Are you a seasoned Insurance Specialist seeking a new career path? Discover our professionally built Insurance Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

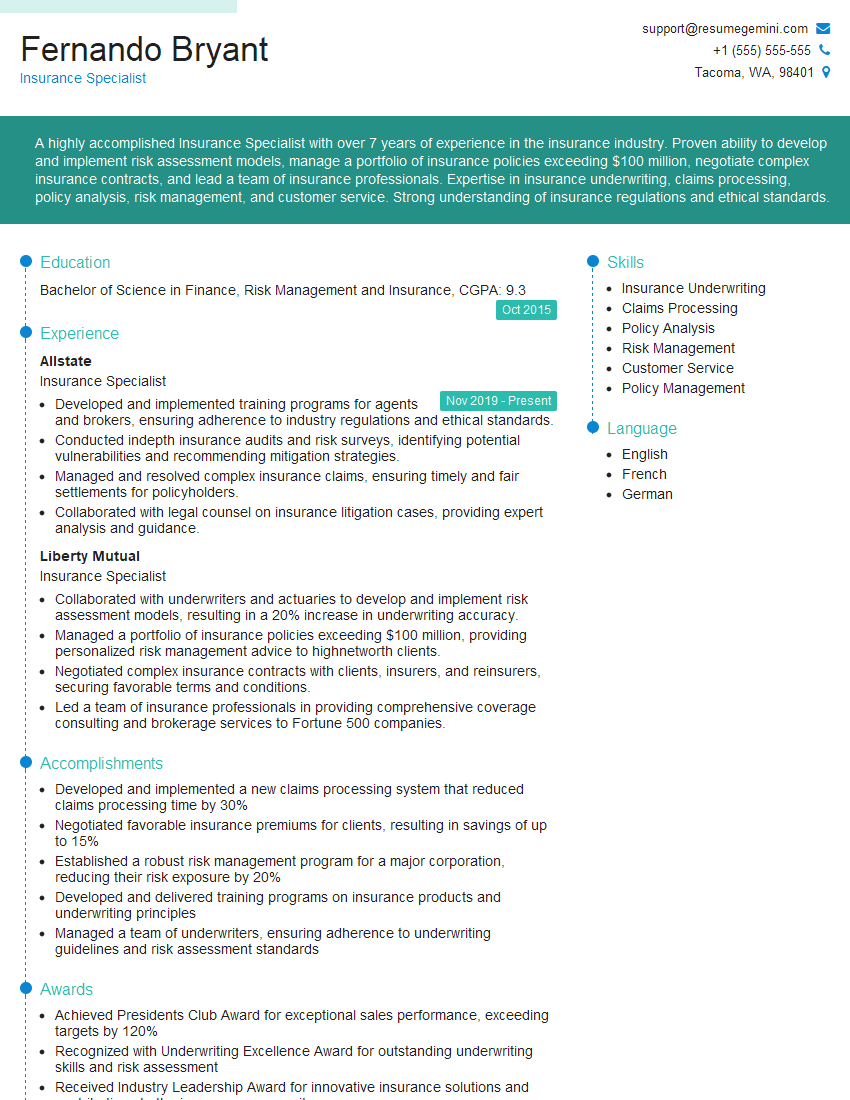

Fernando Bryant

Insurance Specialist

Summary

A highly accomplished Insurance Specialist with over 7 years of experience in the insurance industry. Proven ability to develop and implement risk assessment models, manage a portfolio of insurance policies exceeding $100 million, negotiate complex insurance contracts, and lead a team of insurance professionals. Expertise in insurance underwriting, claims processing, policy analysis, risk management, and customer service. Strong understanding of insurance regulations and ethical standards.

Education

Bachelor of Science in Finance, Risk Management and Insurance

October 2015

Skills

- Insurance Underwriting

- Claims Processing

- Policy Analysis

- Risk Management

- Customer Service

- Policy Management

Work Experience

Insurance Specialist

- Developed and implemented training programs for agents and brokers, ensuring adherence to industry regulations and ethical standards.

