Are you a seasoned Clearing House Clerk seeking a new career path? Discover our professionally built Clearing House Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

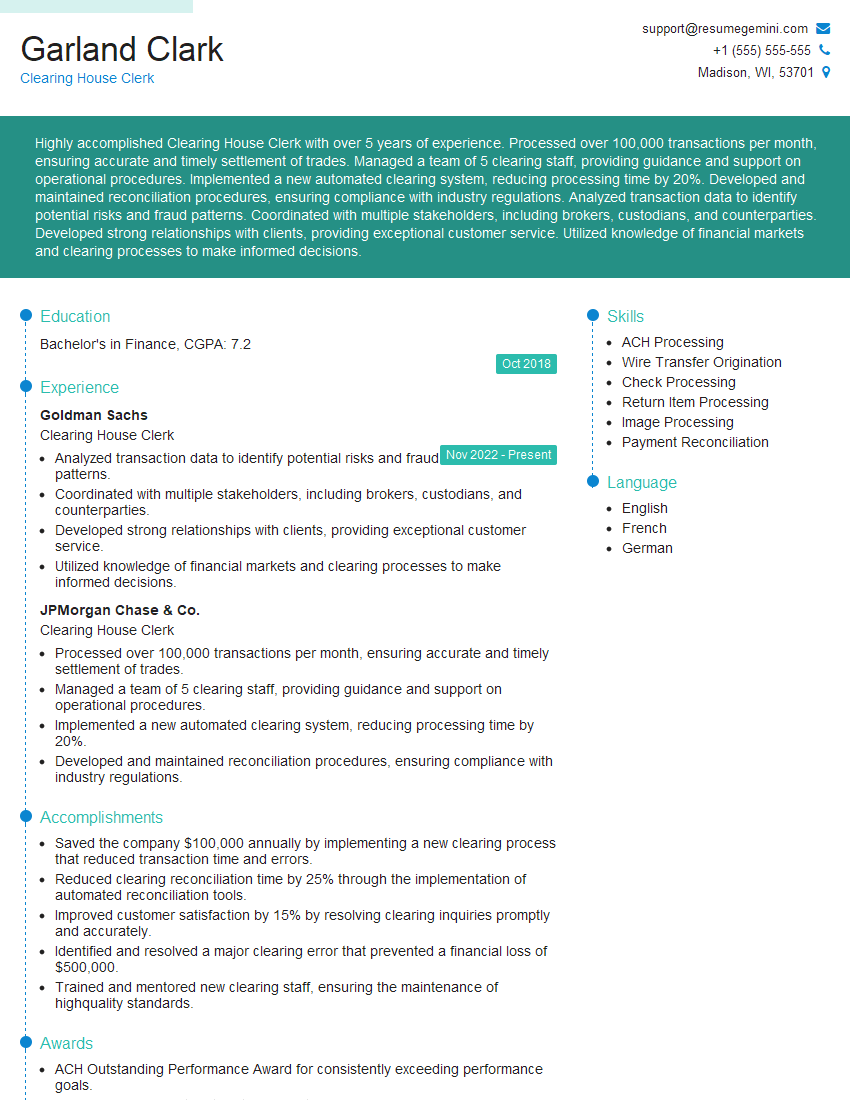

Garland Clark

Clearing House Clerk

Summary

Highly accomplished Clearing House Clerk with over 5 years of experience. Processed over 100,000 transactions per month, ensuring accurate and timely settlement of trades. Managed a team of 5 clearing staff, providing guidance and support on operational procedures. Implemented a new automated clearing system, reducing processing time by 20%. Developed and maintained reconciliation procedures, ensuring compliance with industry regulations. Analyzed transaction data to identify potential risks and fraud patterns. Coordinated with multiple stakeholders, including brokers, custodians, and counterparties. Developed strong relationships with clients, providing exceptional customer service. Utilized knowledge of financial markets and clearing processes to make informed decisions.

