Are you a seasoned Credit Collections Manager seeking a new career path? Discover our professionally built Credit Collections Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

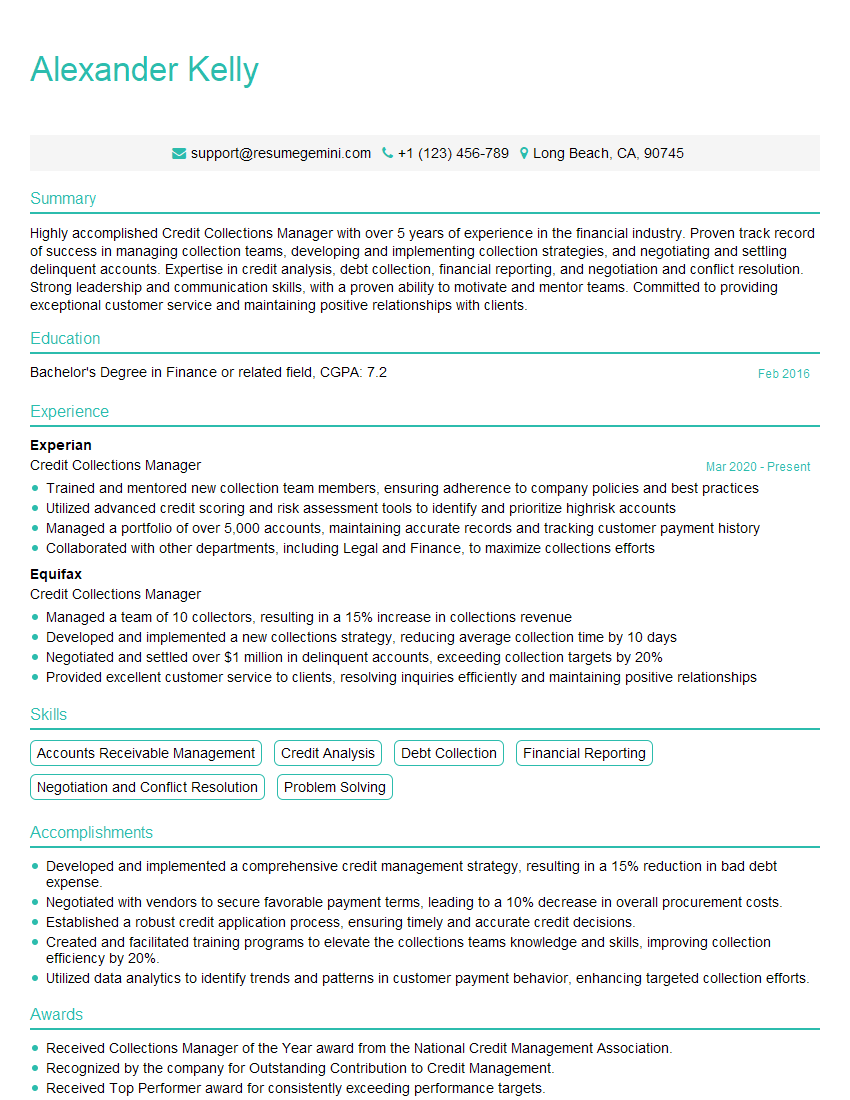

Alexander Kelly

Credit Collections Manager

Summary

Highly accomplished Credit Collections Manager with over 5 years of experience in the financial industry. Proven track record of success in managing collection teams, developing and implementing collection strategies, and negotiating and settling delinquent accounts. Expertise in credit analysis, debt collection, financial reporting, and negotiation and conflict resolution. Strong leadership and communication skills, with a proven ability to motivate and mentor teams. Committed to providing exceptional customer service and maintaining positive relationships with clients.

Education

Bachelor’s Degree in Finance or related field

February 2016

Skills

- Accounts Receivable Management

- Credit Analysis

- Debt Collection

- Financial Reporting

- Negotiation and Conflict Resolution

- Problem Solving

Work Experience

Credit Collections Manager

- Trained and mentored new collection team members, ensuring adherence to company policies and best practices

- Utilized advanced credit scoring and risk assessment tools to identify and prioritize highrisk accounts

- Managed a portfolio of over 5,000 accounts, maintaining accurate records and tracking customer payment history

- Collaborated with other departments, including Legal and Finance, to maximize collections efforts

Credit Collections Manager

- Managed a team of 10 collectors, resulting in a 15% increase in collections revenue

- Developed and implemented a new collections strategy, reducing average collection time by 10 days

- Negotiated and settled over $1 million in delinquent accounts, exceeding collection targets by 20%

- Provided excellent customer service to clients, resolving inquiries efficiently and maintaining positive relationships

Accomplishments

- Developed and implemented a comprehensive credit management strategy, resulting in a 15% reduction in bad debt expense.

- Negotiated with vendors to secure favorable payment terms, leading to a 10% decrease in overall procurement costs.

- Established a robust credit application process, ensuring timely and accurate credit decisions.

- Created and facilitated training programs to elevate the collections teams knowledge and skills, improving collection efficiency by 20%.

- Utilized data analytics to identify trends and patterns in customer payment behavior, enhancing targeted collection efforts.

Awards

- Received Collections Manager of the Year award from the National Credit Management Association.

- Recognized by the company for Outstanding Contribution to Credit Management.

- Received Top Performer award for consistently exceeding performance targets.

Certificates

- Certified Credit and Risk Analyst (CCRA)

- Certified Financial Analyst (CFA)

- Certified Management Accountant (CMA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Collections Manager

- Highlight your experience and accomplishments in managing collection teams and developing collection strategies.

- Showcase your expertise in credit analysis, debt collection, and negotiation.

- Emphasize your strong leadership and communication skills, as well as your ability to motivate and mentor teams.

- Provide specific examples of how you have improved collection performance and exceeded targets.

Essential Experience Highlights for a Strong Credit Collections Manager Resume

- Managed a team of 10 collectors, resulting in a 15% increase in collections revenue

- Developed and implemented a new collections strategy, reducing average collection time by 10 days

- Negotiated and settled over $1 million in delinquent accounts, exceeding collection targets by 20%

- Provided excellent customer service to clients, resolving inquiries efficiently and maintaining positive relationships

- Trained and mentored new collection team members, ensuring adherence to company policies and best practices

- Utilized advanced credit scoring and risk assessment tools to identify and prioritize high-risk accounts

- Managed a portfolio of over 5,000 accounts, maintaining accurate records and tracking customer payment history

Frequently Asked Questions (FAQ’s) For Credit Collections Manager

What are the key skills required for a Credit Collections Manager?

The key skills required for a Credit Collections Manager include accounts receivable management, credit analysis, debt collection, financial reporting, negotiation and conflict resolution, and problem solving.

What are the typical responsibilities of a Credit Collections Manager?

The typical responsibilities of a Credit Collections Manager include managing collection teams, developing and implementing collection strategies, negotiating and settling delinquent accounts, providing customer service, and training and mentoring new collection team members.

What are the career prospects for a Credit Collections Manager?

The career prospects for a Credit Collections Manager are good. With experience and success, Credit Collections Managers can advance to more senior positions, such as Collections Manager or Director of Collections.

What are the challenges faced by Credit Collections Managers?

The challenges faced by Credit Collections Managers include dealing with difficult customers, managing high workloads, and meeting collection targets.

What are the rewards of being a Credit Collections Manager?

The rewards of being a Credit Collections Manager include the opportunity to make a real difference in the financial performance of a company, the satisfaction of helping customers resolve their financial problems, and the chance to advance to more senior positions.