Are you a seasoned Mortgage Loan Computation Clerk seeking a new career path? Discover our professionally built Mortgage Loan Computation Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

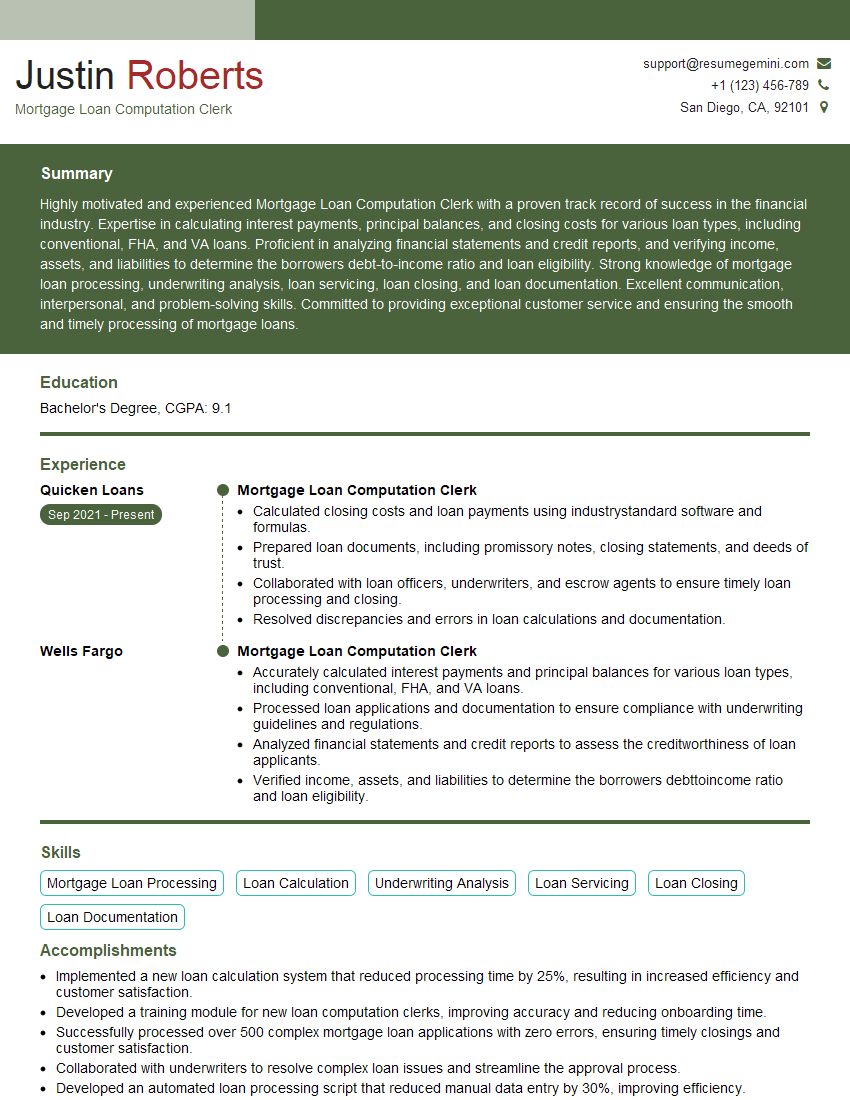

Justin Roberts

Mortgage Loan Computation Clerk

Summary

Highly motivated and experienced Mortgage Loan Computation Clerk with a proven track record of success in the financial industry. Expertise in calculating interest payments, principal balances, and closing costs for various loan types, including conventional, FHA, and VA loans. Proficient in analyzing financial statements and credit reports, and verifying income, assets, and liabilities to determine the borrowers debt-to-income ratio and loan eligibility. Strong knowledge of mortgage loan processing, underwriting analysis, loan servicing, loan closing, and loan documentation. Excellent communication, interpersonal, and problem-solving skills. Committed to providing exceptional customer service and ensuring the smooth and timely processing of mortgage loans.

Education

Bachelor’s Degree

August 2017

Skills

- Mortgage Loan Processing

- Loan Calculation

- Underwriting Analysis

- Loan Servicing

- Loan Closing

- Loan Documentation

Work Experience

Mortgage Loan Computation Clerk

- Calculated closing costs and loan payments using industrystandard software and formulas.

