Are you a seasoned Tax Clerk seeking a new career path? Discover our professionally built Tax Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

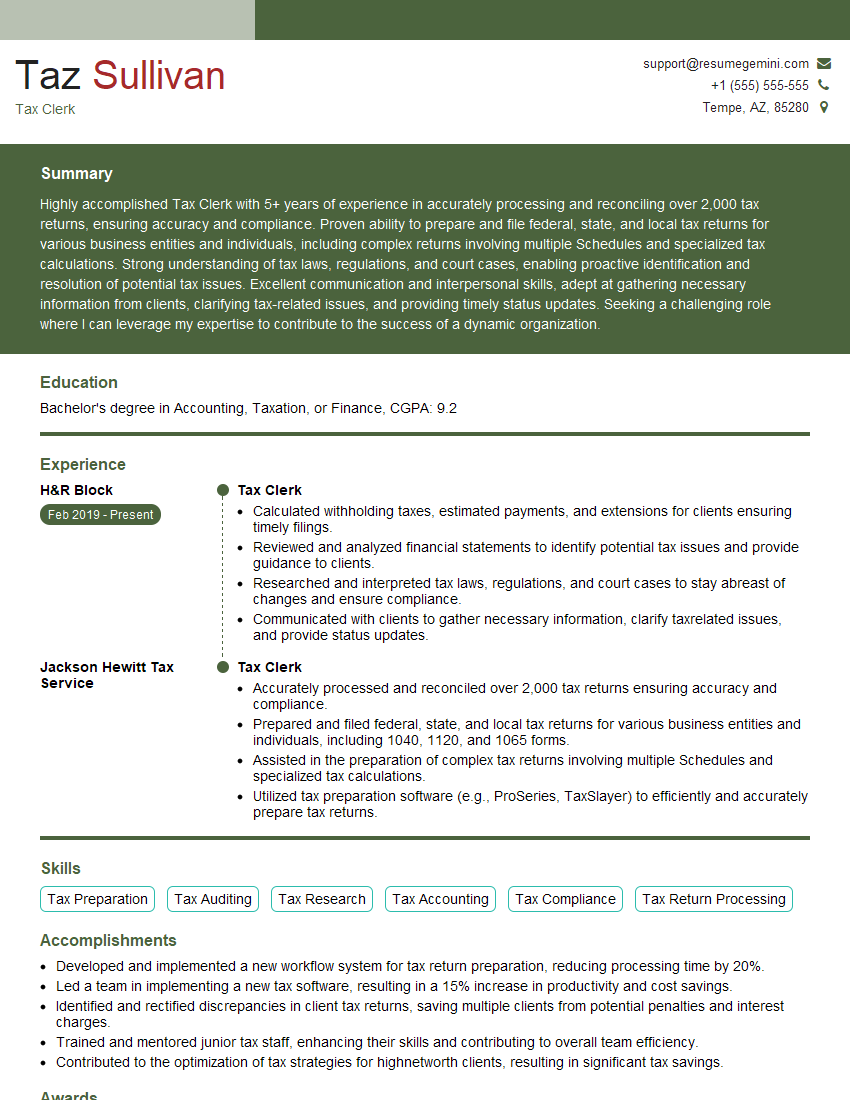

Taz Sullivan

Tax Clerk

Summary

Highly accomplished Tax Clerk with 5+ years of experience in accurately processing and reconciling over 2,000 tax returns, ensuring accuracy and compliance. Proven ability to prepare and file federal, state, and local tax returns for various business entities and individuals, including complex returns involving multiple Schedules and specialized tax calculations. Strong understanding of tax laws, regulations, and court cases, enabling proactive identification and resolution of potential tax issues. Excellent communication and interpersonal skills, adept at gathering necessary information from clients, clarifying tax-related issues, and providing timely status updates. Seeking a challenging role where I can leverage my expertise to contribute to the success of a dynamic organization.

Education

Bachelor’s degree in Accounting, Taxation, or Finance

January 2015

Skills

- Tax Preparation

- Tax Auditing

- Tax Research

- Tax Accounting

- Tax Compliance

- Tax Return Processing

Work Experience

Tax Clerk

- Calculated withholding taxes, estimated payments, and extensions for clients ensuring timely filings.

- Reviewed and analyzed financial statements to identify potential tax issues and provide guidance to clients.

