Are you a seasoned Check Processing Clerk seeking a new career path? Discover our professionally built Check Processing Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

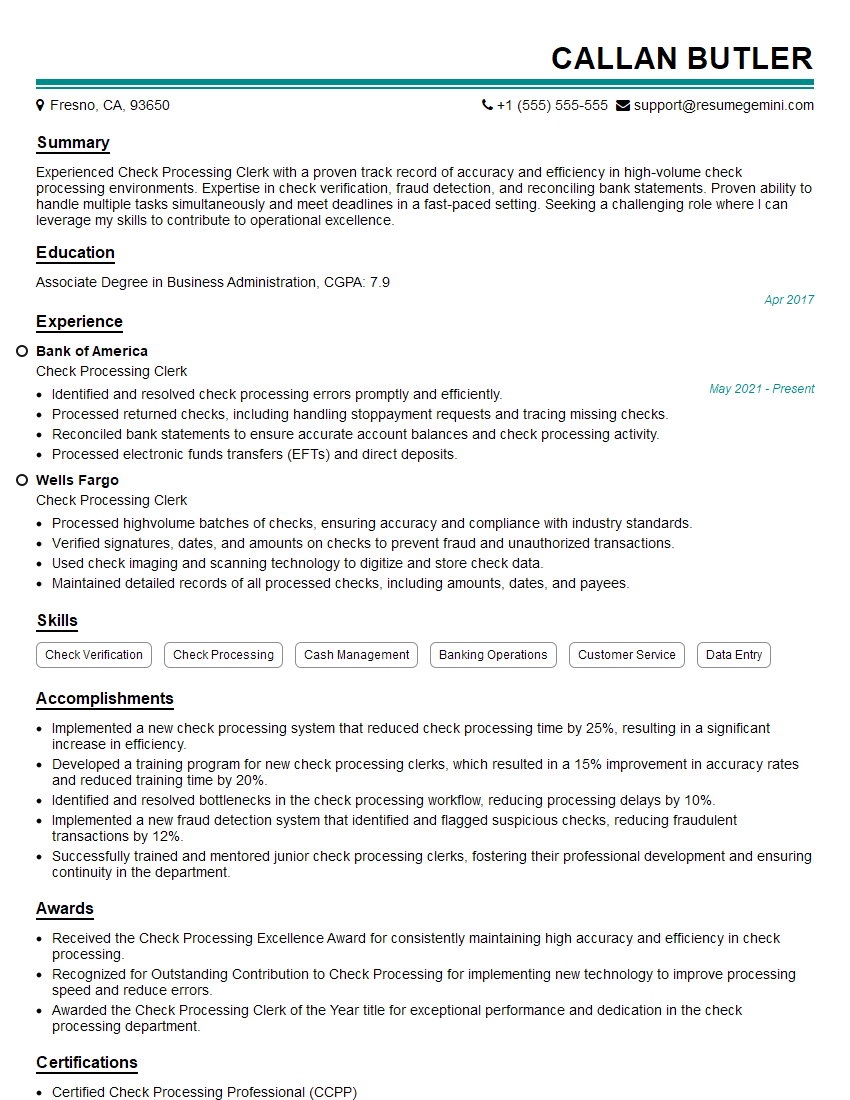

Callan Butler

Check Processing Clerk

Summary

Experienced Check Processing Clerk with a proven track record of accuracy and efficiency in high-volume check processing environments. Expertise in check verification, fraud detection, and reconciling bank statements. Proven ability to handle multiple tasks simultaneously and meet deadlines in a fast-paced setting. Seeking a challenging role where I can leverage my skills to contribute to operational excellence.

Education

Associate Degree in Business Administration

April 2017

Skills

- Check Verification

- Check Processing

- Cash Management

- Banking Operations

- Customer Service

- Data Entry

Work Experience

Check Processing Clerk

- Identified and resolved check processing errors promptly and efficiently.

- Processed returned checks, including handling stoppayment requests and tracing missing checks.

- Reconciled bank statements to ensure accurate account balances and check processing activity.

- Processed electronic funds transfers (EFTs) and direct deposits.

Check Processing Clerk

- Processed highvolume batches of checks, ensuring accuracy and compliance with industry standards.

- Verified signatures, dates, and amounts on checks to prevent fraud and unauthorized transactions.

- Used check imaging and scanning technology to digitize and store check data.

- Maintained detailed records of all processed checks, including amounts, dates, and payees.

Accomplishments

- Implemented a new check processing system that reduced check processing time by 25%, resulting in a significant increase in efficiency.

- Developed a training program for new check processing clerks, which resulted in a 15% improvement in accuracy rates and reduced training time by 20%.

- Identified and resolved bottlenecks in the check processing workflow, reducing processing delays by 10%.

- Implemented a new fraud detection system that identified and flagged suspicious checks, reducing fraudulent transactions by 12%.

- Successfully trained and mentored junior check processing clerks, fostering their professional development and ensuring continuity in the department.

Awards

- Received the Check Processing Excellence Award for consistently maintaining high accuracy and efficiency in check processing.

- Recognized for Outstanding Contribution to Check Processing for implementing new technology to improve processing speed and reduce errors.

- Awarded the Check Processing Clerk of the Year title for exceptional performance and dedication in the check processing department.

Certificates

- Certified Check Processing Professional (CCPP)

- Certified Financial Crimes Analyst (CFCA)

- Certified Anti-Money Laundering Specialist (CAMS)

- Six Sigma

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Check Processing Clerk

- Highlight your experience in check processing and knowledge of industry standards.

- Showcase your accuracy and attention to detail in handling high-volume transactions.

- Emphasize your proficiency in using check imaging and scanning technology.

- Quantify your accomplishments whenever possible, using specific metrics.

- Proofread your resume carefully before submitting it to ensure there are no errors.

Essential Experience Highlights for a Strong Check Processing Clerk Resume

- Processed high-volume batches of checks, ensuring accuracy and compliance with industry standards.

- Verified signatures, dates, and amounts on checks to prevent fraud and unauthorized transactions.

- Used check imaging and scanning technology to digitize and store check data.

- Processed returned checks, including handling stop-payment requests and tracing missing checks.

- Reconciled bank statements to ensure accurate account balances and check processing activity.

- Processed electronic funds transfers (EFTs) and direct deposits.

- Maintained detailed records of all processed checks, including amounts, dates, and payees.

Frequently Asked Questions (FAQ’s) For Check Processing Clerk

What is the primary role of a Check Processing Clerk?

The primary role of a Check Processing Clerk is to ensure the accurate and efficient processing of high-volume batches of checks, while adhering to industry standards and preventing fraud.

What are the key skills required for a Check Processing Clerk?

Key skills for a Check Processing Clerk include check verification, check processing, cash management, banking operations, customer service, and data entry.

What are the different types of checks that a Check Processing Clerk may encounter?

Check Processing Clerks may encounter various types of checks, including personal checks, business checks, cashier’s checks, money orders, and electronic checks.

What are the common challenges faced by Check Processing Clerks?

Common challenges faced by Check Processing Clerks include processing high volumes of checks accurately and efficiently, detecting fraudulent checks, and resolving discrepancies.

What is the career path for a Check Processing Clerk?

Check Processing Clerks may advance to roles such as Check Processing Supervisor, Bank Teller, or Customer Service Representative.

What are the benefits of becoming a Check Processing Clerk?

Benefits of becoming a Check Processing Clerk include job security, opportunities for career advancement, and the chance to make a valuable contribution to the financial industry.