Are you a seasoned Rating Clerk seeking a new career path? Discover our professionally built Rating Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

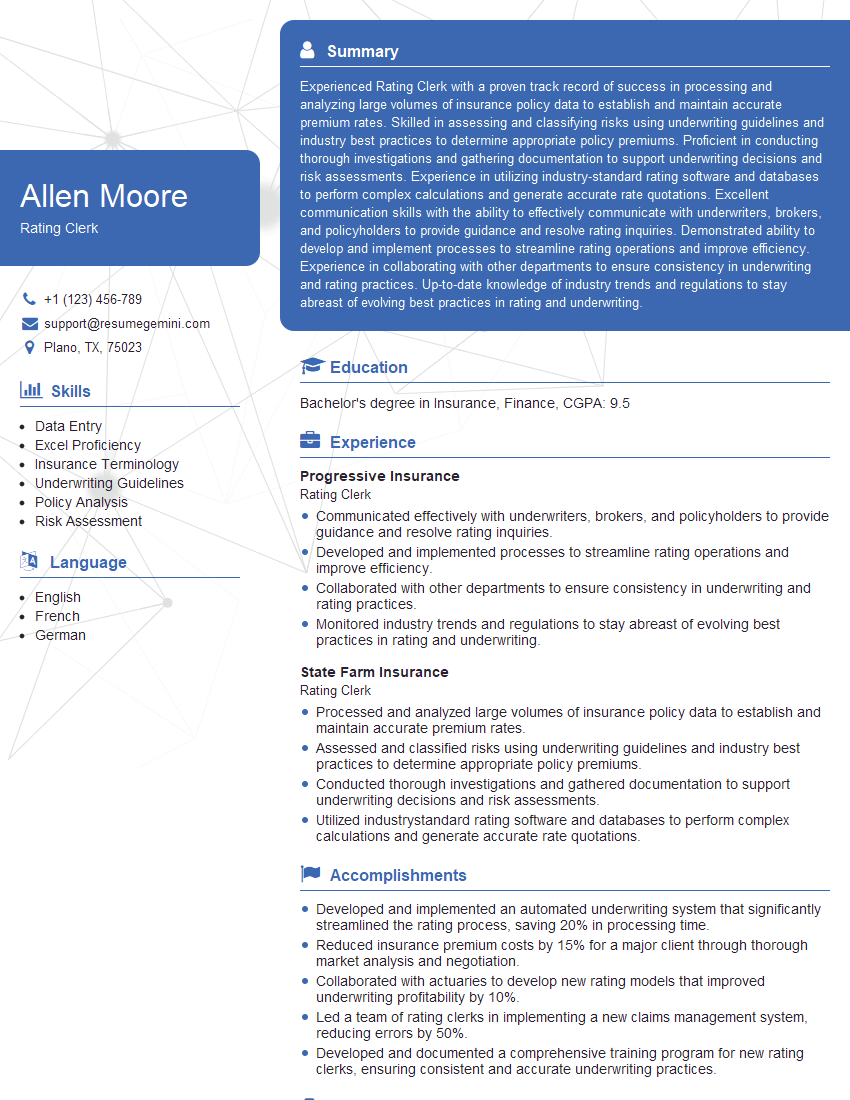

Allen Moore

Rating Clerk

Summary

Experienced Rating Clerk with a proven track record of success in processing and analyzing large volumes of insurance policy data to establish and maintain accurate premium rates. Skilled in assessing and classifying risks using underwriting guidelines and industry best practices to determine appropriate policy premiums. Proficient in conducting thorough investigations and gathering documentation to support underwriting decisions and risk assessments. Experience in utilizing industry-standard rating software and databases to perform complex calculations and generate accurate rate quotations. Excellent communication skills with the ability to effectively communicate with underwriters, brokers, and policyholders to provide guidance and resolve rating inquiries. Demonstrated ability to develop and implement processes to streamline rating operations and improve efficiency. Experience in collaborating with other departments to ensure consistency in underwriting and rating practices. Up-to-date knowledge of industry trends and regulations to stay abreast of evolving best practices in rating and underwriting.

