Are you a seasoned Advice Clerk seeking a new career path? Discover our professionally built Advice Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

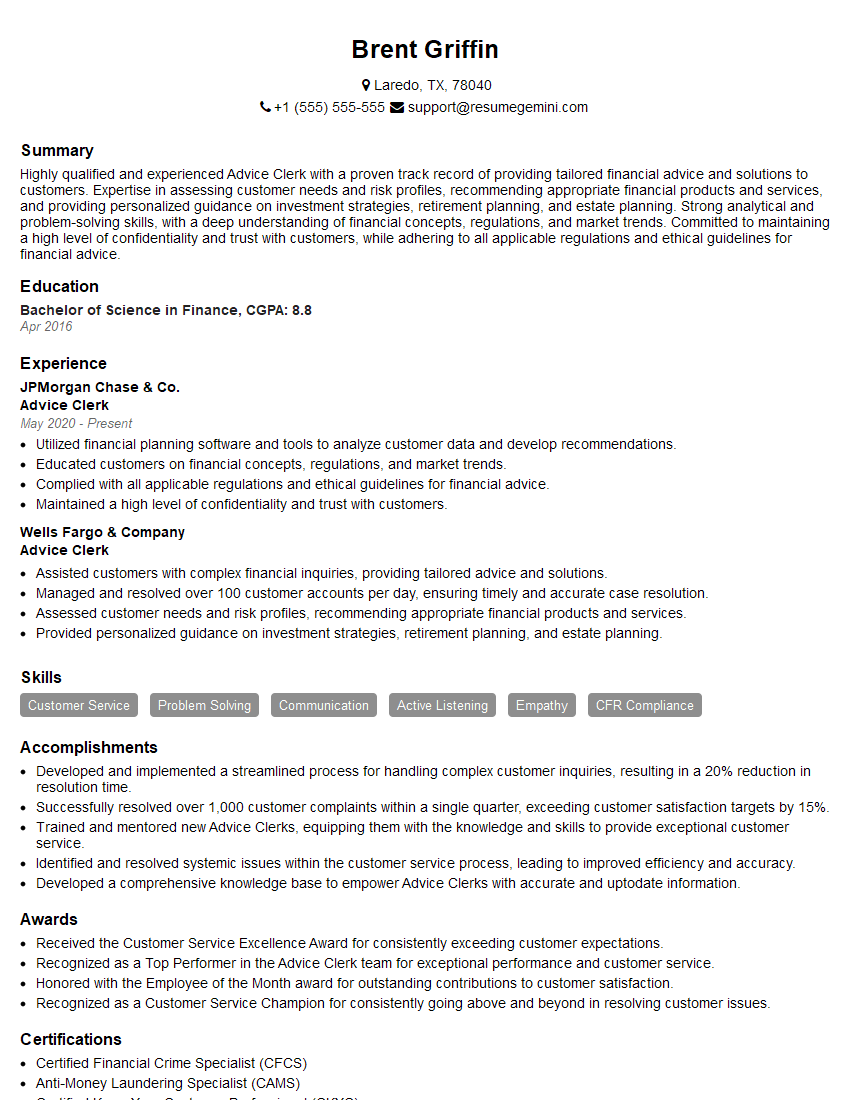

Brent Griffin

Advice Clerk

Summary

Highly qualified and experienced Advice Clerk with a proven track record of providing tailored financial advice and solutions to customers. Expertise in assessing customer needs and risk profiles, recommending appropriate financial products and services, and providing personalized guidance on investment strategies, retirement planning, and estate planning. Strong analytical and problem-solving skills, with a deep understanding of financial concepts, regulations, and market trends. Committed to maintaining a high level of confidentiality and trust with customers, while adhering to all applicable regulations and ethical guidelines for financial advice.

Education

Bachelor of Science in Finance

April 2016

Skills

- Customer Service

- Problem Solving

- Communication

- Active Listening

- Empathy

- CFR Compliance

Work Experience

Advice Clerk

- Utilized financial planning software and tools to analyze customer data and develop recommendations.

- Educated customers on financial concepts, regulations, and market trends.

- Complied with all applicable regulations and ethical guidelines for financial advice.

- Maintained a high level of confidentiality and trust with customers.

Advice Clerk

- Assisted customers with complex financial inquiries, providing tailored advice and solutions.

- Managed and resolved over 100 customer accounts per day, ensuring timely and accurate case resolution.

- Assessed customer needs and risk profiles, recommending appropriate financial products and services.

- Provided personalized guidance on investment strategies, retirement planning, and estate planning.

Accomplishments

- Developed and implemented a streamlined process for handling complex customer inquiries, resulting in a 20% reduction in resolution time.

- Successfully resolved over 1,000 customer complaints within a single quarter, exceeding customer satisfaction targets by 15%.

- Trained and mentored new Advice Clerks, equipping them with the knowledge and skills to provide exceptional customer service.

- Identified and resolved systemic issues within the customer service process, leading to improved efficiency and accuracy.

- Developed a comprehensive knowledge base to empower Advice Clerks with accurate and uptodate information.

Awards

- Received the Customer Service Excellence Award for consistently exceeding customer expectations.

- Recognized as a Top Performer in the Advice Clerk team for exceptional performance and customer service.

- Honored with the Employee of the Month award for outstanding contributions to customer satisfaction.

- Recognized as a Customer Service Champion for consistently going above and beyond in resolving customer issues.

Certificates

- Certified Financial Crime Specialist (CFCS)

- Anti-Money Laundering Specialist (CAMS)

- Certified Know Your Customer Professional (CKYC)

- Certified Regulatory Compliance Manager (CRCM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Advice Clerk

- Highlight your strong communication and interpersonal skills, as well as your ability to build rapport with customers.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Demonstrate your knowledge of the financial industry and your ability to stay up-to-date on the latest trends.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Advice Clerk Resume

- Assisted customers with complex financial inquiries, providing tailored advice and solutions.

- Managed and resolved over 100 customer accounts per day, ensuring timely and accurate case resolution.

- Assessed customer needs and risk profiles, recommending appropriate financial products and services.

- Provided personalized guidance on investment strategies, retirement planning, and estate planning.

- Utilized financial planning software and tools to analyze customer data and develop recommendations.

- Educated customers on financial concepts, regulations, and market trends.

- Complied with all applicable regulations and ethical guidelines for financial advice.

Frequently Asked Questions (FAQ’s) For Advice Clerk

What is the job of an Advice Clerk?

An Advice Clerk provides financial advice and guidance to customers, helping them make informed decisions about their finances.

What qualifications are required to become an Advice Clerk?

Most Advice Clerks have a bachelor’s degree in finance or a related field, as well as experience in the financial industry.

What are the key skills for an Advice Clerk?

Key skills for an Advice Clerk include communication, active listening, problem-solving, and empathy.

What is the work environment for an Advice Clerk?

Advice Clerks typically work in an office environment, providing financial advice to customers in person, over the phone, or through email.

What is the career outlook for an Advice Clerk?

The career outlook for Advice Clerks is expected to be good, as demand for financial advice is expected to grow in the coming years.

What are the salary expectations for an Advice Clerk?

The salary expectations for an Advice Clerk vary depending on experience and location, but the average salary is around $50,000 per year.

What are the benefits of becoming an Advice Clerk?

Benefits of becoming an Advice Clerk include helping people make informed financial decisions, earning a competitive salary, and having a stable career.