Are you a seasoned Payroll Accounting Clerk seeking a new career path? Discover our professionally built Payroll Accounting Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

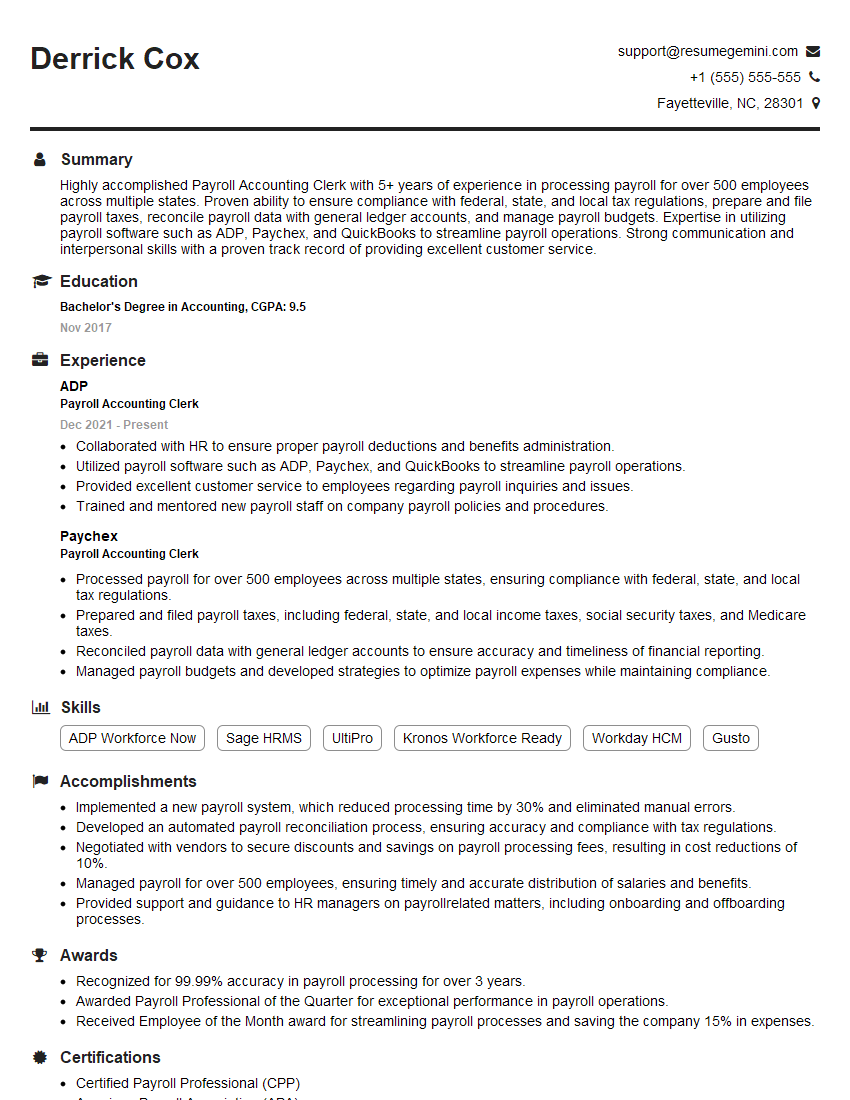

Derrick Cox

Payroll Accounting Clerk

Summary

Highly accomplished Payroll Accounting Clerk with 5+ years of experience in processing payroll for over 500 employees across multiple states. Proven ability to ensure compliance with federal, state, and local tax regulations, prepare and file payroll taxes, reconcile payroll data with general ledger accounts, and manage payroll budgets. Expertise in utilizing payroll software such as ADP, Paychex, and QuickBooks to streamline payroll operations. Strong communication and interpersonal skills with a proven track record of providing excellent customer service.

Education

Bachelor’s Degree in Accounting

November 2017

Skills

- ADP Workforce Now

- Sage HRMS

- UltiPro

- Kronos Workforce Ready

- Workday HCM

- Gusto

Work Experience

Payroll Accounting Clerk

- Collaborated with HR to ensure proper payroll deductions and benefits administration.

- Utilized payroll software such as ADP, Paychex, and QuickBooks to streamline payroll operations.

- Provided excellent customer service to employees regarding payroll inquiries and issues.

- Trained and mentored new payroll staff on company payroll policies and procedures.

Payroll Accounting Clerk

- Processed payroll for over 500 employees across multiple states, ensuring compliance with federal, state, and local tax regulations.

- Prepared and filed payroll taxes, including federal, state, and local income taxes, social security taxes, and Medicare taxes.

- Reconciled payroll data with general ledger accounts to ensure accuracy and timeliness of financial reporting.

- Managed payroll budgets and developed strategies to optimize payroll expenses while maintaining compliance.

Accomplishments

- Implemented a new payroll system, which reduced processing time by 30% and eliminated manual errors.

- Developed an automated payroll reconciliation process, ensuring accuracy and compliance with tax regulations.

- Negotiated with vendors to secure discounts and savings on payroll processing fees, resulting in cost reductions of 10%.

- Managed payroll for over 500 employees, ensuring timely and accurate distribution of salaries and benefits.

- Provided support and guidance to HR managers on payrollrelated matters, including onboarding and offboarding processes.

Awards

- Recognized for 99.99% accuracy in payroll processing for over 3 years.

- Awarded Payroll Professional of the Quarter for exceptional performance in payroll operations.

- Received Employee of the Month award for streamlining payroll processes and saving the company 15% in expenses.

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA)

- National Payroll Reporting Consortium (NPRC)

- Payroll Services Specialist (PSS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Accounting Clerk

- Highlight your experience in processing payroll for a large number of employees.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Demonstrate your knowledge of payroll tax laws and regulations.

- Showcase your proficiency in using payroll software.

Essential Experience Highlights for a Strong Payroll Accounting Clerk Resume

- Processed payroll for over 500 employees across multiple states, ensuring compliance with federal, state, and local tax regulations.

- Prepared and filed payroll taxes, including federal, state, and local income taxes, social security taxes, and Medicare taxes.

- Reconciled payroll data with general ledger accounts to ensure accuracy and timeliness of financial reporting.

- Managed payroll budgets and developed strategies to optimize payroll expenses while maintaining compliance.

- Collaborated with HR to ensure proper payroll deductions and benefits administration.

Frequently Asked Questions (FAQ’s) For Payroll Accounting Clerk

What are the key responsibilities of a Payroll Accounting Clerk?

The key responsibilities of a Payroll Accounting Clerk include processing payroll, preparing and filing payroll taxes, reconciling payroll data, managing payroll budgets, and collaborating with HR.

What are the qualifications required to become a Payroll Accounting Clerk?

The minimum qualification required to become a Payroll Accounting Clerk is a high school diploma or equivalent. However, most employers prefer candidates with a bachelor’s degree in accounting or a related field.

What is the average salary for a Payroll Accounting Clerk?

The average salary for a Payroll Accounting Clerk in the United States is around $50,000 per year.

What are the career prospects for a Payroll Accounting Clerk?

Payroll Accounting Clerks with experience and additional certifications can advance to roles such as Payroll Manager, Accounting Manager, or Financial Manager.

What are the top skills required for a Payroll Accounting Clerk?

The top skills required for a Payroll Accounting Clerk include attention to detail, accuracy, knowledge of payroll tax laws and regulations, and proficiency in using payroll software.