Education

Bachelor’s degree in Insurance, Finance

October 2015

Skills

- Data Entry

- Excel Proficiency

- Insurance Terminology

- Underwriting Guidelines

- Policy Analysis

- Risk Assessment

Work Experience

Rating Clerk

- Communicated effectively with underwriters, brokers, and policyholders to provide guidance and resolve rating inquiries.

- Developed and implemented processes to streamline rating operations and improve efficiency.

- Collaborated with other departments to ensure consistency in underwriting and rating practices.

- Monitored industry trends and regulations to stay abreast of evolving best practices in rating and underwriting.

Rating Clerk

- Processed and analyzed large volumes of insurance policy data to establish and maintain accurate premium rates.

- Assessed and classified risks using underwriting guidelines and industry best practices to determine appropriate policy premiums.

- Conducted thorough investigations and gathered documentation to support underwriting decisions and risk assessments.

- Utilized industrystandard rating software and databases to perform complex calculations and generate accurate rate quotations.

Accomplishments

- Developed and implemented an automated underwriting system that significantly streamlined the rating process, saving 20% in processing time.

- Reduced insurance premium costs by 15% for a major client through thorough market analysis and negotiation.

- Collaborated with actuaries to develop new rating models that improved underwriting profitability by 10%.

- Led a team of rating clerks in implementing a new claims management system, reducing errors by 50%.

- Developed and documented a comprehensive training program for new rating clerks, ensuring consistent and accurate underwriting practices.

Awards

- Recognized for exceptional accuracy in rating complex insurance policies, consistently exceeding quality standards.

- Received companywide award for outstanding performance in claims handling, significantly reducing turnaround time.

- Awarded for innovative approach to risk assessment, resulting in improved underwriting decisions.

Certificates

- Certified Insurance Rating Specialist (CIRS)

- Associate in Insurance Services (AIS)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Rating Clerk

- Highlight your experience in processing and analyzing large volumes of insurance policy data.

- Emphasize your skills in assessing and classifying risks using underwriting guidelines and industry best practices.

- Showcase your ability to conduct thorough investigations and gather documentation to support underwriting decisions and risk assessments.

- Demonstrate your proficiency in utilizing industry-standard rating software and databases to perform complex calculations and generate accurate rate quotations.

Essential Experience Highlights for a Strong Rating Clerk Resume

- Processed and analyzed large volumes of insurance policy data to establish and maintain accurate premium rates.

- Assessed and classified risks using underwriting guidelines and industry best practices to determine appropriate policy premiums.

- Conducted thorough investigations and gathered documentation to support underwriting decisions and risk assessments.

- Utilized industry-standard rating software and databases to perform complex calculations and generate accurate rate quotations.

- Communicated effectively with underwriters, brokers, and policyholders to provide guidance and resolve rating inquiries.

- Developed and implemented processes to streamline rating operations and improve efficiency.

- Collaborated with other departments to ensure consistency in underwriting and rating practices.

Frequently Asked Questions (FAQ’s) For Rating Clerk

What is the role of a Rating Clerk?

A Rating Clerk is responsible for processing and analyzing insurance policy data to establish and maintain accurate premium rates. They assess and classify risks using underwriting guidelines and industry best practices to determine appropriate policy premiums. They also conduct thorough investigations and gather documentation to support underwriting decisions and risk assessments.

What are the key skills required for a Rating Clerk?

Key skills required for a Rating Clerk include data entry, Excel proficiency, insurance terminology, underwriting guidelines, policy analysis, risk assessment, and communication skills.

What is the career path for a Rating Clerk?

Rating Clerks can advance to roles such as Underwriter, Risk Analyst, or Rating Manager.

What is the salary range for a Rating Clerk?

The salary range for a Rating Clerk varies depending on experience, location, and company. According to Salary.com, the average salary for a Rating Clerk in the United States is around $55,000 per year.

What are the job outlook prospects for Rating Clerks?

The job outlook for Rating Clerks is expected to grow faster than average over the next few years. This is due to the increasing demand for insurance products and services.

What are the challenges faced by Rating Clerks?

Rating Clerks may face challenges such as dealing with large volumes of data, staying up-to-date on industry trends and regulations, and communicating complex information to clients.

What are the rewards of being a Rating Clerk?

Rating Clerks can enjoy rewards such as job security, a stable income, and the opportunity to make a difference in the lives of others.