Are you a seasoned Payroll Processor seeking a new career path? Discover our professionally built Payroll Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

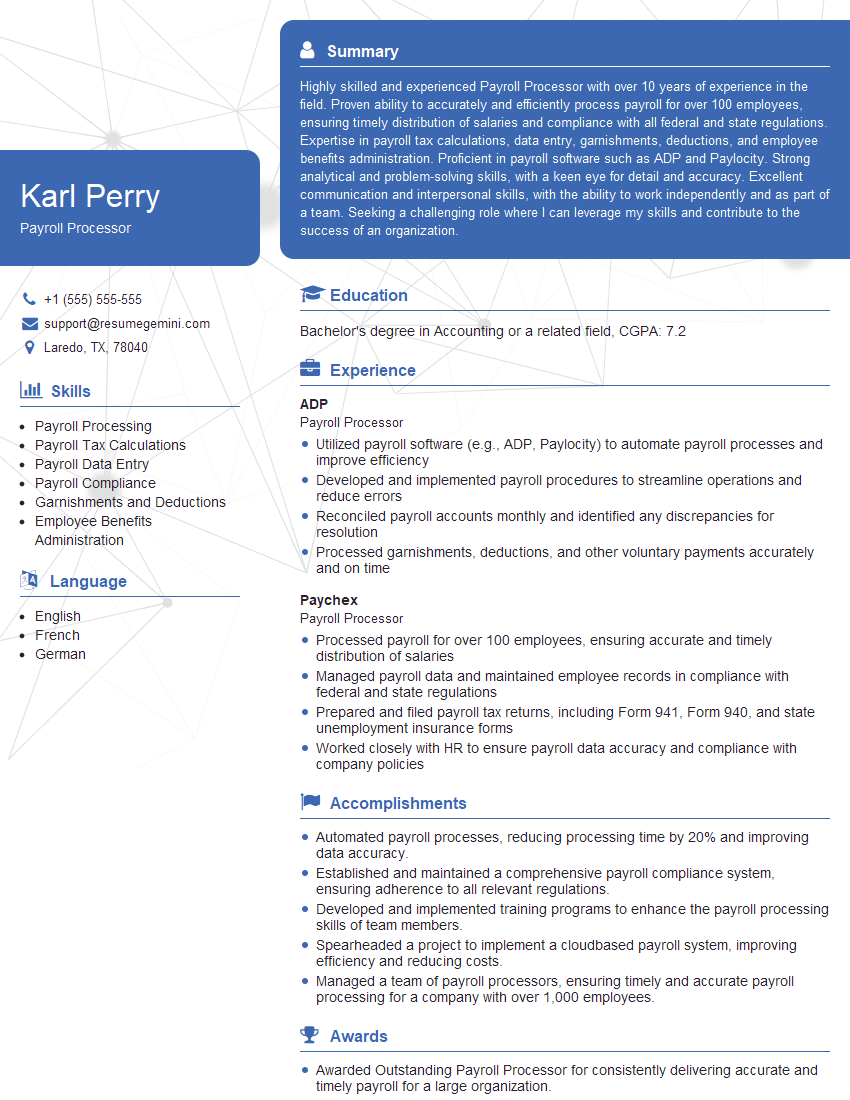

Karl Perry

Payroll Processor

Summary

Highly skilled and experienced Payroll Processor with over 10 years of experience in the field. Proven ability to accurately and efficiently process payroll for over 100 employees, ensuring timely distribution of salaries and compliance with all federal and state regulations. Expertise in payroll tax calculations, data entry, garnishments, deductions, and employee benefits administration. Proficient in payroll software such as ADP and Paylocity. Strong analytical and problem-solving skills, with a keen eye for detail and accuracy. Excellent communication and interpersonal skills, with the ability to work independently and as part of a team. Seeking a challenging role where I can leverage my skills and contribute to the success of an organization.

