit and Loan Collections Supervisor Resume

- Leading and managing a team of collection specialists to recover delinquent loans and surpass performance targets.

- Developing and implementing collection strategies to identify and contact potential defaulters, resulting in reduced write-offs.

- Establishing and maintaining relationships with external collection agencies to ensure seamless coordination and timely resolution of delinquent accounts.

- Training and mentoring junior collection staff, fostering a positive work environment and improving team performance.

- Managing a portfolio of delinquent loans, prioritizing accounts, and negotiating payment arrangements to maximize recovery.

- Utilizing a variety of collection tools and techniques to effectively recover past-due balances.

- Developing and implementing a comprehensive collection policy and procedure, ensuring compliance with industry regulations and ethical guidelines.

Frequently Asked Questions (FAQ’s) For Credit and Loan Collections Supervisor

What are the key skills and qualifications required for a Credit and Loan Collections Supervisor?

The key skills and qualifications required for a Credit and Loan Collections Supervisor include experience in credit and loan collections, negotiation, communication, problem-solving, leadership, and management.

What are the primary responsibilities of a Credit and Loan Collections Supervisor?

The primary responsibilities of a Credit and Loan Collections Supervisor include leading and managing a team of collection specialists, developing and implementing collection strategies, negotiating payment arrangements, training and mentoring junior staff, and managing a portfolio of delinquent loans.

What are the career prospects for a Credit and Loan Collections Supervisor?

The career prospects for a Credit and Loan Collections Supervisor are good, as there is a growing demand for qualified professionals in this field. With experience and additional training, a Credit and Loan Collections Supervisor can advance to roles such as Collections Manager or Director of Collections.

What is the average salary for a Credit and Loan Collections Supervisor?

The average salary for a Credit and Loan Collections Supervisor varies depending on experience, location, and company size. According to Salary.com, the average salary for a Credit and Loan Collections Supervisor in the United States is $65,000 per year.

What are the challenges faced by Credit and Loan Collections Supervisors?

The challenges faced by Credit and Loan Collections Supervisors include managing delinquent accounts, negotiating with customers, and ensuring compliance with industry regulations. Additionally, Credit and Loan Collections Supervisors may face pressure to meet performance targets and may work in a high-stress environment.

What are the opportunities for a Credit and Loan Collections Supervisor?

The opportunities for a Credit and Loan Collections Supervisor include career advancement, professional development, and the chance to make a positive impact on the financial success of an organization.

What is the job outlook for Credit and Loan Collections Supervisors?

The job outlook for Credit and Loan Collections Supervisors is expected to grow faster than average in the coming years. This growth is due to the increasing need for qualified professionals to manage delinquent accounts and recover unpaid debts.