- Prepared loan documents, including promissory notes, closing statements, and deeds of trust.

- Collaborated with loan officers, underwriters, and escrow agents to ensure timely loan processing and closing.

- Resolved discrepancies and errors in loan calculations and documentation.

Mortgage Loan Computation Clerk

- Accurately calculated interest payments and principal balances for various loan types, including conventional, FHA, and VA loans.

- Processed loan applications and documentation to ensure compliance with underwriting guidelines and regulations.

- Analyzed financial statements and credit reports to assess the creditworthiness of loan applicants.

- Verified income, assets, and liabilities to determine the borrowers debttoincome ratio and loan eligibility.

Accomplishments

- Implemented a new loan calculation system that reduced processing time by 25%, resulting in increased efficiency and customer satisfaction.

- Developed a training module for new loan computation clerks, improving accuracy and reducing onboarding time.

- Successfully processed over 500 complex mortgage loan applications with zero errors, ensuring timely closings and customer satisfaction.

- Collaborated with underwriters to resolve complex loan issues and streamline the approval process.

- Developed an automated loan processing script that reduced manual data entry by 30%, improving efficiency.

Awards

- Received Mortgage Loan Computation Clerk of the Year award for outstanding performance in loan computations and customer service.

- Recognized for Exceptional Accuracy in loan computations, maintaining a 99.9% accuracy rate.

- Recipient of the Customer Excellence Award for consistently providing exceptional customer service to loan clients.

- Honored with the Teamwork Collaboration Award for actively contributing to a successful team environment.

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Mortgage Processor (CMP)

- Certified Residential Mortgage Underwriter (CRMU)

- Certified Mortgage Servicer (CMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Computation Clerk

- Highlight your experience and skills in mortgage loan processing, loan calculation, underwriting analysis, loan servicing, loan closing, and loan documentation.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the business.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Mortgage Loan Computation Clerk Resume

- Calculated interest payments and principal balances for various loan types, including conventional, FHA, and VA loans.

- Processed loan applications and documentation to ensure compliance with underwriting guidelines and regulations.

- Analyzed financial statements and credit reports to assess the creditworthiness of loan applicants.

- Verified income, assets, and liabilities to determine the borrowers debt-to-income ratio and loan eligibility.

- Calculated closing costs and loan payments using industry-standard software and formulas.

- Prepared loan documents, including promissory notes, closing statements, and deeds of trust.

- Collaborated with loan officers, underwriters, and escrow agents to ensure timely loan processing and closing.

Frequently Asked Questions (FAQ’s) For Mortgage Loan Computation Clerk

What is a Mortgage Loan Computation Clerk?

A Mortgage Loan Computation Clerk is responsible for calculating interest payments and principal balances for various loan types, including conventional, FHA, and VA loans. They also process loan applications and documentation to ensure compliance with underwriting guidelines and regulations, and analyze financial statements and credit reports to assess the creditworthiness of loan applicants.

What are the key skills required to be a successful Mortgage Loan Computation Clerk?

The key skills required to be a successful Mortgage Loan Computation Clerk include experience in mortgage loan processing, loan calculation, underwriting analysis, loan servicing, loan closing, and loan documentation. They should also have excellent communication, interpersonal, and problem-solving skills.

What is the job outlook for Mortgage Loan Computation Clerks?

The job outlook for Mortgage Loan Computation Clerks is expected to be good over the next few years. As the economy continues to improve, there will be an increased demand for mortgage loans, which will lead to an increased need for Mortgage Loan Computation Clerks.

What is the average salary for a Mortgage Loan Computation Clerk?

The average salary for a Mortgage Loan Computation Clerk is around $45,000 per year.

What are the benefits of working as a Mortgage Loan Computation Clerk?

The benefits of working as a Mortgage Loan Computation Clerk include a competitive salary, a stable work environment, and the opportunity to help people achieve their dream of homeownership.

What are the challenges of working as a Mortgage Loan Computation Clerk?

The challenges of working as a Mortgage Loan Computation Clerk include the need to be accurate and detail-oriented, the ability to work independently, and the ability to meet deadlines.