Are you a seasoned Statement Clerk seeking a new career path? Discover our professionally built Statement Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

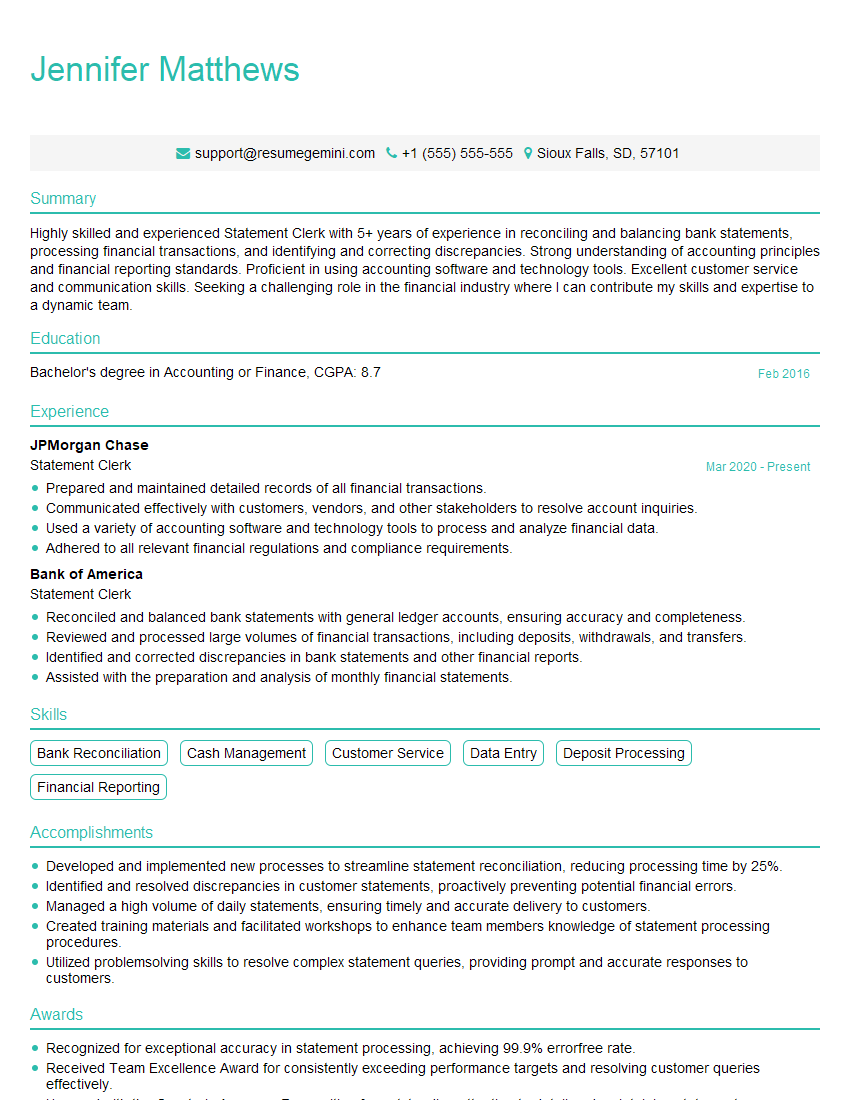

Jennifer Matthews

Statement Clerk

Summary

Highly skilled and experienced Statement Clerk with 5+ years of experience in reconciling and balancing bank statements, processing financial transactions, and identifying and correcting discrepancies. Strong understanding of accounting principles and financial reporting standards. Proficient in using accounting software and technology tools. Excellent customer service and communication skills. Seeking a challenging role in the financial industry where I can contribute my skills and expertise to a dynamic team.

Education

Bachelor’s degree in Accounting or Finance

February 2016

Skills

- Bank Reconciliation

- Cash Management

- Customer Service

- Data Entry

- Deposit Processing

- Financial Reporting

Work Experience

Statement Clerk

- Prepared and maintained detailed records of all financial transactions.

- Communicated effectively with customers, vendors, and other stakeholders to resolve account inquiries.

- Used a variety of accounting software and technology tools to process and analyze financial data.

- Adhered to all relevant financial regulations and compliance requirements.

Statement Clerk

- Reconciled and balanced bank statements with general ledger accounts, ensuring accuracy and completeness.

- Reviewed and processed large volumes of financial transactions, including deposits, withdrawals, and transfers.

- Identified and corrected discrepancies in bank statements and other financial reports.

- Assisted with the preparation and analysis of monthly financial statements.

Accomplishments

- Developed and implemented new processes to streamline statement reconciliation, reducing processing time by 25%.

- Identified and resolved discrepancies in customer statements, proactively preventing potential financial errors.

- Managed a high volume of daily statements, ensuring timely and accurate delivery to customers.

- Created training materials and facilitated workshops to enhance team members knowledge of statement processing procedures.

- Utilized problemsolving skills to resolve complex statement queries, providing prompt and accurate responses to customers.

Awards

- Recognized for exceptional accuracy in statement processing, achieving 99.9% errorfree rate.

- Received Team Excellence Award for consistently exceeding performance targets and resolving customer queries effectively.

- Honored with the Quarterly Accuracy Recognition for outstanding attention to detail and maintaining statement accuracy.

- Elected as a member of the Customer Service Excellence Committee for excellence in communication and customer relations.

Certificates

- Certified Bank Statement Analyst (CBSA)

- Certified Bookkeeper (CB)

- Certified Fraud Examiner (CFE)

- Certified Management Accountant (CMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Statement Clerk

- Highlight your experience in bank reconciliation and financial transaction processing.

- Quantify your accomplishments using specific metrics and results.

- Emphasize your strong understanding of financial reporting standards.

- Demonstrate your proficiency in accounting software and technology tools.

- Showcase your excellent customer service and communication skills.

Essential Experience Highlights for a Strong Statement Clerk Resume

- Reconciled bank statements with general ledger accounts, ensuring accuracy and completeness.

- Reviewed and processed large volumes of financial transactions, including deposits, withdrawals, and transfers.

- Identified and corrected discrepancies in bank statements and other financial reports.

- Assisted with the preparation and analysis of monthly financial statements.

- Prepared and maintained detailed records of all financial transactions.

- Communicated effectively with customers, vendors, and other stakeholders to resolve account inquiries.

- Adhered to all relevant financial regulations and compliance requirements.

Frequently Asked Questions (FAQ’s) For Statement Clerk

What is the primary responsibility of a Statement Clerk?

The primary responsibility of a Statement Clerk is to reconcile bank statements with general ledger accounts, ensuring accuracy and completeness.

What skills are required to be a Statement Clerk?

The skills required to be a Statement Clerk include bank reconciliation, cash management, customer service, data entry, deposit processing, and financial reporting.

What is the typical education requirement for a Statement Clerk?

The typical education requirement for a Statement Clerk is a Bachelor’s degree in Accounting or Finance.

What is the average salary for a Statement Clerk?

The average salary for a Statement Clerk is around $45,000 per year.

What is the job outlook for Statement Clerks?

The job outlook for Statement Clerks is expected to grow faster than average in the coming years.

What are the career advancement opportunities for Statement Clerks?

The career advancement opportunities for Statement Clerks include positions such as Accounting Clerk, Senior Statement Clerk, and Financial Analyst.