Are you a seasoned Commercial Teller seeking a new career path? Discover our professionally built Commercial Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

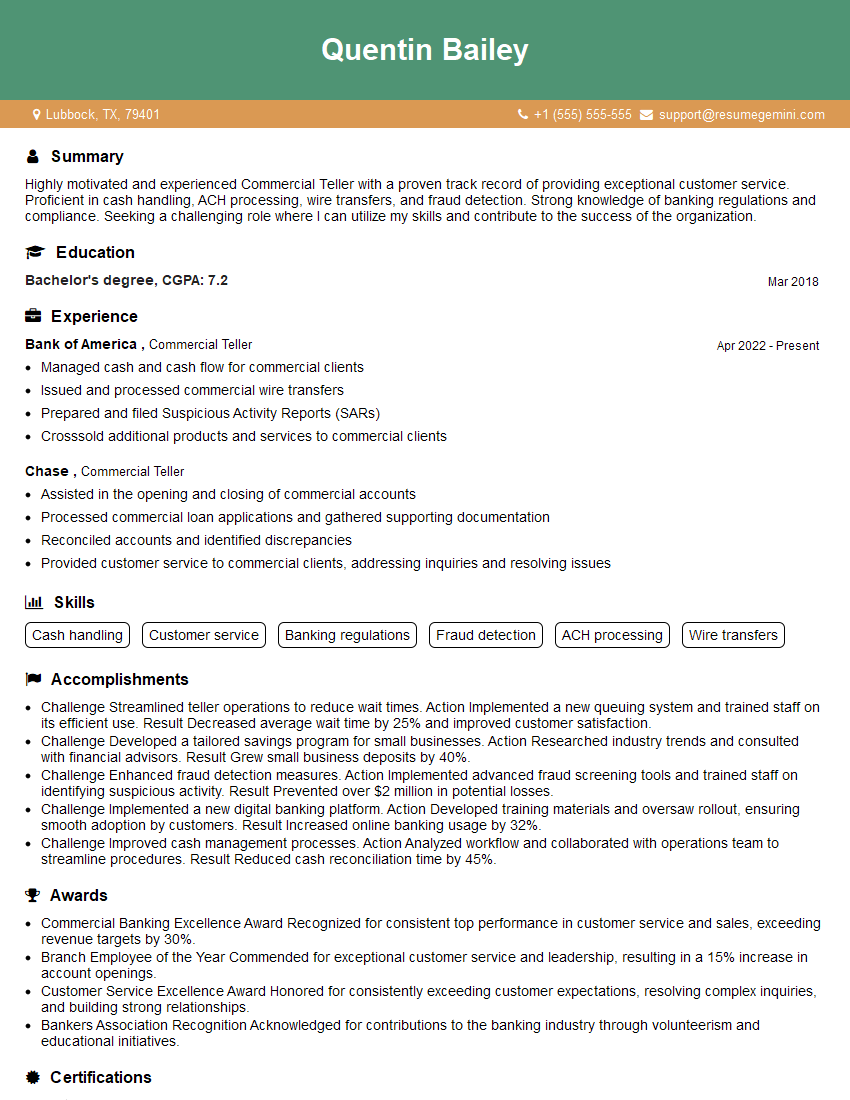

Quentin Bailey

Commercial Teller

Summary

Highly motivated and experienced Commercial Teller with a proven track record of providing exceptional customer service. Proficient in cash handling, ACH processing, wire transfers, and fraud detection. Strong knowledge of banking regulations and compliance. Seeking a challenging role where I can utilize my skills and contribute to the success of the organization.

Education

Bachelor’s degree

March 2018

Skills

- Cash handling

- Customer service

- Banking regulations

- Fraud detection

- ACH processing

- Wire transfers

Work Experience

Commercial Teller

- Managed cash and cash flow for commercial clients

- Issued and processed commercial wire transfers

- Prepared and filed Suspicious Activity Reports (SARs)

- Crosssold additional products and services to commercial clients

Commercial Teller

- Assisted in the opening and closing of commercial accounts

- Processed commercial loan applications and gathered supporting documentation

- Reconciled accounts and identified discrepancies

- Provided customer service to commercial clients, addressing inquiries and resolving issues

Accomplishments

- Challenge Streamlined teller operations to reduce wait times. Action Implemented a new queuing system and trained staff on its efficient use. Result Decreased average wait time by 25% and improved customer satisfaction.

- Challenge Developed a tailored savings program for small businesses. Action Researched industry trends and consulted with financial advisors. Result Grew small business deposits by 40%.

- Challenge Enhanced fraud detection measures. Action Implemented advanced fraud screening tools and trained staff on identifying suspicious activity. Result Prevented over $2 million in potential losses.

- Challenge Implemented a new digital banking platform. Action Developed training materials and oversaw rollout, ensuring smooth adoption by customers. Result Increased online banking usage by 32%.

- Challenge Improved cash management processes. Action Analyzed workflow and collaborated with operations team to streamline procedures. Result Reduced cash reconciliation time by 45%.

Awards

- Commercial Banking Excellence Award Recognized for consistent top performance in customer service and sales, exceeding revenue targets by 30%.

- Branch Employee of the Year Commended for exceptional customer service and leadership, resulting in a 15% increase in account openings.

- Customer Service Excellence Award Honored for consistently exceeding customer expectations, resolving complex inquiries, and building strong relationships.

- Bankers Association Recognition Acknowledged for contributions to the banking industry through volunteerism and educational initiatives.

Certificates

- Certified Teller

- Bank Secrecy Act Compliance Certification

- Anti-Money Laundering Compliance Certification

- Customer Service Excellence Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Teller

- Highlight your relevant skills and experience in your resume.

- Showcase your customer service skills and ability to build relationships.

- Demonstrate your knowledge of banking regulations and compliance.

- Quantify your accomplishments whenever possible.

Essential Experience Highlights for a Strong Commercial Teller Resume

- Assisted in the opening and closing of commercial accounts

- Processed commercial loan applications and gathered supporting documentation

- Reconciled accounts and identified discrepancies

- Provided customer service to commercial clients, addressing inquiries and resolving issues

- Managed cash and cash flow for commercial clients

- Issued and processed commercial wire transfers

- Prepared and filed Suspicious Activity Reports (SARs)

Frequently Asked Questions (FAQ’s) For Commercial Teller

What are the primary responsibilities of a Commercial Teller?

The primary responsibilities of a Commercial Teller include assisting in the opening and closing of commercial accounts, processing commercial loan applications, reconciling accounts, providing customer service to commercial clients, and managing cash and cash flow for commercial clients.

What skills are required to be a successful Commercial Teller?

To be a successful Commercial Teller, you will need strong cash handling skills, customer service skills, knowledge of banking regulations, fraud detection skills, ACH processing skills, and wire transfer skills.

What is the career outlook for Commercial Tellers?

The career outlook for Commercial Tellers is expected to be positive over the next several years. As businesses continue to grow and expand, they will need qualified Commercial Tellers to manage their financial transactions.

What are the typical salary expectations for Commercial Tellers?

The typical salary expectations for Commercial Tellers vary depending on experience, location, and employer. However, you can expect to earn a competitive salary and benefits package.

What are the opportunities for advancement for Commercial Tellers?

Commercial Tellers can advance to roles such as Branch Manager, Assistant Branch Manager, and Personal Banker. With experience and additional education, you can also move into management positions within the banking industry.