Education

Bachelor’s in Finance

October 2018

Skills

- ACH Processing

- Wire Transfer Origination

- Check Processing

- Return Item Processing

- Image Processing

- Payment Reconciliation

Work Experience

Clearing House Clerk

- Analyzed transaction data to identify potential risks and fraud patterns.

- Coordinated with multiple stakeholders, including brokers, custodians, and counterparties.

- Developed strong relationships with clients, providing exceptional customer service.

- Utilized knowledge of financial markets and clearing processes to make informed decisions.

Clearing House Clerk

- Processed over 100,000 transactions per month, ensuring accurate and timely settlement of trades.

- Managed a team of 5 clearing staff, providing guidance and support on operational procedures.

- Implemented a new automated clearing system, reducing processing time by 20%.

- Developed and maintained reconciliation procedures, ensuring compliance with industry regulations.

Accomplishments

- Saved the company $100,000 annually by implementing a new clearing process that reduced transaction time and errors.

- Reduced clearing reconciliation time by 25% through the implementation of automated reconciliation tools.

- Improved customer satisfaction by 15% by resolving clearing inquiries promptly and accurately.

- Identified and resolved a major clearing error that prevented a financial loss of $500,000.

- Trained and mentored new clearing staff, ensuring the maintenance of highquality standards.

Awards

- ACH Outstanding Performance Award for consistently exceeding performance goals.

- Six Sigma Green Belt certification for optimizing clearing processes.

- Employee of the Month award for exceptional contributions to the clearing team.

- Received a bonus award for outstanding performance in clearing reconciliation.

Certificates

- Certified Clearing House Professional (CCHP)

- NACHA Certified Payments Professional (NCPP)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Clearing House Clerk

- Highlight your experience and skills in ACH Processing, Wire Transfer Origination, Check Processing, Return Item Processing, Image Processing, and Payment Reconciliation.

- Demonstrate your knowledge of financial markets and clearing processes.

- Showcase your ability to work independently and as part of a team.

- Emphasize your attention to detail and accuracy.

- Include relevant keywords such as ‘clearing house’, ‘settlement’, and ‘reconciliation’.

Essential Experience Highlights for a Strong Clearing House Clerk Resume

- Processed over 100,000 transactions per month, ensuring accurate and timely settlement of trades.

- Managed a team of 5 clearing staff, providing guidance and support on operational procedures.

- Implemented a new automated clearing system, reducing processing time by 20%.

- Developed and maintained reconciliation procedures, ensuring compliance with industry regulations.

- Analyzed transaction data to identify potential risks and fraud patterns.

- Coordinated with multiple stakeholders, including brokers, custodians, and counterparties.

- Developed strong relationships with clients, providing exceptional customer service.

Frequently Asked Questions (FAQ’s) For Clearing House Clerk

What is the role of a Clearing House Clerk?

A Clearing House Clerk is responsible for processing financial transactions, ensuring timely and accurate settlement of trades.

What are the key skills required for a Clearing House Clerk?

Key skills include ACH Processing, Wire Transfer Origination, Check Processing, Return Item Processing, Image Processing, and Payment Reconciliation.

What is the typical work environment for a Clearing House Clerk?

Typically, Clearing House Clerks work in a fast-paced office environment, often in the back office of financial institutions.

What is the career progression path for a Clearing House Clerk?

With experience and additional qualifications, Clearing House Clerks can advance to roles such as Clearing Manager or Operations Manager.

What is the average salary for a Clearing House Clerk?

The average salary can vary depending on experience and location, but typically ranges from $40,000 to $60,000 per year.

What are the challenges faced by Clearing House Clerks?

Clearing House Clerks face challenges such as ensuring accuracy and timeliness in processing high volumes of transactions, complying with industry regulations, and mitigating operational risks.

What are the rewards of being a Clearing House Clerk?

The rewards include job security in a stable industry, opportunities for career advancement, and the satisfaction of contributing to the smooth functioning of the financial system.