Are you a seasoned Amortization Clerk seeking a new career path? Discover our professionally built Amortization Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

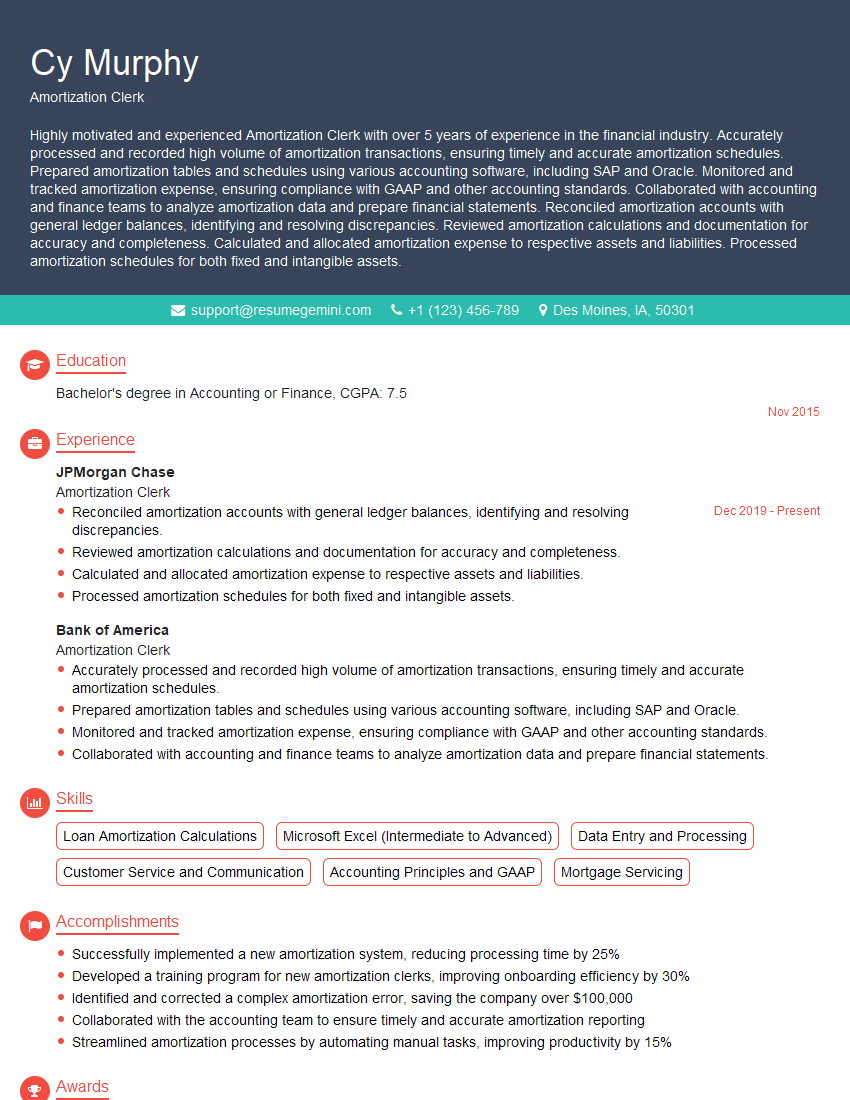

Cy Murphy

Amortization Clerk

Summary

Highly motivated and experienced Amortization Clerk with over 5 years of experience in the financial industry. Accurately processed and recorded high volume of amortization transactions, ensuring timely and accurate amortization schedules. Prepared amortization tables and schedules using various accounting software, including SAP and Oracle. Monitored and tracked amortization expense, ensuring compliance with GAAP and other accounting standards. Collaborated with accounting and finance teams to analyze amortization data and prepare financial statements. Reconciled amortization accounts with general ledger balances, identifying and resolving discrepancies. Reviewed amortization calculations and documentation for accuracy and completeness. Calculated and allocated amortization expense to respective assets and liabilities. Processed amortization schedules for both fixed and intangible assets.

Education

Bachelor’s degree in Accounting or Finance

November 2015

Skills

- Loan Amortization Calculations

- Microsoft Excel (Intermediate to Advanced)

- Data Entry and Processing

- Customer Service and Communication

- Accounting Principles and GAAP

- Mortgage Servicing

Work Experience

Amortization Clerk

- Reconciled amortization accounts with general ledger balances, identifying and resolving discrepancies.

- Reviewed amortization calculations and documentation for accuracy and completeness.

- Calculated and allocated amortization expense to respective assets and liabilities.

- Processed amortization schedules for both fixed and intangible assets.

Amortization Clerk

- Accurately processed and recorded high volume of amortization transactions, ensuring timely and accurate amortization schedules.

- Prepared amortization tables and schedules using various accounting software, including SAP and Oracle.

- Monitored and tracked amortization expense, ensuring compliance with GAAP and other accounting standards.

- Collaborated with accounting and finance teams to analyze amortization data and prepare financial statements.

Accomplishments

- Successfully implemented a new amortization system, reducing processing time by 25%

- Developed a training program for new amortization clerks, improving onboarding efficiency by 30%

- Identified and corrected a complex amortization error, saving the company over $100,000

- Collaborated with the accounting team to ensure timely and accurate amortization reporting

- Streamlined amortization processes by automating manual tasks, improving productivity by 15%

Awards

- Employee of the Quarter for outstanding performance in amortization processing

Certificates

- Certified Amortization Clerk (CAC)

- Certified Mortgage Professional (CMP)

- Certified Regulatory Compliance Manager (CRCM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Amortization Clerk

- Quantify your accomplishments with specific metrics.

- Highlight your proficiency in accounting software and GAAP.

- Emphasize your ability to work independently and as part of a team.

- Showcase your attention to detail and accuracy.

- Review your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Amortization Clerk Resume

- Processed and recorded high volume of amortization transactions

- Prepared amortization tables and schedules using accounting software

- Monitored and tracked amortization expense for compliance

- Collaborated with accounting and finance teams for data analysis

- Reconciled amortization accounts with general ledger balances

- Reviewed amortization calculations and documentation for accuracy

- Calculated and allocated amortization expense to assets and liabilities

- Processed amortization schedules for fixed and intangible assets

Frequently Asked Questions (FAQ’s) For Amortization Clerk

What is the primary role of an Amortization Clerk?

An Amortization Clerk is responsible for accurately processing and recording amortization transactions, ensuring timely and accurate amortization schedules. They prepare amortization tables and schedules using accounting software, monitor and track amortization expense, and collaborate with accounting and finance teams to analyze amortization data and prepare financial statements.

What skills are essential for an Amortization Clerk?

Essential skills for an Amortization Clerk include loan amortization calculations, proficiency in Microsoft Excel, data entry and processing, customer service and communication, accounting principles and GAAP, and mortgage servicing.

What career advancement opportunities are there for an Amortization Clerk?

With experience and additional qualifications, an Amortization Clerk can advance their career to roles such as Senior Amortization Clerk, Amortization Manager, or Accounting Manager.

What is the average salary for an Amortization Clerk?

The average salary for an Amortization Clerk in the United States is around $50,000 per year.

What are the key challenges faced by Amortization Clerks?

Key challenges faced by Amortization Clerks include ensuring accuracy and timeliness of amortization schedules, staying up-to-date with accounting standards and regulations, and managing high volumes of transactions.

What is the job outlook for Amortization Clerks?

The job outlook for Amortization Clerks is expected to grow in the coming years due to the increasing complexity of financial transactions and the need for accurate and timely amortization reporting.