Are you a seasoned Collections Clerk seeking a new career path? Discover our professionally built Collections Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

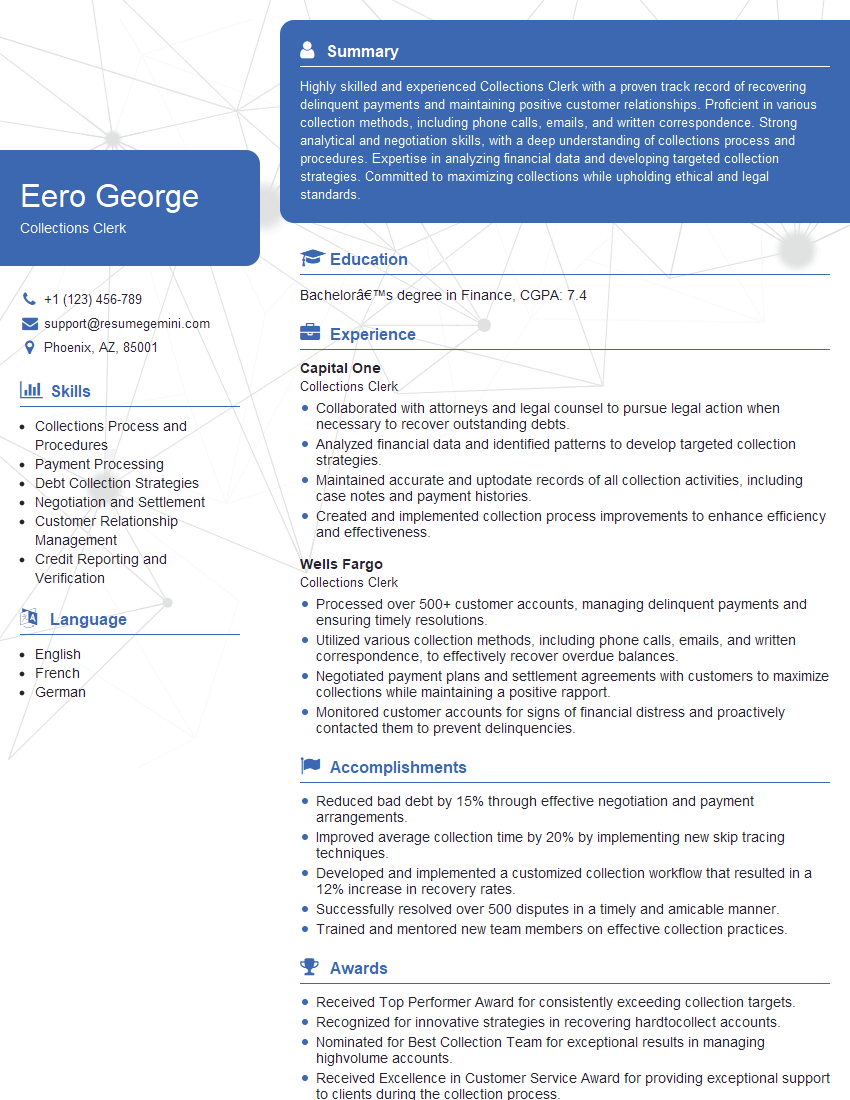

Eero George

Collections Clerk

Summary

Highly skilled and experienced Collections Clerk with a proven track record of recovering delinquent payments and maintaining positive customer relationships. Proficient in various collection methods, including phone calls, emails, and written correspondence. Strong analytical and negotiation skills, with a deep understanding of collections process and procedures. Expertise in analyzing financial data and developing targeted collection strategies. Committed to maximizing collections while upholding ethical and legal standards.

Education

Bachelor’s degree in Finance

October 2015

Skills

- Collections Process and Procedures

- Payment Processing

- Debt Collection Strategies

- Negotiation and Settlement

- Customer Relationship Management

- Credit Reporting and Verification

Work Experience

Collections Clerk

- Collaborated with attorneys and legal counsel to pursue legal action when necessary to recover outstanding debts.

- Analyzed financial data and identified patterns to develop targeted collection strategies.

- Maintained accurate and uptodate records of all collection activities, including case notes and payment histories.

- Created and implemented collection process improvements to enhance efficiency and effectiveness.

Collections Clerk

- Processed over 500+ customer accounts, managing delinquent payments and ensuring timely resolutions.

