Are you a seasoned Accounting Clerk seeking a new career path? Discover our professionally built Accounting Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

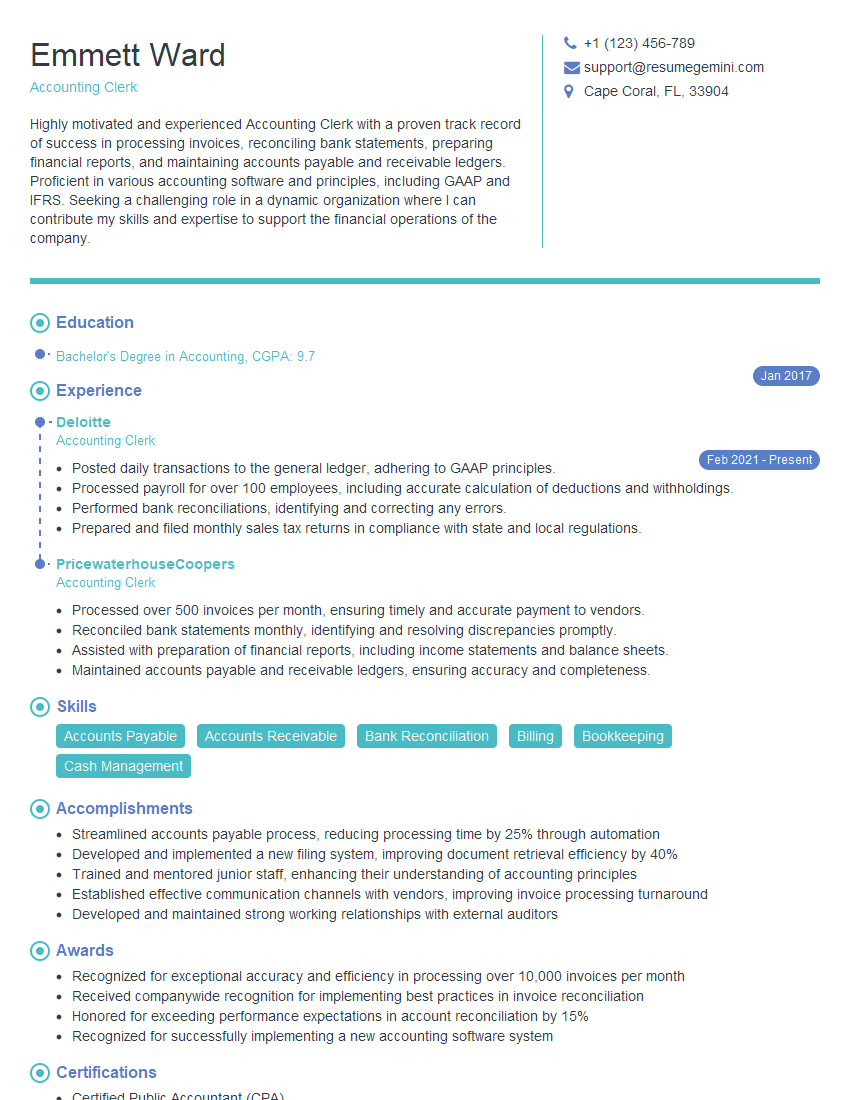

Emmett Ward

Accounting Clerk

Summary

Highly motivated and experienced Accounting Clerk with a proven track record of success in processing invoices, reconciling bank statements, preparing financial reports, and maintaining accounts payable and receivable ledgers. Proficient in various accounting software and principles, including GAAP and IFRS. Seeking a challenging role in a dynamic organization where I can contribute my skills and expertise to support the financial operations of the company.

Education

Bachelor’s Degree in Accounting

January 2017

Skills

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Billing

- Bookkeeping

- Cash Management

Work Experience

Accounting Clerk

- Posted daily transactions to the general ledger, adhering to GAAP principles.

- Processed payroll for over 100 employees, including accurate calculation of deductions and withholdings.

- Performed bank reconciliations, identifying and correcting any errors.

- Prepared and filed monthly sales tax returns in compliance with state and local regulations.

Accounting Clerk

- Processed over 500 invoices per month, ensuring timely and accurate payment to vendors.

- Reconciled bank statements monthly, identifying and resolving discrepancies promptly.

- Assisted with preparation of financial reports, including income statements and balance sheets.

- Maintained accounts payable and receivable ledgers, ensuring accuracy and completeness.

Accomplishments

- Streamlined accounts payable process, reducing processing time by 25% through automation

- Developed and implemented a new filing system, improving document retrieval efficiency by 40%

- Trained and mentored junior staff, enhancing their understanding of accounting principles

- Established effective communication channels with vendors, improving invoice processing turnaround

- Developed and maintained strong working relationships with external auditors

Awards

- Recognized for exceptional accuracy and efficiency in processing over 10,000 invoices per month

- Received companywide recognition for implementing best practices in invoice reconciliation

- Honored for exceeding performance expectations in account reconciliation by 15%

- Recognized for successfully implementing a new accounting software system

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Bookkeeper (CB)

- Certified QuickBooks ProAdvisor

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accounting Clerk

- Highlight your experience and skills relevant to the job description.

- Use keywords from the job description throughout your resume.

- Proofread your resume carefully for any errors.

- Tailor your resume to each job you apply for.

- Quantify your accomplishments with specific numbers and metrics.

Essential Experience Highlights for a Strong Accounting Clerk Resume

- Processed over 500 invoices per month, ensuring timely and accurate payment to vendors.

- Reconciled bank statements monthly, identifying and resolving discrepancies promptly.

- Assisted with preparation of financial reports, including income statements and balance sheets.

- Maintained accounts payable and receivable ledgers, ensuring accuracy and completeness.

- Posted daily transactions to the general ledger, adhering to GAAP principles.

- Processed payroll for over 100 employees, including accurate calculation of deductions and withholdings.

- Performed bank reconciliations, identifying and correcting any errors.

Frequently Asked Questions (FAQ’s) For Accounting Clerk

What are the key responsibilities of an Accounting Clerk?

Key responsibilities of an Accounting Clerk typically include processing invoices, reconciling bank statements, preparing financial reports, maintaining accounts payable and receivable ledgers, posting daily transactions to the general ledger, processing payroll, and performing bank reconciliations.

What are the educational requirements for an Accounting Clerk?

Most employers require at least a high school diploma or equivalent for an Accounting Clerk position. However, some employers may prefer candidates with an Associate’s or Bachelor’s degree in Accounting or a related field.

What are the career prospects for an Accounting Clerk?

Accounting Clerks can advance their careers by gaining experience and certifications. They may be promoted to roles such as Accounting Supervisor, Senior Accountant, or Controller.

What are the key skills required for an Accounting Clerk?

Key skills for an Accounting Clerk include attention to detail, accuracy, and strong organizational and communication skills. They should also be proficient in Microsoft Office Suite and accounting software.

What is the average salary for an Accounting Clerk?

The average salary for an Accounting Clerk varies depending on experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for Accounting Clerks was $45,260 in May 2021.

What are the job opportunities for an Accounting Clerk?

Accounting Clerks are employed in various industries, including financial services, healthcare, manufacturing, and government. They can work in both the private and public sectors.

What are the challenges faced by an Accounting Clerk?

Accounting Clerks may face challenges such as tight deadlines, heavy workloads, and the need to stay up-to-date on accounting regulations and software.