Education

Bachelor’s degree in Accounting or a related field

February 2017

Skills

- Payroll Processing

- Payroll Tax Calculations

- Payroll Data Entry

- Payroll Compliance

- Garnishments and Deductions

- Employee Benefits Administration

Work Experience

Payroll Processor

- Utilized payroll software (e.g., ADP, Paylocity) to automate payroll processes and improve efficiency

- Developed and implemented payroll procedures to streamline operations and reduce errors

- Reconciled payroll accounts monthly and identified any discrepancies for resolution

- Processed garnishments, deductions, and other voluntary payments accurately and on time

Payroll Processor

- Processed payroll for over 100 employees, ensuring accurate and timely distribution of salaries

- Managed payroll data and maintained employee records in compliance with federal and state regulations

- Prepared and filed payroll tax returns, including Form 941, Form 940, and state unemployment insurance forms

- Worked closely with HR to ensure payroll data accuracy and compliance with company policies

Accomplishments

- Automated payroll processes, reducing processing time by 20% and improving data accuracy.

- Established and maintained a comprehensive payroll compliance system, ensuring adherence to all relevant regulations.

- Developed and implemented training programs to enhance the payroll processing skills of team members.

- Spearheaded a project to implement a cloudbased payroll system, improving efficiency and reducing costs.

- Managed a team of payroll processors, ensuring timely and accurate payroll processing for a company with over 1,000 employees.

Awards

- Awarded Outstanding Payroll Processor for consistently delivering accurate and timely payroll for a large organization.

- Recognized for exceptional accuracy in payroll processing, with zero errors over a twoyear period.

- Received a certificate of appreciation for implementing a new payroll system, streamlining operations and enhancing data security.

- Awarded Rising Star recognition for demonstrating exceptional potential and commitment to the field of payroll processing.

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA) Certification

- Fundamental Payroll Certification (FPC)

- Certified Global Payroll Professional (CGP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Processor

- Highlight your experience and skills in payroll processing, tax calculations, and compliance.

- Showcase your proficiency in payroll software and your ability to automate processes.

- Demonstrate your attention to detail and accuracy, as well as your ability to identify and resolve errors.

- Emphasize your strong communication and interpersonal skills, and your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Payroll Processor Resume

- Processed payroll for over 100 employees, ensuring accurate and timely distribution of salaries.

- Managed payroll data and maintained employee records in compliance with federal and state regulations.

- Prepared and filed payroll tax returns, including Form 941, Form 940, and state unemployment insurance forms.

- Worked closely with HR to ensure payroll data accuracy and compliance with company policies.

- Utilized payroll software (e.g., ADP, Paylocity) to automate payroll processes and improve efficiency.

- Developed and implemented payroll procedures to streamline operations and reduce errors.

- Reconciled payroll accounts monthly and identified any discrepancies for resolution.

- Processed garnishments, deductions, and other voluntary payments accurately and on time.

Frequently Asked Questions (FAQ’s) For Payroll Processor

What are the key responsibilities of a Payroll Processor?

The key responsibilities of a Payroll Processor include processing payroll for employees, managing payroll data, preparing and filing payroll tax returns, working closely with HR, utilizing payroll software, developing and implementing payroll procedures, reconciling payroll accounts, and processing garnishments and deductions.

What are the educational requirements for a Payroll Processor?

The educational requirements for a Payroll Processor typically include a Bachelor’s degree in Accounting or a related field.

What are the skills required for a Payroll Processor?

The skills required for a Payroll Processor include payroll processing, payroll tax calculations, payroll data entry, payroll compliance, garnishments and deductions, and employee benefits administration.

What are the career prospects for a Payroll Processor?

The career prospects for a Payroll Processor are good, with job growth expected to be faster than average in the coming years.

What is the average salary for a Payroll Processor?

The average salary for a Payroll Processor varies depending on experience and location, but is typically around $50,000 per year.

What are the top companies that hire Payroll Processors?

The top companies that hire Payroll Processors include ADP and Paychex.