- Utilized various collection methods, including phone calls, emails, and written correspondence, to effectively recover overdue balances.

- Negotiated payment plans and settlement agreements with customers to maximize collections while maintaining a positive rapport.

- Monitored customer accounts for signs of financial distress and proactively contacted them to prevent delinquencies.

Accomplishments

- Reduced bad debt by 15% through effective negotiation and payment arrangements.

- Improved average collection time by 20% by implementing new skip tracing techniques.

- Developed and implemented a customized collection workflow that resulted in a 12% increase in recovery rates.

- Successfully resolved over 500 disputes in a timely and amicable manner.

- Trained and mentored new team members on effective collection practices.

Awards

- Received Top Performer Award for consistently exceeding collection targets.

- Recognized for innovative strategies in recovering hardtocollect accounts.

- Nominated for Best Collection Team for exceptional results in managing highvolume accounts.

- Received Excellence in Customer Service Award for providing exceptional support to clients during the collection process.

Certificates

- Certified Debt Collector (CDC)

- Certified Collections Professional (CCP)

- Fair Debt Collection Practices Act (FDCPA) Certification

- Association of Credit and Collection Professionals (ACA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collections Clerk

- In your resume, highlight your proficiency in collections processes, payment processing, debt collection strategies, negotiation and settlement, and customer relationship management.

- Quantify your accomplishments whenever possible, such as the number of accounts managed, the amount of overdue balances recovered, or the percentage of customers who entered payment plans.

- Showcase your communication and interpersonal skills, emphasizing your ability to build rapport with customers and resolve disputes amicably.

- Demonstrate your attention to detail and accuracy by highlighting your success in maintaining accurate records and identifying financial irregularities.

- Consider including any relevant certifications or training programs that demonstrate your expertise in collections, such as the Certified Collection Specialist (CCS) certification.

Essential Experience Highlights for a Strong Collections Clerk Resume

- Processed over 500+ customer accounts, managing delinquent payments and ensuring timely resolutions.

- Utilized various collection methods, including phone calls, emails, and written correspondence, to effectively recover overdue balances.

- Negotiated payment plans and settlement agreements with customers to maximize collections while maintaining a positive rapport.

- Monitored customer accounts for signs of financial distress and proactively contacted them to prevent delinquencies.

- Collaborated with attorneys and legal counsel to pursue legal action when necessary to recover outstanding debts.

- Analyzed financial data and identified patterns to develop targeted collection strategies.

- Maintained accurate and up-to-date records of all collection activities, including case notes and payment histories.

Frequently Asked Questions (FAQ’s) For Collections Clerk

What are the key responsibilities of a Collections Clerk?

Collections Clerks are responsible for contacting delinquent customers, negotiating payment plans, and recovering overdue balances. They must have a strong understanding of collections laws and regulations, as well as excellent communication and interpersonal skills.

What skills are required to be a successful Collections Clerk?

Successful Collections Clerks typically have a combination of hard and soft skills, including proficiency in collections processes, payment processing, debt collection strategies, negotiation and settlement, and customer relationship management. They must also be detail-oriented, accurate, and have strong communication and interpersonal skills.

What is the career path for a Collections Clerk?

Collections Clerks can advance to roles such as Collections Supervisor, Collections Manager, or Credit Analyst. With additional experience and education, they may also pursue careers in management, finance, or law.

How can I improve my chances of getting a job as a Collections Clerk?

To improve your chances of getting a job as a Collections Clerk, focus on developing your hard and soft skills, such as proficiency in collections processes, payment processing, debt collection strategies, negotiation and settlement, and customer relationship management. Additionally, consider obtaining relevant certifications or training programs, such as the Certified Collection Specialist (CCS) certification.

What is the salary range for Collections Clerks?

The salary range for Collections Clerks can vary depending on experience, location, and company size. According to Salary.com, the average salary for Collections Clerks in the United States is $45,000 per year.

What are the job prospects for Collections Clerks?

The job outlook for Collections Clerks is expected to grow faster than average over the next few years. This is due to the increasing number of delinquent accounts and the need for businesses to recover unpaid debts.

What are some of the challenges faced by Collections Clerks?

Collections Clerks may face a number of challenges, including dealing with difficult customers, managing high workloads, and working under pressure. They must also be able to maintain a professional demeanor while working with customers who may be in financial distress.