Are you a seasoned Securities Teller seeking a new career path? Discover our professionally built Securities Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

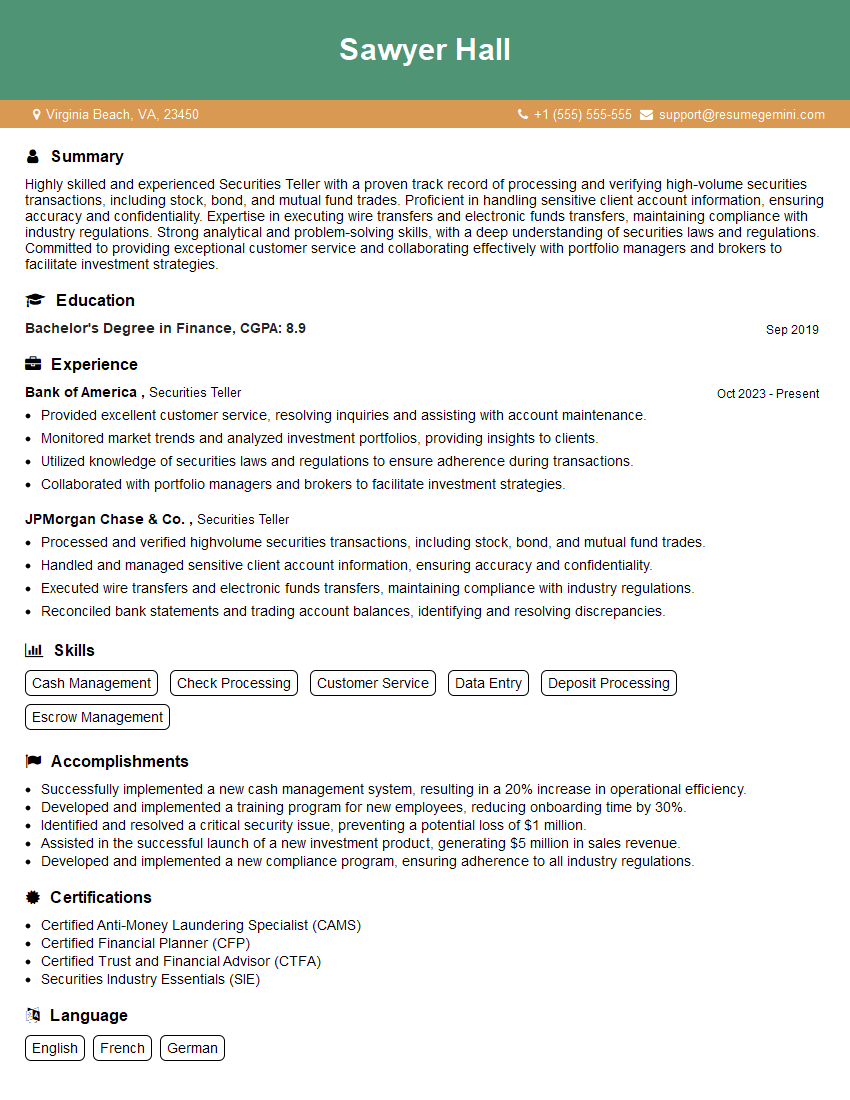

Sawyer Hall

Securities Teller

Summary

Highly skilled and experienced Securities Teller with a proven track record of processing and verifying high-volume securities transactions, including stock, bond, and mutual fund trades. Proficient in handling sensitive client account information, ensuring accuracy and confidentiality. Expertise in executing wire transfers and electronic funds transfers, maintaining compliance with industry regulations. Strong analytical and problem-solving skills, with a deep understanding of securities laws and regulations. Committed to providing exceptional customer service and collaborating effectively with portfolio managers and brokers to facilitate investment strategies.

