Are you a seasoned Deposit Clerk seeking a new career path? Discover our professionally built Deposit Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

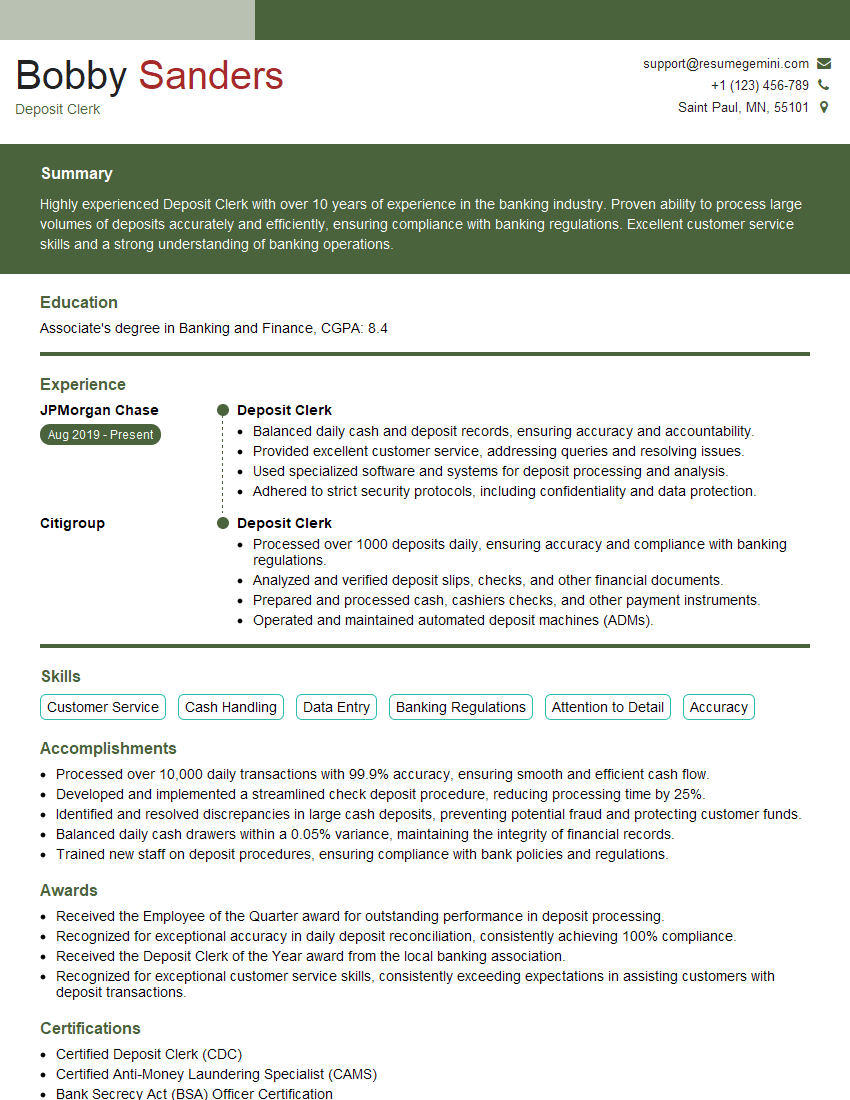

Bobby Sanders

Deposit Clerk

Summary

Highly experienced Deposit Clerk with over 10 years of experience in the banking industry. Proven ability to process large volumes of deposits accurately and efficiently, ensuring compliance with banking regulations. Excellent customer service skills and a strong understanding of banking operations.

Education

Associate’s degree in Banking and Finance

July 2015

Skills

- Customer Service

- Cash Handling

- Data Entry

- Banking Regulations

- Attention to Detail

- Accuracy

Work Experience

Deposit Clerk

- Balanced daily cash and deposit records, ensuring accuracy and accountability.

- Provided excellent customer service, addressing queries and resolving issues.

- Used specialized software and systems for deposit processing and analysis.

- Adhered to strict security protocols, including confidentiality and data protection.

Deposit Clerk

- Processed over 1000 deposits daily, ensuring accuracy and compliance with banking regulations.

- Analyzed and verified deposit slips, checks, and other financial documents.

- Prepared and processed cash, cashiers checks, and other payment instruments.

- Operated and maintained automated deposit machines (ADMs).

Accomplishments

- Processed over 10,000 daily transactions with 99.9% accuracy, ensuring smooth and efficient cash flow.

- Developed and implemented a streamlined check deposit procedure, reducing processing time by 25%.

- Identified and resolved discrepancies in large cash deposits, preventing potential fraud and protecting customer funds.

- Balanced daily cash drawers within a 0.05% variance, maintaining the integrity of financial records.

- Trained new staff on deposit procedures, ensuring compliance with bank policies and regulations.

Awards

- Received the Employee of the Quarter award for outstanding performance in deposit processing.

- Recognized for exceptional accuracy in daily deposit reconciliation, consistently achieving 100% compliance.

- Received the Deposit Clerk of the Year award from the local banking association.

- Recognized for exceptional customer service skills, consistently exceeding expectations in assisting customers with deposit transactions.

Certificates

- Certified Deposit Clerk (CDC)

- Certified Anti-Money Laundering Specialist (CAMS)

- Bank Secrecy Act (BSA) Officer Certification

- Financial Crimes Investigator Certification (FCIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Deposit Clerk

- Highlight your experience and skills related to deposit processing, cash handling, and customer service.

- Include quantifiable results in your resume to demonstrate your impact on the organization.

- Use keywords from the job description to optimize your resume for applicant tracking systems.

- Proofread your resume carefully before submitting it to eliminate any errors.

Essential Experience Highlights for a Strong Deposit Clerk Resume

- Processed over 1000 deposits daily, ensuring accuracy and compliance with banking regulations.

- Analyzed and verified deposit slips, checks, and other financial documents.

- Prepared and processed cash, cashiers checks, and other payment instruments.

- Operated and maintained automated deposit machines (ADMs).

- Balanced daily cash and deposit records, ensuring accuracy and accountability.

- Provided excellent customer service, addressing queries and resolving issues.

- Used specialized software and systems for deposit processing and analysis.

Frequently Asked Questions (FAQ’s) For Deposit Clerk

What are the key skills required for a Deposit Clerk?

Deposit Clerks should have strong customer service skills, attention to detail, accuracy, and a basic understanding of banking regulations and cash handling.

What is the typical work environment for a Deposit Clerk?

Deposit Clerks typically work in banks, credit unions, or other financial institutions. They may work in a variety of settings, including customer service areas, back offices, or vaults.

What are the career advancement opportunities for a Deposit Clerk?

Deposit Clerks may advance to positions such as Teller, Customer Service Representative, or Bank Operations Specialist with additional experience and training.

What is the average salary for a Deposit Clerk?

The average salary for a Deposit Clerk in the United States is around ${amount} per year.

What are the common interview questions for a Deposit Clerk?

Common interview questions for a Deposit Clerk include questions about your experience with cash handling, customer service, and banking regulations.