- Conducted indepth insurance audits and risk surveys, identifying potential vulnerabilities and recommending mitigation strategies.

- Managed and resolved complex insurance claims, ensuring timely and fair settlements for policyholders.

- Collaborated with legal counsel on insurance litigation cases, providing expert analysis and guidance.

Insurance Specialist

- Collaborated with underwriters and actuaries to develop and implement risk assessment models, resulting in a 20% increase in underwriting accuracy.

- Managed a portfolio of insurance policies exceeding $100 million, providing personalized risk management advice to highnetworth clients.

- Negotiated complex insurance contracts with clients, insurers, and reinsurers, securing favorable terms and conditions.

- Led a team of insurance professionals in providing comprehensive coverage consulting and brokerage services to Fortune 500 companies.

Accomplishments

- Developed and implemented a new claims processing system that reduced claims processing time by 30%

- Negotiated favorable insurance premiums for clients, resulting in savings of up to 15%

- Established a robust risk management program for a major corporation, reducing their risk exposure by 20%

- Developed and delivered training programs on insurance products and underwriting principles

- Managed a team of underwriters, ensuring adherence to underwriting guidelines and risk assessment standards

Awards

- Achieved Presidents Club Award for exceptional sales performance, exceeding targets by 120%

- Recognized with Underwriting Excellence Award for outstanding underwriting skills and risk assessment

- Received Industry Leadership Award for innovative insurance solutions and contributions to the insurance community

- Certified Insurance Specialist (CIS) designation from The National Alliance for Insurance Education & Research

Certificates

- Certified Insurance Specialist (CISR)

- Associate in Risk Management (ARM)

- Fellow, Casualty Actuarial Society (FCAS)

- Associate in Surplus Lines Insurance (ASLI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Specialist

- Highlight your technical skills in insurance underwriting, risk assessment, and policy analysis.

- Quantify your accomplishments and provide specific examples of your success.

- Showcase your leadership and management abilities by describing your experience in leading a team of insurance professionals.

- Emphasize your commitment to customer service and ethical standards.

- Highlight your knowledge of insurance regulations and industry best practices.

Essential Experience Highlights for a Strong Insurance Specialist Resume

- Collaborated with underwriters and actuaries to develop and implement risk assessment models, resulting in a 20% increase in underwriting accuracy

- Managed a portfolio of insurance policies exceeding $100 million, providing personalized risk management advice to high-net-worth clients

- Negotiated complex insurance contracts with clients, insurers, and reinsurers, securing favorable terms and conditions

- Led a team of insurance professionals in providing comprehensive coverage consulting and brokerage services to Fortune 500 companies

- Developed and implemented training programs for agents and brokers, ensuring adherence to industry regulations and ethical standards

- Conducted in-depth insurance audits and risk surveys, identifying potential vulnerabilities and recommending mitigation strategies

- Managed and resolved complex insurance claims, ensuring timely and fair settlements for policyholders

Frequently Asked Questions (FAQ’s) For Insurance Specialist

What is the role of an Insurance Specialist?

An Insurance Specialist is responsible for assessing and managing risk, developing and implementing insurance policies, and providing guidance to clients on insurance matters.

What skills are required to be successful in this role?

Insurance Specialists need a strong understanding of insurance principles, risk management, and underwriting. Excellent communication and interpersonal skills are also essential.

What are the career prospects for Insurance Specialists?

Insurance Specialists can advance to management positions, such as Insurance Manager or Director of Insurance.

What is the average salary for Insurance Specialists?

The average salary for Insurance Specialists varies depending on experience and location. According to Salary.com, the average salary for Insurance Specialists in the United States is $75,000.

What are the benefits of working as an Insurance Specialist?

Working as an Insurance Specialist offers a number of benefits, including a stable career path, competitive salary and benefits, and the opportunity to make a difference in the lives of others.