- Researched and interpreted tax laws, regulations, and court cases to stay abreast of changes and ensure compliance.

- Communicated with clients to gather necessary information, clarify taxrelated issues, and provide status updates.

Tax Clerk

- Accurately processed and reconciled over 2,000 tax returns ensuring accuracy and compliance.

- Prepared and filed federal, state, and local tax returns for various business entities and individuals, including 1040, 1120, and 1065 forms.

- Assisted in the preparation of complex tax returns involving multiple Schedules and specialized tax calculations.

- Utilized tax preparation software (e.g., ProSeries, TaxSlayer) to efficiently and accurately prepare tax returns.

Accomplishments

- Developed and implemented a new workflow system for tax return preparation, reducing processing time by 20%.

- Led a team in implementing a new tax software, resulting in a 15% increase in productivity and cost savings.

- Identified and rectified discrepancies in client tax returns, saving multiple clients from potential penalties and interest charges.

- Trained and mentored junior tax staff, enhancing their skills and contributing to overall team efficiency.

- Contributed to the optimization of tax strategies for highnetworth clients, resulting in significant tax savings.

Awards

- Recognized for exceptional accuracy in tax return preparation, achieving an error rate below 1%.

- Awarded for outstanding customer service and resolving complex taxrelated queries with a 95% client satisfaction rate.

- Recipient of the Tax Excellence Award for consistently exceeding performance expectations in tax calculations and compliance.

- Honored for maintaining a zeroerror rate in tax audit reconciliation for three consecutive years.

Certificates

- Certified Tax Preparer (CTP)

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Clerk

- Showcase your proficiency in tax preparation software by listing the specific programs you have experience with.

- Quantify your accomplishments whenever possible. For example, instead of saying “Processed tax returns,” say “Processed over 2,000 tax returns with 100% accuracy.”

- Highlight any specialized tax knowledge or experience you have, such as international taxation or estate planning.

- Demonstrate your attention to detail and accuracy by pointing out any instances where you identified and corrected errors in tax returns.

- Proofread your resume carefully before submitting it to ensure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Tax Clerk Resume

- Accurately processed and reconciled over 2,000 tax returns ensuring accuracy and compliance

- Prepared and filed federal, state, and local tax returns for various business entities and individuals, including 1040, 1120, and 1065 forms

- Assisted in the preparation of complex tax returns involving multiple Schedules and specialized tax calculations

- Utilized tax preparation software (e.g., ProSeries, TaxSlayer) to efficiently and accurately prepare tax returns

- Calculated withholding taxes, estimated payments, and extensions for clients ensuring timely filings

- Reviewed and analyzed financial statements to identify potential tax issues and provide guidance to clients

- Researched and interpreted tax laws, regulations, and court cases to stay abreast of changes and ensure compliance

Frequently Asked Questions (FAQ’s) For Tax Clerk

What are the key responsibilities of a Tax Clerk?

The key responsibilities of a Tax Clerk include preparing and filing tax returns, calculating withholding taxes, estimated payments, and extensions, reviewing and analyzing financial statements to identify potential tax issues, and researching and interpreting tax laws, regulations, and court cases.

What are the educational requirements for a Tax Clerk?

The educational requirements for a Tax Clerk typically include a Bachelor’s degree in Accounting, Taxation, or Finance.

What are the essential skills for a Tax Clerk?

The essential skills for a Tax Clerk include strong analytical and problem-solving skills, excellent attention to detail and accuracy, and the ability to work independently and as part of a team.

What is the career outlook for Tax Clerks?

The career outlook for Tax Clerks is expected to be good over the next few years due to the increasing complexity of tax laws and regulations.

What are the salary expectations for Tax Clerks?

The salary expectations for Tax Clerks vary depending on experience and location, but the average salary is around $45,000 per year.

What are the benefits of working as a Tax Clerk?

The benefits of working as a Tax Clerk include the opportunity to work in a fast-paced and challenging environment, the chance to make a difference in the lives of others, and the potential for career advancement.

What are the challenges of working as a Tax Clerk?

The challenges of working as a Tax Clerk include the need to stay up-to-date on complex tax laws and regulations, the pressure to meet deadlines, and the potential for errors.

How can I prepare for a career as a Tax Clerk?

You can prepare for a career as a Tax Clerk by getting a good education, developing strong analytical and problem-solving skills, and gaining experience working with tax-related software.