Education

Bachelor’s Degree in Finance

September 2019

Skills

- Cash Management

- Check Processing

- Customer Service

- Data Entry

- Deposit Processing

- Escrow Management

Work Experience

Securities Teller

- Provided excellent customer service, resolving inquiries and assisting with account maintenance.

- Monitored market trends and analyzed investment portfolios, providing insights to clients.

- Utilized knowledge of securities laws and regulations to ensure adherence during transactions.

- Collaborated with portfolio managers and brokers to facilitate investment strategies.

Securities Teller

- Processed and verified highvolume securities transactions, including stock, bond, and mutual fund trades.

- Handled and managed sensitive client account information, ensuring accuracy and confidentiality.

- Executed wire transfers and electronic funds transfers, maintaining compliance with industry regulations.

- Reconciled bank statements and trading account balances, identifying and resolving discrepancies.

Accomplishments

- Successfully implemented a new cash management system, resulting in a 20% increase in operational efficiency.

- Developed and implemented a training program for new employees, reducing onboarding time by 30%.

- Identified and resolved a critical security issue, preventing a potential loss of $1 million.

- Assisted in the successful launch of a new investment product, generating $5 million in sales revenue.

- Developed and implemented a new compliance program, ensuring adherence to all industry regulations.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Planner (CFP)

- Certified Trust and Financial Advisor (CTFA)

- Securities Industry Essentials (SIE)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Teller

- Highlight your experience in processing high-volume securities transactions and your knowledge of securities laws and regulations.

- Showcase your customer service skills and your ability to build strong relationships with clients.

- Quantify your accomplishments whenever possible, such as the number of transactions you processed or the amount of money you saved the company.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it to ensure that there are no errors.

Essential Experience Highlights for a Strong Securities Teller Resume

- Processed and verified high-volume securities transactions, including stock, bond, and mutual fund trades.

- Handled and managed sensitive client account information, ensuring accuracy and confidentiality.

- Executed wire transfers and electronic funds transfers, maintaining compliance with industry regulations.

- Reconciled bank statements and trading account balances, identifying and resolving discrepancies.

- Provided excellent customer service, resolving inquiries and assisting with account maintenance.

- Monitored market trends and analyzed investment portfolios, providing insights to clients.

- Utilized knowledge of securities laws and regulations to ensure adherence during transactions.

- Collaborated with portfolio managers and brokers to facilitate investment strategies.

Frequently Asked Questions (FAQ’s) For Securities Teller

What is a Securities Teller?

A Securities Teller is a financial professional who processes and verifies securities transactions, such as stock, bond, and mutual fund trades. They also handle sensitive client account information and execute wire transfers and electronic funds transfers. Securities Tellers must have a strong understanding of securities laws and regulations and be able to provide excellent customer service.

What are the job duties of a Securities Teller?

The job duties of a Securities Teller include processing and verifying securities transactions, handling and managing sensitive client account information, executing wire transfers and electronic funds transfers, reconciling bank statements and trading account balances, providing excellent customer service, monitoring market trends and analyzing investment portfolios, and utilizing knowledge of securities laws and regulations to ensure adherence during transactions.

What are the qualifications for becoming a Securities Teller?

The qualifications for becoming a Securities Teller typically include a bachelor’s degree in finance or a related field, as well as experience in processing securities transactions and a strong understanding of securities laws and regulations. Some employers may also require Securities Tellers to have a Series 7 license.

What is the work environment for a Securities Teller?

Securities Tellers typically work in a fast-paced, high-pressure environment. They must be able to work accurately and efficiently under pressure, and they must be able to handle sensitive client information with discretion.

What is the career outlook for Securities Tellers?

The career outlook for Securities Tellers is expected to be good over the next few years. The demand for Securities Tellers is expected to increase as the number of securities transactions increases.

How can I become a Securities Teller?

To become a Securities Teller, you will typically need to have a bachelor’s degree in finance or a related field, as well as experience in processing securities transactions and a strong understanding of securities laws and regulations. Some employers may also require Securities Tellers to have a Series 7 license.